As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Travis County, Texas is known for its thriving business community and robust financial sector. Every year, businesses in Travis County engage the services of independent accountants to conduct audits of their financial statements. These audits aim to ensure the accuracy and transparency of financial information disclosed by companies within the county. The Travis Texas Report of Independent Accountants after Audit of Financial Statements is a comprehensive document that summarizes the findings and conclusions of these audits. The report serves as a valuable tool for business owners, investors, and stakeholders, providing them with an in-depth analysis of the financial health and integrity of companies operating in Travis County. There are several types of Travis Texas Reports of Independent Accountants after Audit of Financial Statements: 1. Standard Report: This report is the most common and straightforward type issued by independent accountants. It states that the financial statements of the audited company present fairly, in all material respects, its financial position, results of operations, and cash flows in accordance with generally accepted accounting principles (GAAP). 2. Qualified Report: A qualified report is issued when the independent accountants encounter a limitation in their audit process but believe that the financial statements overall are fairly presented. The qualified report includes a paragraph explaining the reason for the limitation. 3. Adverse Report: An adverse report is issued when the independent accountants determine that the financial statements do not present the company's financial position, results of operations, or cash flows in accordance with GAAP. This type of report raises serious concerns about the accuracy and reliability of the company's financial information. 4. Disclaimer of Opinion: In certain circumstances, independent accountants may issue a disclaimer of opinion when they are unable to express an opinion on the financial statements. This might occur due to significant limitations encountered during the audit or inadequate financial records. The disclaimer of opinion report emphasizes that the auditors were unable to form an opinion on the financial statements. The Travis Texas Report of Independent Accountants after Audit of Financial Statements plays a crucial role in maintaining confidence in the integrity of financial information within Travis County. Businesses and stakeholders heavily rely on these reports to make informed decisions regarding investment, lending, and other financial activities. The various types of reports issued by independent accountants provide a range of insights into the financial performance and compliance practices of companies operating in Travis County, ensuring transparency and trust in the local business community.Travis County, Texas is known for its thriving business community and robust financial sector. Every year, businesses in Travis County engage the services of independent accountants to conduct audits of their financial statements. These audits aim to ensure the accuracy and transparency of financial information disclosed by companies within the county. The Travis Texas Report of Independent Accountants after Audit of Financial Statements is a comprehensive document that summarizes the findings and conclusions of these audits. The report serves as a valuable tool for business owners, investors, and stakeholders, providing them with an in-depth analysis of the financial health and integrity of companies operating in Travis County. There are several types of Travis Texas Reports of Independent Accountants after Audit of Financial Statements: 1. Standard Report: This report is the most common and straightforward type issued by independent accountants. It states that the financial statements of the audited company present fairly, in all material respects, its financial position, results of operations, and cash flows in accordance with generally accepted accounting principles (GAAP). 2. Qualified Report: A qualified report is issued when the independent accountants encounter a limitation in their audit process but believe that the financial statements overall are fairly presented. The qualified report includes a paragraph explaining the reason for the limitation. 3. Adverse Report: An adverse report is issued when the independent accountants determine that the financial statements do not present the company's financial position, results of operations, or cash flows in accordance with GAAP. This type of report raises serious concerns about the accuracy and reliability of the company's financial information. 4. Disclaimer of Opinion: In certain circumstances, independent accountants may issue a disclaimer of opinion when they are unable to express an opinion on the financial statements. This might occur due to significant limitations encountered during the audit or inadequate financial records. The disclaimer of opinion report emphasizes that the auditors were unable to form an opinion on the financial statements. The Travis Texas Report of Independent Accountants after Audit of Financial Statements plays a crucial role in maintaining confidence in the integrity of financial information within Travis County. Businesses and stakeholders heavily rely on these reports to make informed decisions regarding investment, lending, and other financial activities. The various types of reports issued by independent accountants provide a range of insights into the financial performance and compliance practices of companies operating in Travis County, ensuring transparency and trust in the local business community.

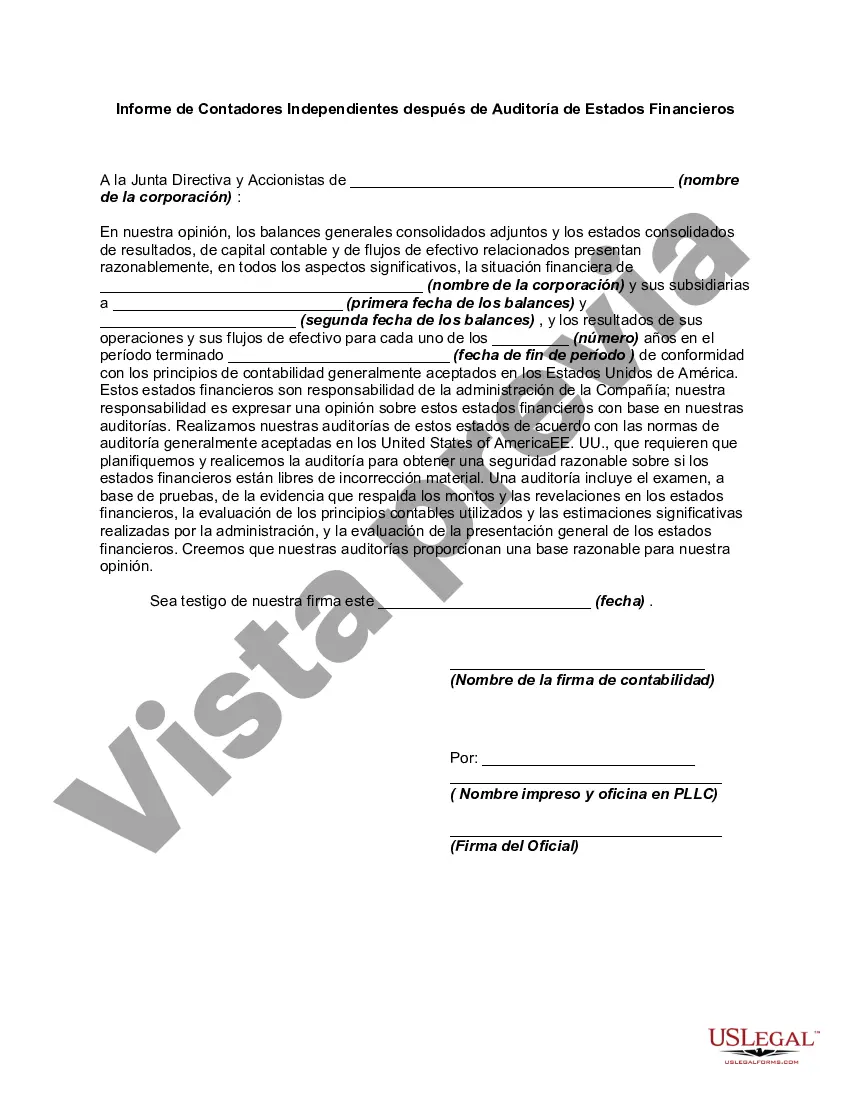

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.