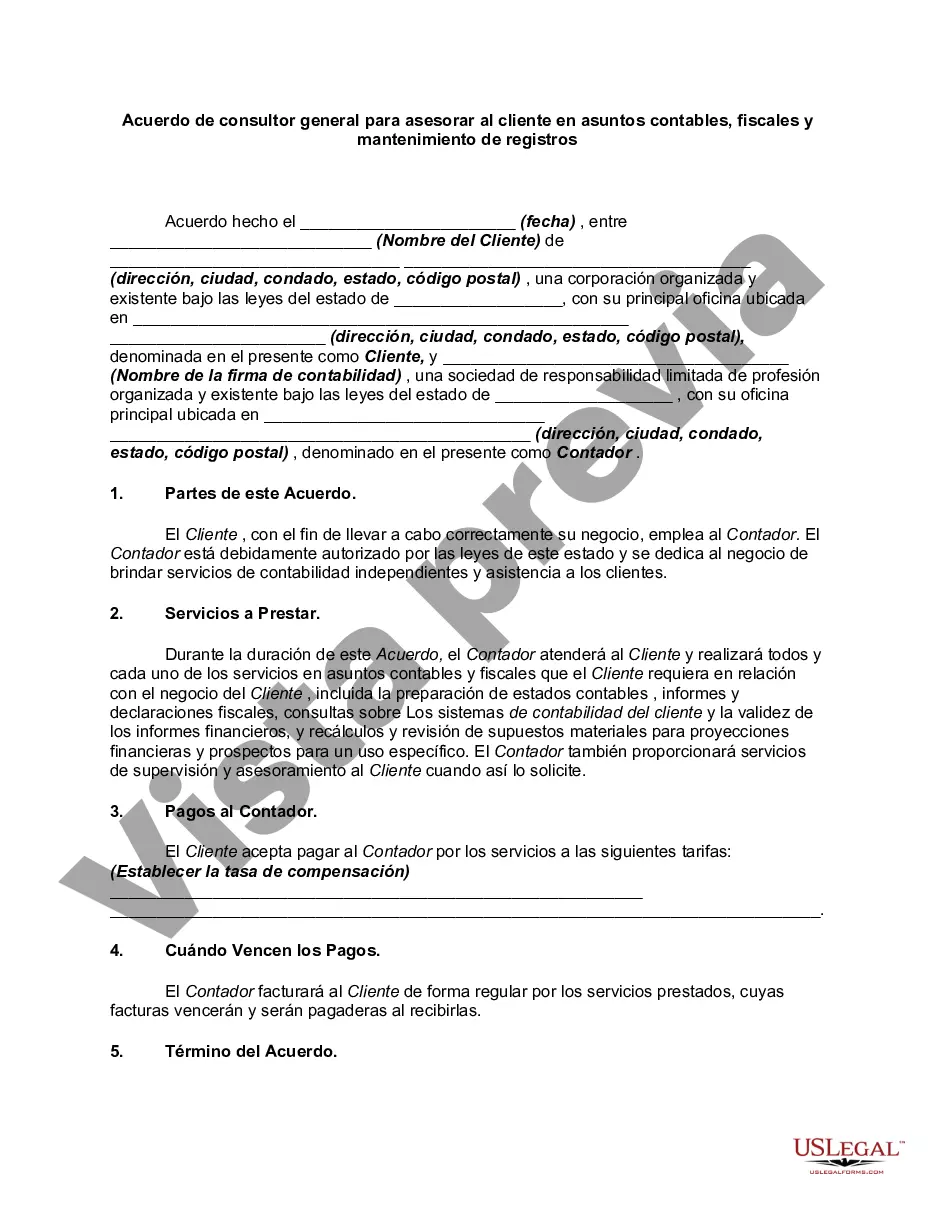

Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nassau New York General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a legally binding contract between a consultant and a client in Nassau, New York. This agreement outlines the scope of services provided by the consultant in regard to accounting, tax matters, and record keeping. It ensures clear communication, sets expectations, and protects the rights and obligations of both parties involved. The agreement typically covers several key areas: 1. Scope of Services: The agreement delineates the specific consulting services to be provided, such as financial analysis, financial planning, tax planning, record keeping, and other related advisory services. The consultant should provide a detailed description of their capabilities, expertise, and qualifications in these areas. 2. Term and Termination: The agreement specifies the duration of the consulting services, whether it is for a fixed term or ongoing. It also includes provisions for termination, including circumstances that may lead to termination, notice periods, and any associated fees or penalties. 3. Payment and Fees: The agreement outlines the compensation structure, including fees, billing cycles, and any additional costs reimbursable by the client. It may specify whether payment is on an hourly, project-based, or retainer basis. 4. Confidentiality: Confidentiality clauses are essential in protecting the client's sensitive financial information. The agreement should include provisions that prohibit the consultant from disclosing or misusing any confidential data shared during the engagement. It may also address the return or destruction of confidential information after the termination of the agreement. 5. Ownership and Intellectual Property: If the consultant develops any intellectual property or proprietary materials during the engagement, the agreement should determine the ownership rights. It may also include clauses preventing the consultant from using the client's intellectual property without consent. 6. Indemnification and Liability: This section addresses the responsibilities and liability of both parties, often including a limitation on the consultant's liability for any damages incurred by the client as a result of their services. It may also clarify the circumstances under which the consultant can be held responsible. 7. Governing Law and Dispute Resolution: This agreement specifies the governing law, often New York State law, and outlines the preferred method for resolving any disputes, such as mediation, arbitration, or litigation. Different types of Nassau New York General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping may vary based on the nature and complexity of the client's business and financial needs. It can range from a simple agreement for basic consulting services to a comprehensive contract for ongoing strategic financial planning and advisory services.Nassau New York General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a legally binding contract between a consultant and a client in Nassau, New York. This agreement outlines the scope of services provided by the consultant in regard to accounting, tax matters, and record keeping. It ensures clear communication, sets expectations, and protects the rights and obligations of both parties involved. The agreement typically covers several key areas: 1. Scope of Services: The agreement delineates the specific consulting services to be provided, such as financial analysis, financial planning, tax planning, record keeping, and other related advisory services. The consultant should provide a detailed description of their capabilities, expertise, and qualifications in these areas. 2. Term and Termination: The agreement specifies the duration of the consulting services, whether it is for a fixed term or ongoing. It also includes provisions for termination, including circumstances that may lead to termination, notice periods, and any associated fees or penalties. 3. Payment and Fees: The agreement outlines the compensation structure, including fees, billing cycles, and any additional costs reimbursable by the client. It may specify whether payment is on an hourly, project-based, or retainer basis. 4. Confidentiality: Confidentiality clauses are essential in protecting the client's sensitive financial information. The agreement should include provisions that prohibit the consultant from disclosing or misusing any confidential data shared during the engagement. It may also address the return or destruction of confidential information after the termination of the agreement. 5. Ownership and Intellectual Property: If the consultant develops any intellectual property or proprietary materials during the engagement, the agreement should determine the ownership rights. It may also include clauses preventing the consultant from using the client's intellectual property without consent. 6. Indemnification and Liability: This section addresses the responsibilities and liability of both parties, often including a limitation on the consultant's liability for any damages incurred by the client as a result of their services. It may also clarify the circumstances under which the consultant can be held responsible. 7. Governing Law and Dispute Resolution: This agreement specifies the governing law, often New York State law, and outlines the preferred method for resolving any disputes, such as mediation, arbitration, or litigation. Different types of Nassau New York General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping may vary based on the nature and complexity of the client's business and financial needs. It can range from a simple agreement for basic consulting services to a comprehensive contract for ongoing strategic financial planning and advisory services.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.