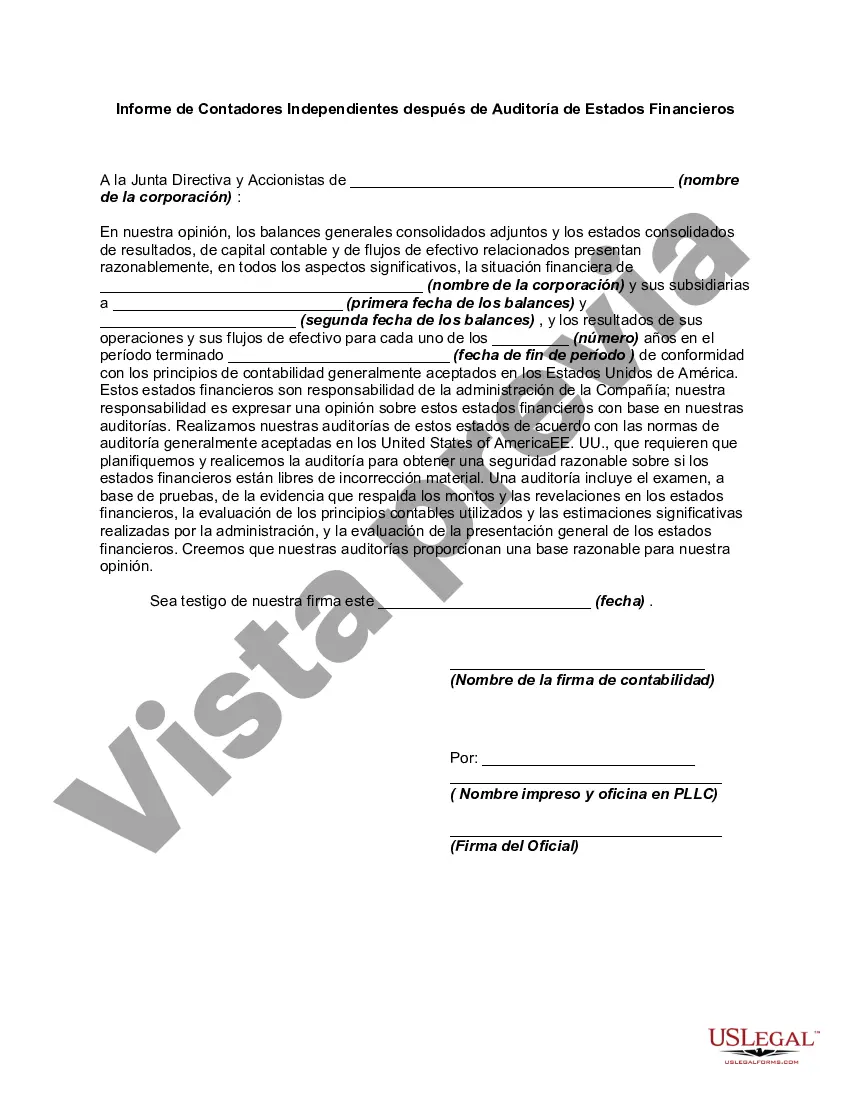

As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Houston, Texas is a vibrant city located in the southeastern part of the state. As the fourth largest city in the United States, Houston is known for its diverse population, rich culture, and thriving economy. When it comes to financial matters, Houston boasts a range of businesses, organizations, and institutions that require professional auditing services. In this context, the Report of Independent Accountants after Audit of Financial Statements plays a crucial role. It serves as a comprehensive assessment and analysis of an entity's financial performance and management systems, conducted by an independent accounting firm. The Report of Independent Accountants after Audit of Financial Statements in Houston, Texas provides a detailed overview of an organization's financial health and compliance with relevant accounting standards and regulatory requirements. It includes an assessment of the financial statements, such as the balance sheet, income statement, cash flow statement, and statement of changes in equity. The purpose of this report is to provide stakeholders, including shareholders, management, and potential investors, with an objective and unbiased opinion on the organization's financial performance and its adherence to accounting principles. The report provides valuable insights into the organization's financial standing, identifying strengths, weaknesses, and areas for improvement. There are various types of Houston Texas Report of Independent Accountants after Audit of Financial Statements, each catering to different entities and sectors. Some common types include: 1. Corporate Financial Statements: These reports are prepared for publicly traded companies, privately held corporations, and organizations with complex financial structures. They analyze the overall financial health of the company, including revenue, expenses, assets, and liabilities. 2. Non-profit Organization Financial Statements: Non-profit organizations, such as charities, foundations, and educational institutions, require audits to ensure transparency and accountability in their financial management. The report focuses on the organization's compliance with applicable laws and regulations governing non-profit entities. 3. Government Financial Statements: Local government bodies, such as municipalities and counties, also require independent audits of their financial statements. These reports ensure the effective and lawful use of public funds, adherence to governmental accounting standards, and transparency in financial reporting. 4. Small Business Financial Statements: Small and medium-sized enterprises (SMEs) often seek the services of independent accountants to assess their financial statements. These reports can help SMEs in areas such as obtaining loans, attracting investors, and evaluating overall financial performance. In conclusion, the Report of Independent Accountants after Audit of Financial Statements in Houston, Texas is a vital tool for organizations of various sizes and sectors to evaluate their financial position, compliance, and transparency. By obtaining and analyzing this report, stakeholders can make informed decisions about investments, partnerships, and overall business strategies.Houston, Texas is a vibrant city located in the southeastern part of the state. As the fourth largest city in the United States, Houston is known for its diverse population, rich culture, and thriving economy. When it comes to financial matters, Houston boasts a range of businesses, organizations, and institutions that require professional auditing services. In this context, the Report of Independent Accountants after Audit of Financial Statements plays a crucial role. It serves as a comprehensive assessment and analysis of an entity's financial performance and management systems, conducted by an independent accounting firm. The Report of Independent Accountants after Audit of Financial Statements in Houston, Texas provides a detailed overview of an organization's financial health and compliance with relevant accounting standards and regulatory requirements. It includes an assessment of the financial statements, such as the balance sheet, income statement, cash flow statement, and statement of changes in equity. The purpose of this report is to provide stakeholders, including shareholders, management, and potential investors, with an objective and unbiased opinion on the organization's financial performance and its adherence to accounting principles. The report provides valuable insights into the organization's financial standing, identifying strengths, weaknesses, and areas for improvement. There are various types of Houston Texas Report of Independent Accountants after Audit of Financial Statements, each catering to different entities and sectors. Some common types include: 1. Corporate Financial Statements: These reports are prepared for publicly traded companies, privately held corporations, and organizations with complex financial structures. They analyze the overall financial health of the company, including revenue, expenses, assets, and liabilities. 2. Non-profit Organization Financial Statements: Non-profit organizations, such as charities, foundations, and educational institutions, require audits to ensure transparency and accountability in their financial management. The report focuses on the organization's compliance with applicable laws and regulations governing non-profit entities. 3. Government Financial Statements: Local government bodies, such as municipalities and counties, also require independent audits of their financial statements. These reports ensure the effective and lawful use of public funds, adherence to governmental accounting standards, and transparency in financial reporting. 4. Small Business Financial Statements: Small and medium-sized enterprises (SMEs) often seek the services of independent accountants to assess their financial statements. These reports can help SMEs in areas such as obtaining loans, attracting investors, and evaluating overall financial performance. In conclusion, the Report of Independent Accountants after Audit of Financial Statements in Houston, Texas is a vital tool for organizations of various sizes and sectors to evaluate their financial position, compliance, and transparency. By obtaining and analyzing this report, stakeholders can make informed decisions about investments, partnerships, and overall business strategies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.