As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

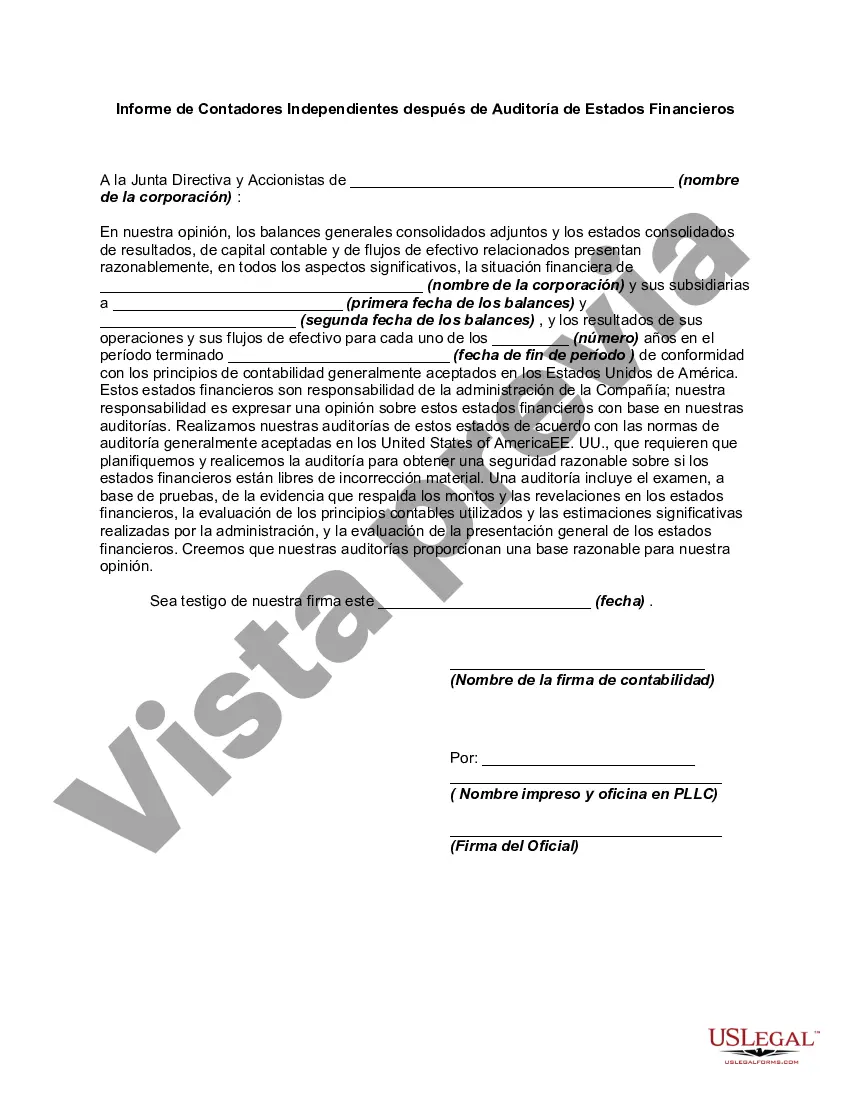

Nassau New York Report of Independent Accountants after Audit of Financial Statements is an essential document produced by independent accountants following a thorough examination of a company's financial records. This report serves to convey the accountants' professional opinion regarding the accuracy, completeness, and fairness of the financial statements. The Nassau New York Report of Independent Accountants after Audit of Financial Statements typically includes several key sections: 1. Introduction: This section provides an overview of the purpose and scope of the audit performed. It describes the responsibilities of both the company's management and the independent accountants. 2. Management's Responsibility: Here, the report outlines the management's role in preparing the financial statements and maintaining internal controls. It emphasizes that the accountants' responsibility is to express an opinion solely on the financial statements themselves. 3. Accountants' Responsibility: This section explains the accountants' role in conducting the audit, including compliance with auditing standards. It highlights that the objective is to obtain reasonable assurance about whether the financial statements are free from material misstatement. 4. Audit Procedures: The report describes the procedures performed during the audit, such as examining evidence supporting figures, verifying the presentation, and assessing the overall financial statement presentation. 5. Opinion: The accountants express their opinion on the financial statements. They may issue an unqualified opinion (when financial statements are fair, accurate, and free of misstatement), a qualified opinion (when certain limitations or exceptions exist), an adverse opinion (when financial statements are materially misstated), or a disclaimer of opinion (when the accountants cannot express an opinion). 6. Other Reporting Requirements: Depending on the circumstances, the Nassau New York Report of Independent Accountants after Audit of Financial Statements may also include additional reporting requirements. For example, if the audit revealed material internal control weaknesses, those would be communicated in this section. 7. Signature and Date: The report is typically signed and dated by the independent accountants and may include their contact information for further clarification. Different types of Nassau New York Report of Independent Accountants after Audit of Financial Statements may include specialized reports tailored for specific industries or regulatory agencies. Examples include reports meant for financial institutions, government entities, or publicly traded companies where additional reporting requirements are mandated. Keywords: Nassau New York, report, independent accountants, audit, financial statements, accuracy, completeness, fairness, management's responsibility, accountants' responsibility, audit procedures, opinion, unqualified opinion, qualified opinion, adverse opinion, disclaimer of opinion, other reporting requirements, signature, date, financial institutions, government entities, publicly traded companies.Nassau New York Report of Independent Accountants after Audit of Financial Statements is an essential document produced by independent accountants following a thorough examination of a company's financial records. This report serves to convey the accountants' professional opinion regarding the accuracy, completeness, and fairness of the financial statements. The Nassau New York Report of Independent Accountants after Audit of Financial Statements typically includes several key sections: 1. Introduction: This section provides an overview of the purpose and scope of the audit performed. It describes the responsibilities of both the company's management and the independent accountants. 2. Management's Responsibility: Here, the report outlines the management's role in preparing the financial statements and maintaining internal controls. It emphasizes that the accountants' responsibility is to express an opinion solely on the financial statements themselves. 3. Accountants' Responsibility: This section explains the accountants' role in conducting the audit, including compliance with auditing standards. It highlights that the objective is to obtain reasonable assurance about whether the financial statements are free from material misstatement. 4. Audit Procedures: The report describes the procedures performed during the audit, such as examining evidence supporting figures, verifying the presentation, and assessing the overall financial statement presentation. 5. Opinion: The accountants express their opinion on the financial statements. They may issue an unqualified opinion (when financial statements are fair, accurate, and free of misstatement), a qualified opinion (when certain limitations or exceptions exist), an adverse opinion (when financial statements are materially misstated), or a disclaimer of opinion (when the accountants cannot express an opinion). 6. Other Reporting Requirements: Depending on the circumstances, the Nassau New York Report of Independent Accountants after Audit of Financial Statements may also include additional reporting requirements. For example, if the audit revealed material internal control weaknesses, those would be communicated in this section. 7. Signature and Date: The report is typically signed and dated by the independent accountants and may include their contact information for further clarification. Different types of Nassau New York Report of Independent Accountants after Audit of Financial Statements may include specialized reports tailored for specific industries or regulatory agencies. Examples include reports meant for financial institutions, government entities, or publicly traded companies where additional reporting requirements are mandated. Keywords: Nassau New York, report, independent accountants, audit, financial statements, accuracy, completeness, fairness, management's responsibility, accountants' responsibility, audit procedures, opinion, unqualified opinion, qualified opinion, adverse opinion, disclaimer of opinion, other reporting requirements, signature, date, financial institutions, government entities, publicly traded companies.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.