Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A San Diego California General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a legally binding contract between a consultant and a client, outlining the terms and conditions of the consulting services provided. This agreement is specifically focused on providing expertise and guidance in the areas of accounting, tax matters, and record keeping to businesses or individuals located in San Diego, California. The purpose of this agreement is to establish a clear understanding between the consultant and the client regarding the scope of services, compensation, responsibilities, confidentiality, and other important aspects of the consulting relationship. By formalizing this agreement, both parties can ensure a professional and ethical collaboration while avoiding any potential misunderstandings or conflicts. 1. Accounting and Bookkeeping Consultant Agreement: This type of agreement primarily focuses on assisting clients with their financial record keeping, bookkeeping, and accounting practices. The consultant may provide guidance on maintaining accurate financial records, preparing financial statements, managing accounts payable and receivable, budgeting, and other related matters. 2. Tax Consulting Agreement: This agreement is specifically tailored for clients seeking expert advice and assistance in managing their tax obligations. The consultant may provide guidance on tax planning strategies, tax compliance, deductions, credits, and other tax-related matters to ensure their clients remain in full compliance with local, state, and federal tax regulations. 3. Business Financial Consultant Agreement: This agreement encompasses a broader range of financial advisory services, including accounting, tax matters, and record keeping. The consultant may provide guidance on financial analysis, cash flow management, financial forecasting, financial risk assessment, financial reporting, and other financial aspects essential for the client's business. In all types of San Diego California General Consultant Agreements focusing on accounting, tax matters, and record keeping, the following key components are typically included: — Scope of Services: Clearly defines the specific consulting services to be provided by the consultant. — Compensation: Outlines the fees, payment terms, and any additional expenses that the client will incur. — Duration: Specifies the length of the agreement, including the start and end date or termination conditions. — Responsibilities: Outlines the roles and responsibilities of both parties during the consulting engagement. — Confidentiality: Establishes the confidential nature of the consulting relationship and defines the non-disclosure obligations of both parties. — Intellectual Property: Addresses the ownership rights of any intellectual property or proprietary information developed during the consulting engagement. — Termination Clause: Sets forth the conditions under which either party can terminate the agreement. — Governing Law: Specifies the jurisdiction and governing law that will apply in case of any legal disputes. Overall, a San Diego California General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping ensures that clients in San Diego receive expert advice and assistance in managing their financial matters, complying with tax regulations, and maintaining accurate records essential for the success of their businesses.A San Diego California General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a legally binding contract between a consultant and a client, outlining the terms and conditions of the consulting services provided. This agreement is specifically focused on providing expertise and guidance in the areas of accounting, tax matters, and record keeping to businesses or individuals located in San Diego, California. The purpose of this agreement is to establish a clear understanding between the consultant and the client regarding the scope of services, compensation, responsibilities, confidentiality, and other important aspects of the consulting relationship. By formalizing this agreement, both parties can ensure a professional and ethical collaboration while avoiding any potential misunderstandings or conflicts. 1. Accounting and Bookkeeping Consultant Agreement: This type of agreement primarily focuses on assisting clients with their financial record keeping, bookkeeping, and accounting practices. The consultant may provide guidance on maintaining accurate financial records, preparing financial statements, managing accounts payable and receivable, budgeting, and other related matters. 2. Tax Consulting Agreement: This agreement is specifically tailored for clients seeking expert advice and assistance in managing their tax obligations. The consultant may provide guidance on tax planning strategies, tax compliance, deductions, credits, and other tax-related matters to ensure their clients remain in full compliance with local, state, and federal tax regulations. 3. Business Financial Consultant Agreement: This agreement encompasses a broader range of financial advisory services, including accounting, tax matters, and record keeping. The consultant may provide guidance on financial analysis, cash flow management, financial forecasting, financial risk assessment, financial reporting, and other financial aspects essential for the client's business. In all types of San Diego California General Consultant Agreements focusing on accounting, tax matters, and record keeping, the following key components are typically included: — Scope of Services: Clearly defines the specific consulting services to be provided by the consultant. — Compensation: Outlines the fees, payment terms, and any additional expenses that the client will incur. — Duration: Specifies the length of the agreement, including the start and end date or termination conditions. — Responsibilities: Outlines the roles and responsibilities of both parties during the consulting engagement. — Confidentiality: Establishes the confidential nature of the consulting relationship and defines the non-disclosure obligations of both parties. — Intellectual Property: Addresses the ownership rights of any intellectual property or proprietary information developed during the consulting engagement. — Termination Clause: Sets forth the conditions under which either party can terminate the agreement. — Governing Law: Specifies the jurisdiction and governing law that will apply in case of any legal disputes. Overall, a San Diego California General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping ensures that clients in San Diego receive expert advice and assistance in managing their financial matters, complying with tax regulations, and maintaining accurate records essential for the success of their businesses.

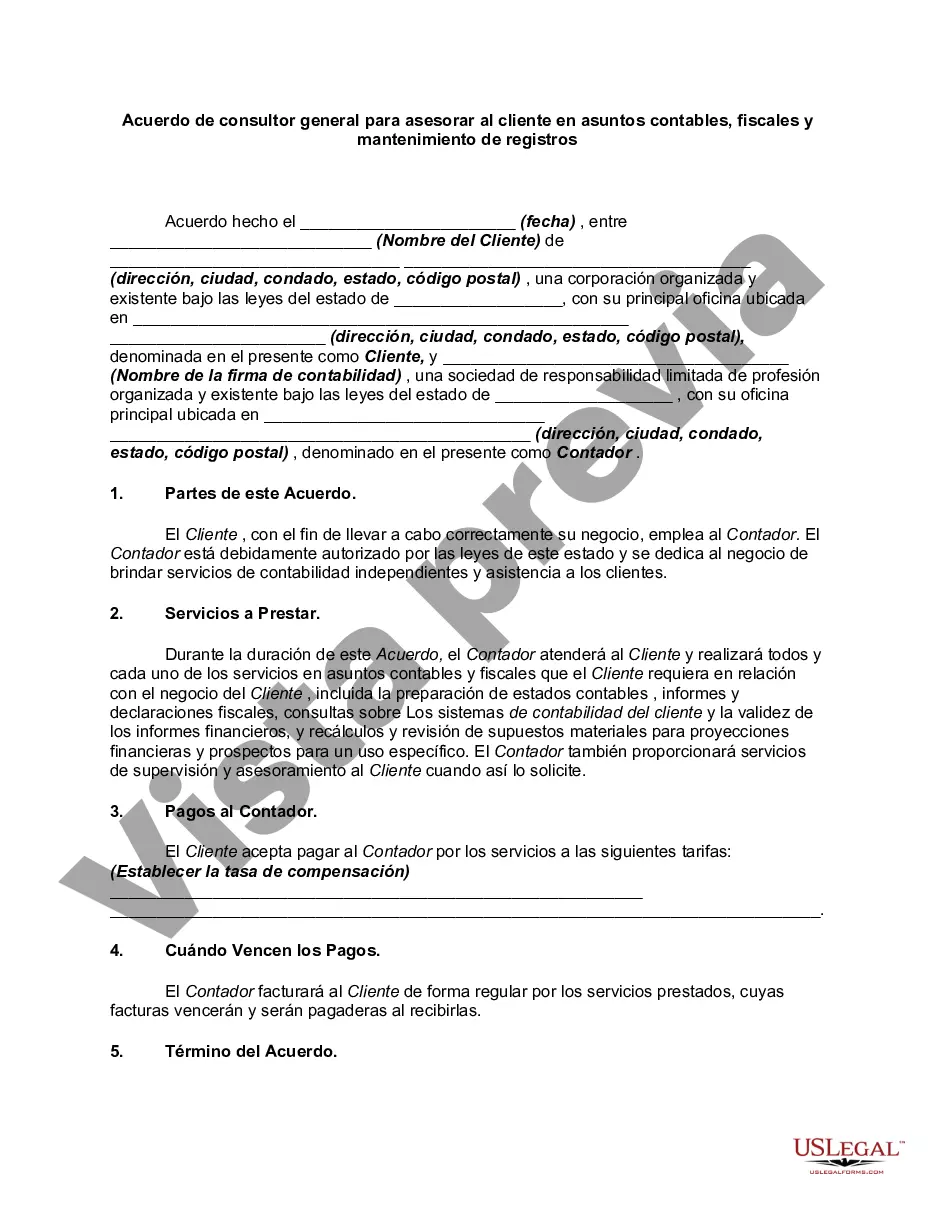

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.