As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Santa Clara California Report of Independent Accountants after Audit of Financial Statements provides a comprehensive analysis and evaluation of the financial statements of organizations based in Santa Clara, California. This document is crucial as it helps stakeholders, including investors, lenders, and government agencies, assess the financial health and performance of these entities. The report is prepared by certified public accountants (CPA's) who conduct a thorough examination of the financial records, ensuring accuracy, compliance with regulations, and transparency. It includes an unbiased opinion presented by the independent accountants regarding the fairness of the presented financial statements. The Santa Clara California Report of Independent Accountants after Audit of Financial Statements encompasses several types based on the nature of the audited entities and their specific reporting requirements: 1. Corporate Financial Statements Audit Report: This type relates to businesses, including corporations and limited liability companies (LCS). 2. Nonprofit Organizations Financial Statements Audit Report: This report focuses on nonprofit organizations, such as charities, foundations, and religious institutions, ensuring proper utilization of funds for their intended purposes. 3. Government Agencies Financial Statements Audit Report: This category pertains to audits conducted on financial statements of various governmental bodies, including municipalities, schools, and other public entities, ensuring compliance with established regulations and legal requirements. 4. Pension Funds Financial Statements Audit Report: This report concentrates on audits conducted specifically on pension funds, verifying their financial viability, investment performances, and compliance with regulations to safeguard beneficiaries' interests. 5. Educational Institutions Financial Statements Audit Report: This type of report focuses on audits performed on the financial statements of schools, colleges, and universities, providing a comprehensive overview of their financial integrity in managing funds, grants, and student tuition fees. 6. Health Care Organizations Financial Statements Audit Report: This report assesses the financial statements of healthcare providers, such as hospitals, clinics, and medical centers, ensuring appropriate financial management and regulatory compliance. The Santa Clara California Report of Independent Accountants after Audit of Financial Statements instills confidence in stakeholders by providing a reliable assessment of an organization's financial standing and accountability. It helps these entities make informed decisions, attract potential investors, and maintain transparent financial practices.Santa Clara California Report of Independent Accountants after Audit of Financial Statements provides a comprehensive analysis and evaluation of the financial statements of organizations based in Santa Clara, California. This document is crucial as it helps stakeholders, including investors, lenders, and government agencies, assess the financial health and performance of these entities. The report is prepared by certified public accountants (CPA's) who conduct a thorough examination of the financial records, ensuring accuracy, compliance with regulations, and transparency. It includes an unbiased opinion presented by the independent accountants regarding the fairness of the presented financial statements. The Santa Clara California Report of Independent Accountants after Audit of Financial Statements encompasses several types based on the nature of the audited entities and their specific reporting requirements: 1. Corporate Financial Statements Audit Report: This type relates to businesses, including corporations and limited liability companies (LCS). 2. Nonprofit Organizations Financial Statements Audit Report: This report focuses on nonprofit organizations, such as charities, foundations, and religious institutions, ensuring proper utilization of funds for their intended purposes. 3. Government Agencies Financial Statements Audit Report: This category pertains to audits conducted on financial statements of various governmental bodies, including municipalities, schools, and other public entities, ensuring compliance with established regulations and legal requirements. 4. Pension Funds Financial Statements Audit Report: This report concentrates on audits conducted specifically on pension funds, verifying their financial viability, investment performances, and compliance with regulations to safeguard beneficiaries' interests. 5. Educational Institutions Financial Statements Audit Report: This type of report focuses on audits performed on the financial statements of schools, colleges, and universities, providing a comprehensive overview of their financial integrity in managing funds, grants, and student tuition fees. 6. Health Care Organizations Financial Statements Audit Report: This report assesses the financial statements of healthcare providers, such as hospitals, clinics, and medical centers, ensuring appropriate financial management and regulatory compliance. The Santa Clara California Report of Independent Accountants after Audit of Financial Statements instills confidence in stakeholders by providing a reliable assessment of an organization's financial standing and accountability. It helps these entities make informed decisions, attract potential investors, and maintain transparent financial practices.

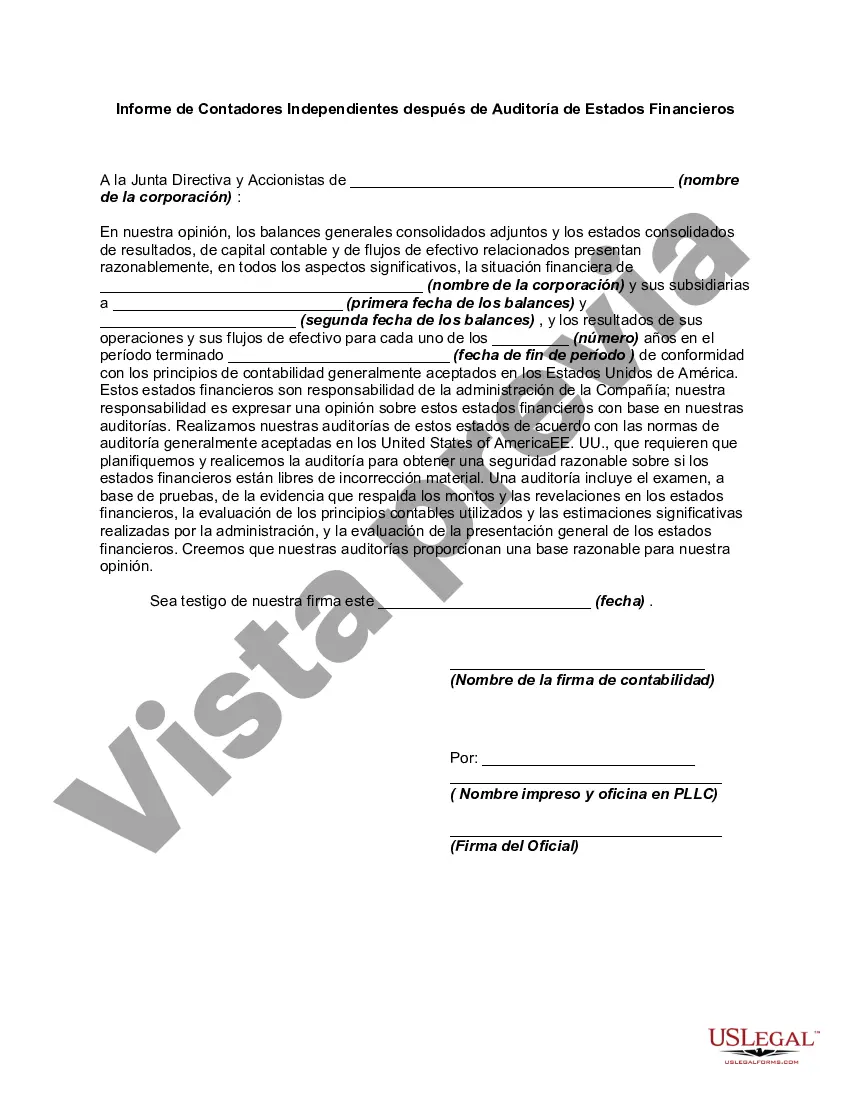

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.