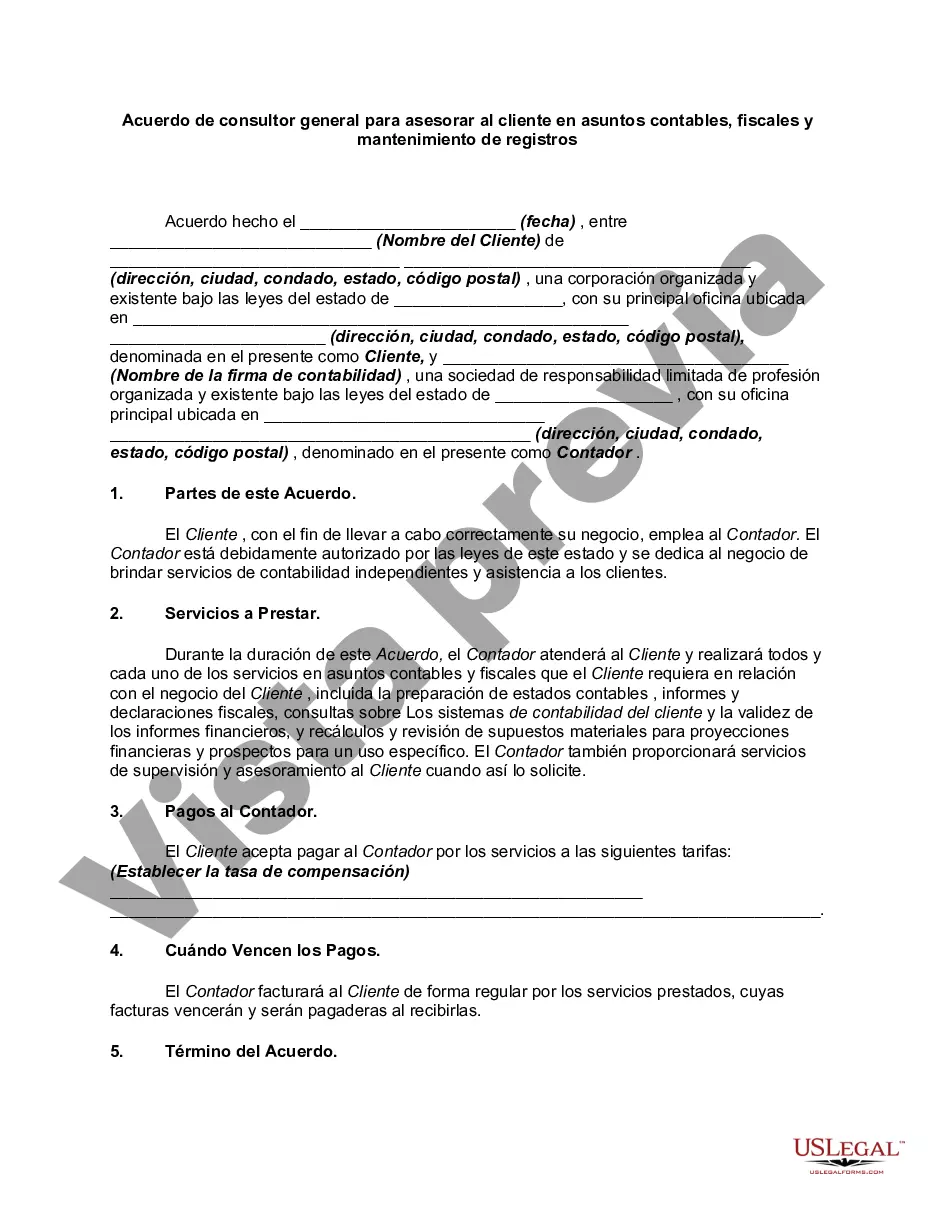

Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its high-tech industry and thriving business environment, it attracts numerous companies and entrepreneurs seeking professional services to enhance their financial management. One such crucial service is the San Jose California General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. This comprehensive consultant agreement encompasses various aspects related to accounting, tax compliance, and record keeping. By utilizing the expertise of a general consultant, clients can streamline their financial operations, effectively manage tax obligations, and maintain accurate records in compliance with local, state, and federal regulations. Key components of the San Jose California General Consultant Agreement include: 1. Accounting Advice: The consultant provides expert advice on accounting principles, bookkeeping practices, financial analysis, and reporting standards. They help clients maintain accurate financial records, identify cost-saving opportunities, and optimize cash flow management. 2. Tax Planning and Compliance: With a thorough understanding of tax laws and regulations, the consultant assists clients in developing strategic tax planning strategies to minimize tax liabilities while ensuring compliance with all applicable laws. They provide guidance on tax deductions, credits, filings, and compliance procedures. 3. Record Keeping and Documentation: The agreement emphasizes the importance of proper record keeping. The consultant advises clients on establishing efficient record keeping systems, ensuring timely and accurate documentation of financial transactions, receipts, and invoices. This helps to streamline auditing processes and ensures compliance with legal and regulatory requirements. 4. Financial Software Implementation: In some cases, the agreement may include provisions for the consultant to assist with the implementation of financial software or accounting systems. This helps clients automate their bookkeeping processes, improve accuracy, and enhance efficiency. Different types of San Jose California General Consultant Agreements to Advise Clients on Accounting, Tax Matters, and Record Keeping might include: 1. Hourly Rate Agreement: This type of agreement is based on an hourly billing rate for the services provided by the consultant. It is commonly used for short-term or ad-hoc projects requiring specific expertise. 2. Fixed-Fee Agreement: In a fixed-fee agreement, the consultant charges a predetermined fee for a specific scope of work. This type of agreement is often utilized for long-term consulting engagements or projects with well-defined objectives. 3. Retainer Agreement: Under a retainer agreement, the client pays a recurring fee to secure ongoing access to the consultant's services. This is especially advantageous when clients require regular advisory and support on accounting, tax, and record-keeping matters. Overall, the San Jose California General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a crucial document that helps businesses in the region optimize their financial management practices, ensure compliance, and make informed decisions to drive growth and success.San Jose, California is a vibrant city located in the heart of Silicon Valley. Known for its high-tech industry and thriving business environment, it attracts numerous companies and entrepreneurs seeking professional services to enhance their financial management. One such crucial service is the San Jose California General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping. This comprehensive consultant agreement encompasses various aspects related to accounting, tax compliance, and record keeping. By utilizing the expertise of a general consultant, clients can streamline their financial operations, effectively manage tax obligations, and maintain accurate records in compliance with local, state, and federal regulations. Key components of the San Jose California General Consultant Agreement include: 1. Accounting Advice: The consultant provides expert advice on accounting principles, bookkeeping practices, financial analysis, and reporting standards. They help clients maintain accurate financial records, identify cost-saving opportunities, and optimize cash flow management. 2. Tax Planning and Compliance: With a thorough understanding of tax laws and regulations, the consultant assists clients in developing strategic tax planning strategies to minimize tax liabilities while ensuring compliance with all applicable laws. They provide guidance on tax deductions, credits, filings, and compliance procedures. 3. Record Keeping and Documentation: The agreement emphasizes the importance of proper record keeping. The consultant advises clients on establishing efficient record keeping systems, ensuring timely and accurate documentation of financial transactions, receipts, and invoices. This helps to streamline auditing processes and ensures compliance with legal and regulatory requirements. 4. Financial Software Implementation: In some cases, the agreement may include provisions for the consultant to assist with the implementation of financial software or accounting systems. This helps clients automate their bookkeeping processes, improve accuracy, and enhance efficiency. Different types of San Jose California General Consultant Agreements to Advise Clients on Accounting, Tax Matters, and Record Keeping might include: 1. Hourly Rate Agreement: This type of agreement is based on an hourly billing rate for the services provided by the consultant. It is commonly used for short-term or ad-hoc projects requiring specific expertise. 2. Fixed-Fee Agreement: In a fixed-fee agreement, the consultant charges a predetermined fee for a specific scope of work. This type of agreement is often utilized for long-term consulting engagements or projects with well-defined objectives. 3. Retainer Agreement: Under a retainer agreement, the client pays a recurring fee to secure ongoing access to the consultant's services. This is especially advantageous when clients require regular advisory and support on accounting, tax, and record-keeping matters. Overall, the San Jose California General Consultant Agreement to Advise Client on Accounting, Tax Matters, and Record Keeping is a crucial document that helps businesses in the region optimize their financial management practices, ensure compliance, and make informed decisions to drive growth and success.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.