Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Fulton Georgia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a legal document that outlines the terms and conditions for a consulting relationship between a consultant and a client in Fulton, Georgia. This agreement specifically focuses on providing advice and assistance in accounting, tax matters, and record-keeping. The main purpose of this agreement is to ensure that the consultant provides professional guidance and support to the client in managing their financial records, tax obligations, and overall accounting practices. By entering into this agreement, both parties acknowledge and agree upon the scope of the consulting services, fees, confidentiality, termination, and other relevant terms. There can be different types of Fulton Georgia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, some of which may include: 1. Fixed-Term Agreement: This type of agreement specifies a specific duration for the consulting services, such as a fixed number of months or years. It includes provisions for renewal or termination of the contract at the end of the term. 2. Retainer Agreement: In this agreement, the consultant is engaged on an ongoing basis to provide continuous accounting, tax, and record-keeping advice and services. The agreement typically includes a retainer fee structure that compensates the consultant for their availability and dedication to the client's needs. 3. Project-Based Agreement: This agreement is established for a specific project or task, such as assisting with tax preparation, financial statement analysis, or other accounting-related projects. It outlines the scope of the project, deliverables, milestones, and payment terms. 4. Hourly Rate Agreement: In this type of agreement, the consultant charges the client on an hourly basis for the time spent providing advice and guidance on accounting, tax matters, and record-keeping. The agreement typically specifies the consultant's hourly rate, billing method, and any additional expenses incurred during the engagement. Regardless of the specific type of agreement, the primary goal remains the same — to establish a clear understanding between the consultant and the client regarding the services to be provided, fees, confidentiality, intellectual property rights, dispute resolution, and any other important terms necessary to ensure a successful consulting relationship. It's crucial for both parties to carefully review and negotiate the terms of the Fulton Georgia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping protecting their respective interests and ensure a mutually beneficial consulting engagement.Fulton Georgia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a legal document that outlines the terms and conditions for a consulting relationship between a consultant and a client in Fulton, Georgia. This agreement specifically focuses on providing advice and assistance in accounting, tax matters, and record-keeping. The main purpose of this agreement is to ensure that the consultant provides professional guidance and support to the client in managing their financial records, tax obligations, and overall accounting practices. By entering into this agreement, both parties acknowledge and agree upon the scope of the consulting services, fees, confidentiality, termination, and other relevant terms. There can be different types of Fulton Georgia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping, some of which may include: 1. Fixed-Term Agreement: This type of agreement specifies a specific duration for the consulting services, such as a fixed number of months or years. It includes provisions for renewal or termination of the contract at the end of the term. 2. Retainer Agreement: In this agreement, the consultant is engaged on an ongoing basis to provide continuous accounting, tax, and record-keeping advice and services. The agreement typically includes a retainer fee structure that compensates the consultant for their availability and dedication to the client's needs. 3. Project-Based Agreement: This agreement is established for a specific project or task, such as assisting with tax preparation, financial statement analysis, or other accounting-related projects. It outlines the scope of the project, deliverables, milestones, and payment terms. 4. Hourly Rate Agreement: In this type of agreement, the consultant charges the client on an hourly basis for the time spent providing advice and guidance on accounting, tax matters, and record-keeping. The agreement typically specifies the consultant's hourly rate, billing method, and any additional expenses incurred during the engagement. Regardless of the specific type of agreement, the primary goal remains the same — to establish a clear understanding between the consultant and the client regarding the services to be provided, fees, confidentiality, intellectual property rights, dispute resolution, and any other important terms necessary to ensure a successful consulting relationship. It's crucial for both parties to carefully review and negotiate the terms of the Fulton Georgia General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping protecting their respective interests and ensure a mutually beneficial consulting engagement.

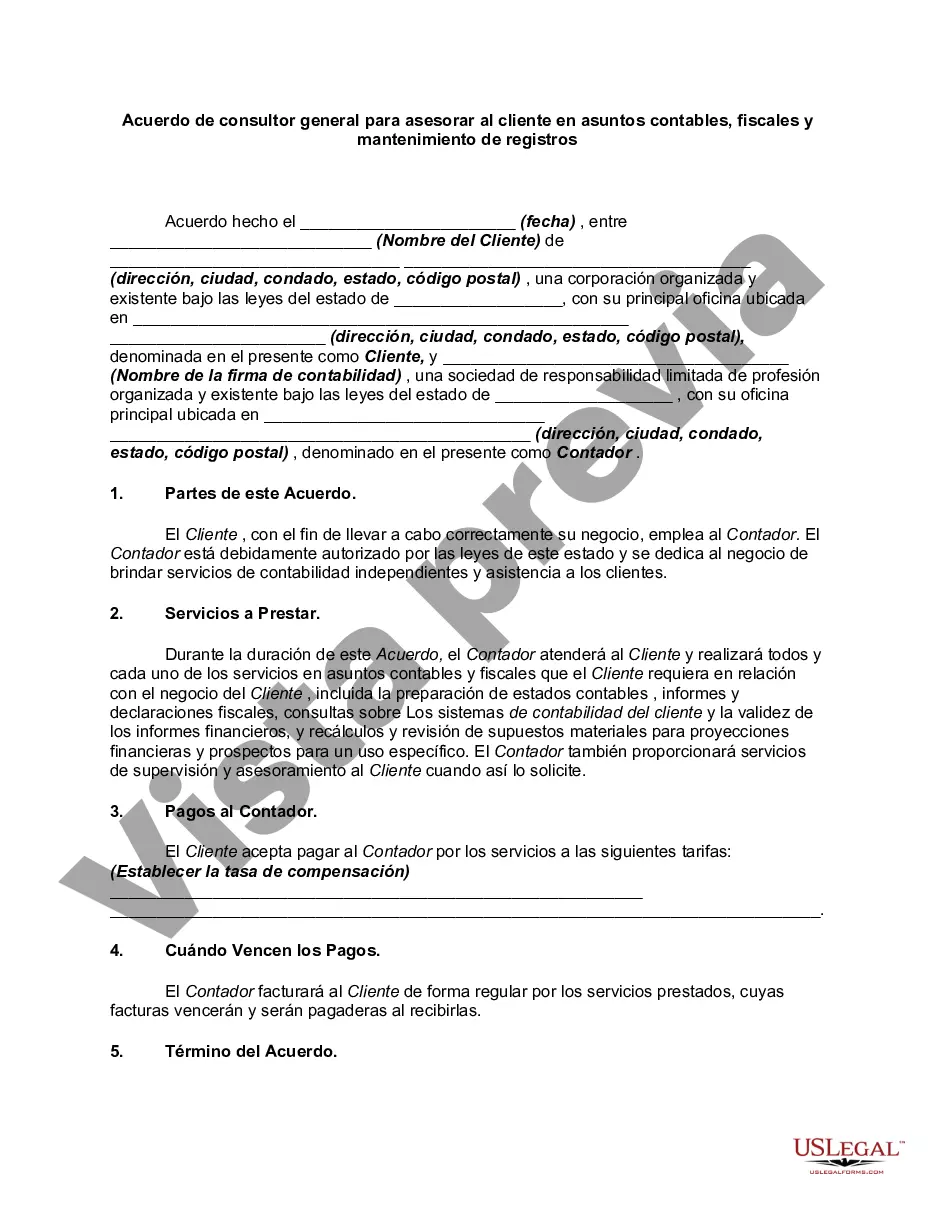

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.