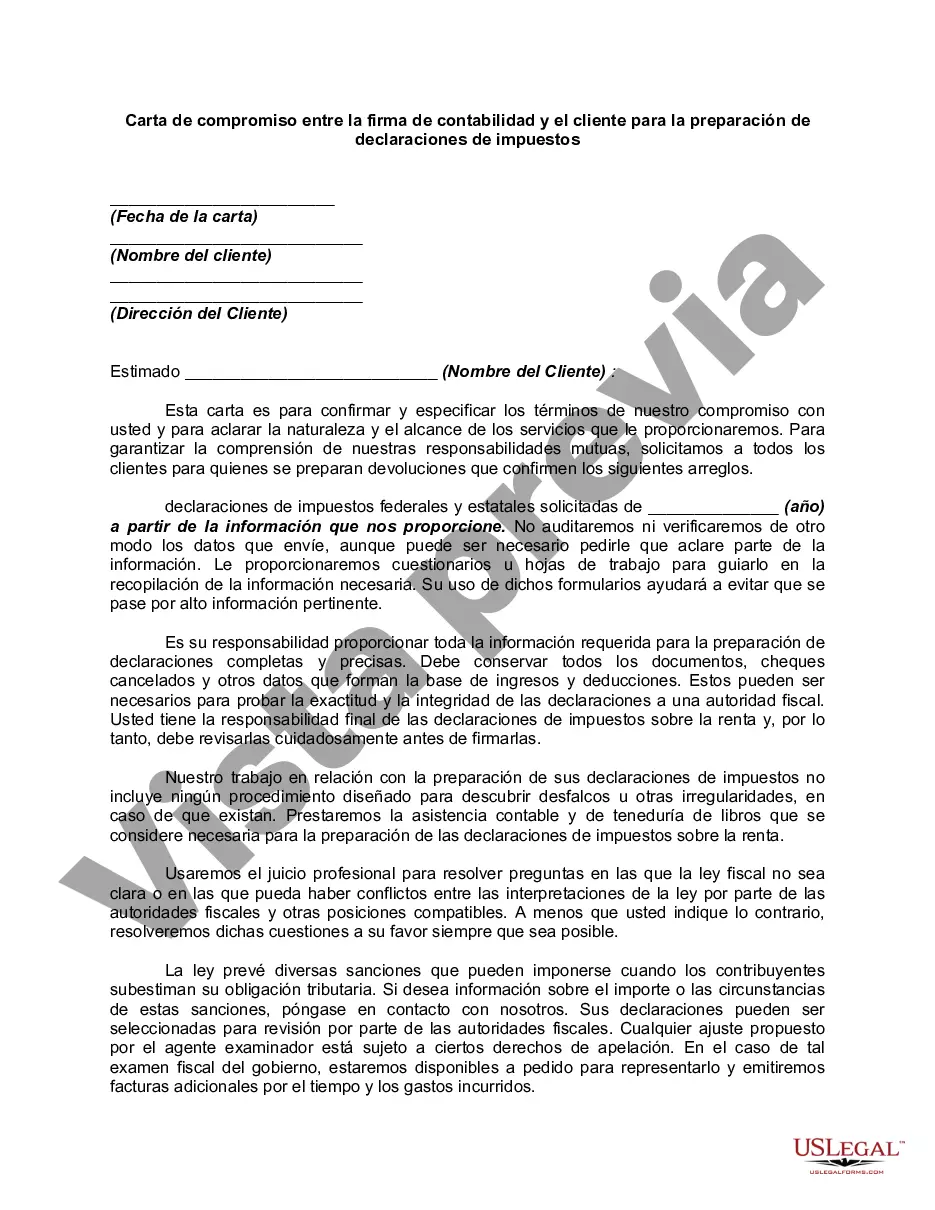

Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Suffolk, New York is a county located on Long Island, renowned for its scenic beauty, vibrant communities, and thriving business environment. As tax season approaches, individuals and businesses in Suffolk often seek the expertise of accounting firms to navigate the complex landscape of tax return preparation. To establish a professional relationship and outline the terms of their collaboration, an Engagement Letter between the accounting firm and client is essential. The Suffolk New York Engagement Letter between an accounting firm and client for tax return preparation serves as a legal document that outlines the scope of services, responsibilities, and expectations of both parties involved. It ensures transparency, clarity, and a smooth workflow throughout the tax return preparation process. Keywords: Suffolk New York, Engagement Letter, accounting firm, client, tax return preparation, services, responsibilities, expectations, transparency, workflow. Different types of Suffolk New York Engagement Letters between accounting firms and clients for tax return preparation can be categorized based on the specific services offered or the type of client: 1. Individual Tax Return Engagement Letter: This engagement letter specifically outlines the relationship between an accounting firm and an individual client seeking assistance with their personal tax return preparation. Keywords: Individual, personal tax return, services, engagement. 2. Business Tax Return Engagement Letter: This type of engagement letter is designed for businesses, including partnerships, corporations, and sole proprietorship, requiring professional tax return preparation and consultation. Keywords: Business, tax return, preparation, consultation, partnership, corporation, sole proprietorship. 3. Non-profit Organization Tax Return Engagement Letter: Non-profit organizations in Suffolk New York often need accounting firms to help with their tax return preparation. This engagement letter addresses the specific needs and responsibilities associated with this type of client. Keywords: Non-profit organization, tax return, preparation, services, responsibilities. 4. Estate and Trust Tax Return Engagement Letter: Individuals who manage estates and trusts can utilize this engagement letter to establish clear communication channels with accounting firms for efficient tax return preparation. Keywords: Estate, trust, tax return, preparation, communication, efficiency. In conclusion, the Suffolk New York Engagement Letter between an accounting firm and client for tax return preparation is a crucial document that ensures a seamless and productive relationship. By specifying the services, responsibilities, and expectations, this agreement facilitates effective communication, compliance with tax regulations, and ultimately helps clients meet their tax obligations accurately and efficiently.Suffolk, New York is a county located on Long Island, renowned for its scenic beauty, vibrant communities, and thriving business environment. As tax season approaches, individuals and businesses in Suffolk often seek the expertise of accounting firms to navigate the complex landscape of tax return preparation. To establish a professional relationship and outline the terms of their collaboration, an Engagement Letter between the accounting firm and client is essential. The Suffolk New York Engagement Letter between an accounting firm and client for tax return preparation serves as a legal document that outlines the scope of services, responsibilities, and expectations of both parties involved. It ensures transparency, clarity, and a smooth workflow throughout the tax return preparation process. Keywords: Suffolk New York, Engagement Letter, accounting firm, client, tax return preparation, services, responsibilities, expectations, transparency, workflow. Different types of Suffolk New York Engagement Letters between accounting firms and clients for tax return preparation can be categorized based on the specific services offered or the type of client: 1. Individual Tax Return Engagement Letter: This engagement letter specifically outlines the relationship between an accounting firm and an individual client seeking assistance with their personal tax return preparation. Keywords: Individual, personal tax return, services, engagement. 2. Business Tax Return Engagement Letter: This type of engagement letter is designed for businesses, including partnerships, corporations, and sole proprietorship, requiring professional tax return preparation and consultation. Keywords: Business, tax return, preparation, consultation, partnership, corporation, sole proprietorship. 3. Non-profit Organization Tax Return Engagement Letter: Non-profit organizations in Suffolk New York often need accounting firms to help with their tax return preparation. This engagement letter addresses the specific needs and responsibilities associated with this type of client. Keywords: Non-profit organization, tax return, preparation, services, responsibilities. 4. Estate and Trust Tax Return Engagement Letter: Individuals who manage estates and trusts can utilize this engagement letter to establish clear communication channels with accounting firms for efficient tax return preparation. Keywords: Estate, trust, tax return, preparation, communication, efficiency. In conclusion, the Suffolk New York Engagement Letter between an accounting firm and client for tax return preparation is a crucial document that ensures a seamless and productive relationship. By specifying the services, responsibilities, and expectations, this agreement facilitates effective communication, compliance with tax regulations, and ultimately helps clients meet their tax obligations accurately and efficiently.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.