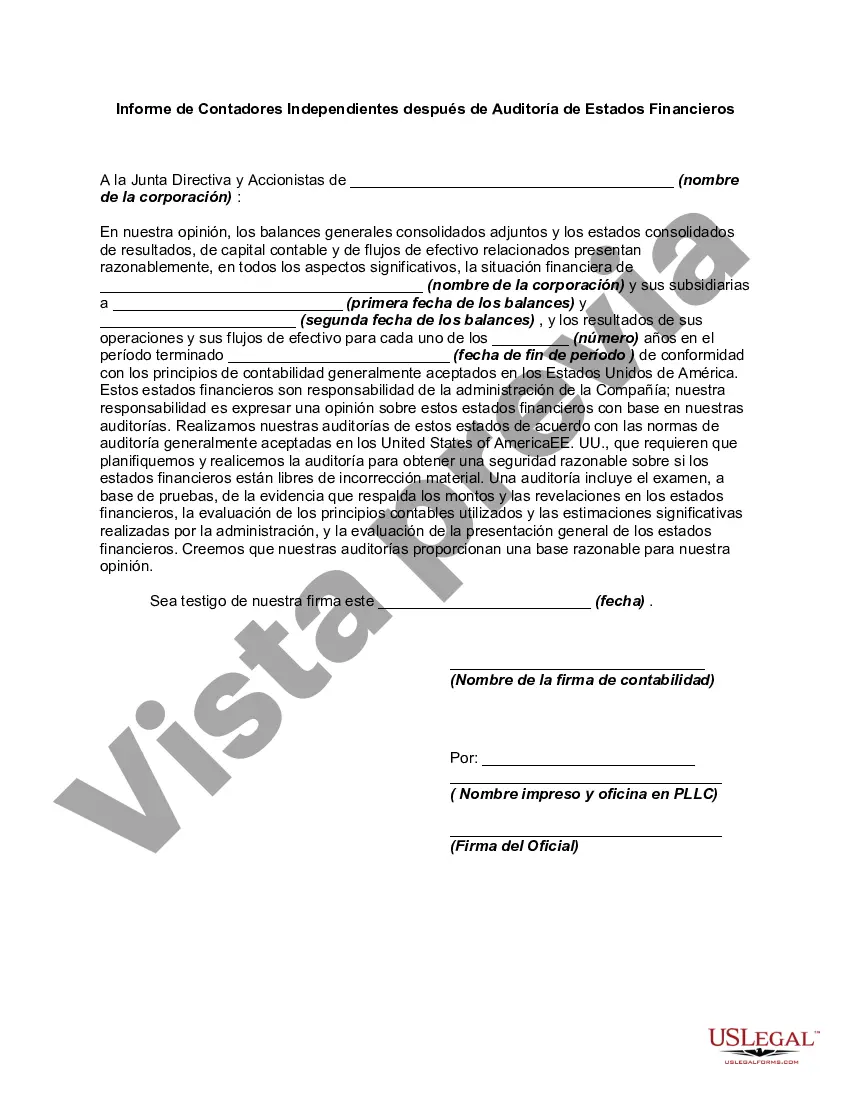

As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Title: Fulton, Georgia: Comprehensive Report of Independent Accountants after Audit of Financial Statements Introduction: The Fulton, Georgia Report of Independent Accountants after Audit of Financial Statements is a detailed and comprehensive assessment performed by certified accountants to evaluate the financial records and overall financial health of Fulton, Georgia. Such reports provide stakeholders, government officials, and the public with a transparent and unbiased analysis of the city's financial position. This article aims to explain the significance of the Fulton, Georgia Report of Independent Accountants after Audit of Financial Statements, its key features, and potential variations. Summary of the Report: The Fulton, Georgia Report of Independent Accountants after Audit of Financial Statements summarizes the findings of the independent auditors who meticulously examine the city's financial records. This report primarily includes a balance sheet, income statement, statement of cash flows, and footnotes, offering a comprehensive view of Fulton, Georgia's financial activities within a specific fiscal period. Key Objectives of the Report: 1. Evaluate Accuracy and Completeness: The report ensures that all financial statements accurately represent the actual financial position of Fulton, Georgia. 2. Assess Compliance with Accounting Principles: The accountants review the financial statements to determine whether they comply with generally accepted accounting principles (GAAP) or any relevant governmental accounting standards. 3. Detect and Report Irregularities: The report identifies any fraudulent activities, material misstatements, or errors in the financial records and brings them to the attention of key stakeholders and management. 4. Impart Confidence and Promote Accountability: The report aims to build trust within the community by providing a transparent view of Fulton, Georgia's financial position, thus enhancing overall accountability and responsible financial management. Types of Fulton Georgia Report of Independent Accountants after Audit of Financial Statements: 1. Annual Financial Report: This report is issued yearly and provides an audited representation of Fulton, Georgia's financial statements for the fiscal year. It contains essential financial information required by government regulations and ensures transparency. 2. Interim Financial Report: Issued between annual reports, this document provides unaudited financial statements for shorter periods (e.g., quarterly) and provides stakeholders with updated financial information. 3. Special-Purpose Financial Report: These reports are tailored to meet specific requirements, such as grant recipients reporting or auditing a particular department's financial statements within Fulton, Georgia. 4. Comprehensive Annual Financial Report (CAR): CAR goes beyond the basics of financial statements, adding additional information, management's discussion and analysis, statistical demographics, and an overview of Fulton, Georgia's financial status. Conclusion: The Fulton, Georgia Report of Independent Accountants after Audit of Financial Statements plays a crucial role in ensuring transparency, accountability, and compliance with financial regulations. It serves as a comprehensive evaluation of the city's financial landscape, providing stakeholders and the public with a clear understanding of Fulton, Georgia's financial health. By employing certified independent accountants to conduct thorough audits, the report helps maintain public trust and promotes responsible financial management within the city.Title: Fulton, Georgia: Comprehensive Report of Independent Accountants after Audit of Financial Statements Introduction: The Fulton, Georgia Report of Independent Accountants after Audit of Financial Statements is a detailed and comprehensive assessment performed by certified accountants to evaluate the financial records and overall financial health of Fulton, Georgia. Such reports provide stakeholders, government officials, and the public with a transparent and unbiased analysis of the city's financial position. This article aims to explain the significance of the Fulton, Georgia Report of Independent Accountants after Audit of Financial Statements, its key features, and potential variations. Summary of the Report: The Fulton, Georgia Report of Independent Accountants after Audit of Financial Statements summarizes the findings of the independent auditors who meticulously examine the city's financial records. This report primarily includes a balance sheet, income statement, statement of cash flows, and footnotes, offering a comprehensive view of Fulton, Georgia's financial activities within a specific fiscal period. Key Objectives of the Report: 1. Evaluate Accuracy and Completeness: The report ensures that all financial statements accurately represent the actual financial position of Fulton, Georgia. 2. Assess Compliance with Accounting Principles: The accountants review the financial statements to determine whether they comply with generally accepted accounting principles (GAAP) or any relevant governmental accounting standards. 3. Detect and Report Irregularities: The report identifies any fraudulent activities, material misstatements, or errors in the financial records and brings them to the attention of key stakeholders and management. 4. Impart Confidence and Promote Accountability: The report aims to build trust within the community by providing a transparent view of Fulton, Georgia's financial position, thus enhancing overall accountability and responsible financial management. Types of Fulton Georgia Report of Independent Accountants after Audit of Financial Statements: 1. Annual Financial Report: This report is issued yearly and provides an audited representation of Fulton, Georgia's financial statements for the fiscal year. It contains essential financial information required by government regulations and ensures transparency. 2. Interim Financial Report: Issued between annual reports, this document provides unaudited financial statements for shorter periods (e.g., quarterly) and provides stakeholders with updated financial information. 3. Special-Purpose Financial Report: These reports are tailored to meet specific requirements, such as grant recipients reporting or auditing a particular department's financial statements within Fulton, Georgia. 4. Comprehensive Annual Financial Report (CAR): CAR goes beyond the basics of financial statements, adding additional information, management's discussion and analysis, statistical demographics, and an overview of Fulton, Georgia's financial status. Conclusion: The Fulton, Georgia Report of Independent Accountants after Audit of Financial Statements plays a crucial role in ensuring transparency, accountability, and compliance with financial regulations. It serves as a comprehensive evaluation of the city's financial landscape, providing stakeholders and the public with a clear understanding of Fulton, Georgia's financial health. By employing certified independent accountants to conduct thorough audits, the report helps maintain public trust and promotes responsible financial management within the city.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.