The main function of a financial advisor is to evaluate the economic performance of certain companies and industries for business firms and other organizations that have the money to make valuable investments.

Other tasks financial advisors have include:

" Compiling data for financial reports

" Analyzing social and economic data

" Examining market conditions

" Working with detailed financial records

" Creating statistical diagrams and charts

" Advising clients on financial matters

" Making investment presentations

Advisers use Form ADV to register as an investment adviser with the SEC. Form ADV also is used for state registration. Generally, an investment adviser that manages $25 million or more in client assets must register with the SEC. Advisers that manage less than $25 million must register with the state securities regulator where the adviser's principal place of business is located.

Form ADV has two parts. Part 1 contains information about the adviser's education, business and disciplinary history within the last ten years. Part 1 is filed electronically with the SEC. Part 2 includes information on an adviser's services, fees, and investment strategies. Currently, the SEC does not require advisers to file Part 2 electronically.

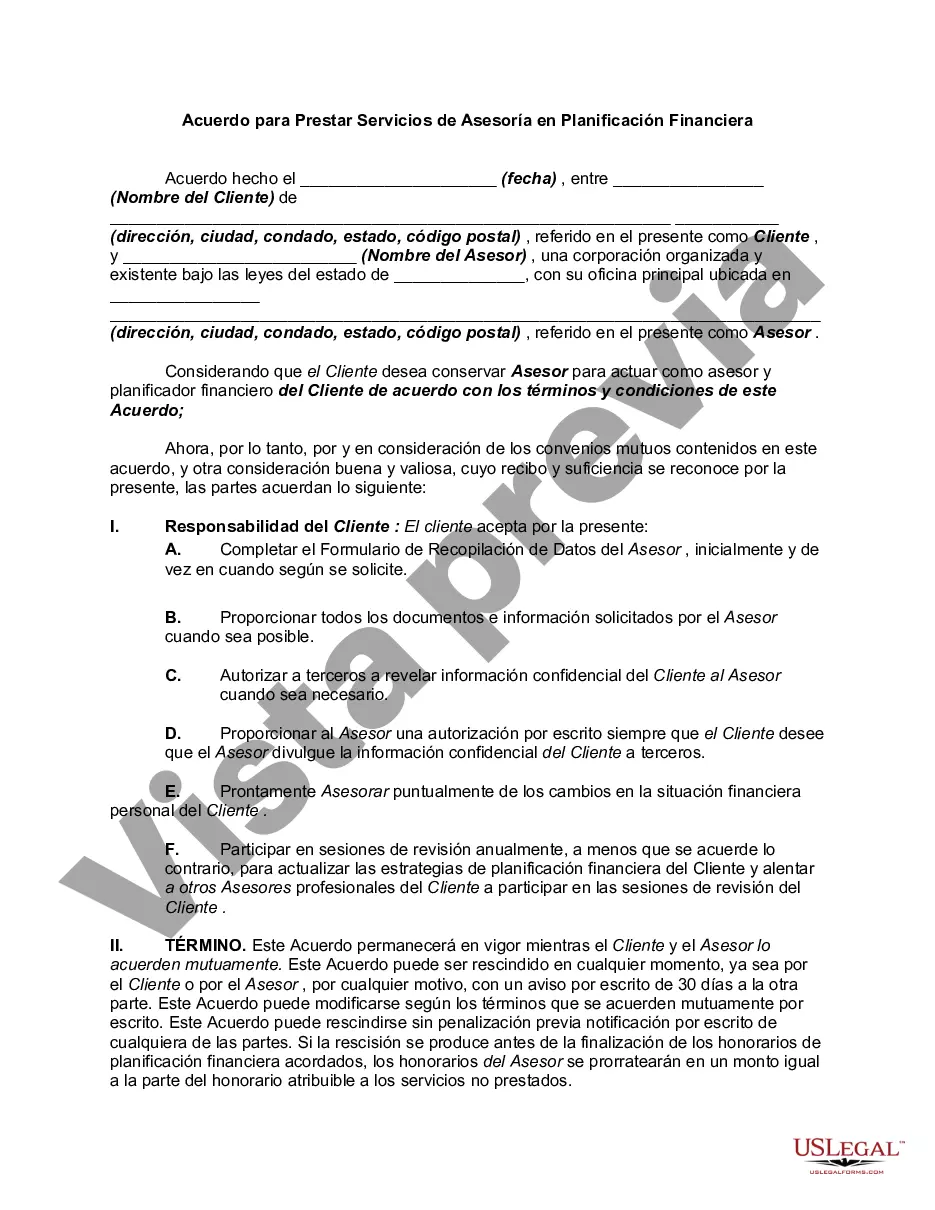

Harris Texas Agreement to Provide Financial Planning Advisory Services is a comprehensive document that outlines the terms, conditions, and responsibilities between Harris Texas, a financial planning advisory firm, and its clients. This agreement serves as a legal contract that ensures transparency, trust, and professionalism in offering financial planning services. The main objective of the Harris Texas Agreement is to establish a solid partnership between the firm and its clients, guiding them towards achieving their financial goals while considering their individual financial circumstances, risk tolerance, and investment preferences. The agreement ensures that the recommended strategies align with the client's best interest, promoting financial growth and security. Key services covered under the Harris Texas Agreement include: 1. Wealth assessment and goal setting: Harris Texas carries out a detailed assessment of the client's current financial situation, analyzing their assets, liabilities, income, and expenses. Based on this information, the firm helps the client establish realistic financial goals, both short and long term. 2. Investment portfolio management: Harris Texas provides expert advice and guidance on investment strategies and asset allocation, taking into account the client's risk profile and investment preferences. The agreement outlines the mutual understanding of how the client's portfolio will be managed, considering factors such as diversification, risk management, and market analysis. 3. Retirement planning: In this section, the agreement focuses on creating a personalized retirement plan for the client. It includes strategies for maximizing retirement savings, projecting future income needs, addressing potential risks, and exploring suitable retirement investment options. 4. Estate planning: Harris Texas assists clients in developing a comprehensive estate plan, including wills, trusts, and beneficiary designations. This section of the agreement covers strategies to minimize estate taxes, outline charitable giving desires, and ensure the smooth transfer of assets to intended beneficiaries. 5. Tax planning: The agreement addresses tax-efficient strategies to minimize the client's tax liability while maintaining compliance with tax laws and regulations. It includes guidance on reducibility of eligible expenses, tax-efficient investments, and considering tax implications when making financial decisions. Additional types of Harris Texas Agreements to Provide Financial Planning Advisory Services may include: 1. Harris Texas Agreement for Business Financial Planning: This agreement specifically caters to clients who own or operate small businesses and require financial planning advice tailored to their unique circumstances. It focuses on issues such as cash flow management, business succession planning, and employee benefits. 2. Harris Texas Agreement for High Net Worth Individuals: This specialized agreement is designed for wealthy clients with substantial financial assets. It deals with complex issues such as tax planning, charitable giving, philanthropy, legacy planning, and intergenerational wealth transfer. 3. Harris Texas Agreement for Investment Advisory Services: This agreement focuses solely on investment advisory services, catering to clients who seek professional advice primarily on managing their investment portfolios. It outlines the advisory relationship, investment philosophies, and responsibilities of both parties. In summary, the Harris Texas Agreement to Provide Financial Planning Advisory Services is a crucial document that outlines the terms, responsibilities, and expectations between a financial planning advisory firm and its clients. It highlights various services provided, including wealth assessment, investment portfolio management, retirement planning, estate planning, and tax planning. Additionally, different types of agreements exist to cater to specific client needs, such as business financial planning, high net worth individuals, and investment advisory services.Harris Texas Agreement to Provide Financial Planning Advisory Services is a comprehensive document that outlines the terms, conditions, and responsibilities between Harris Texas, a financial planning advisory firm, and its clients. This agreement serves as a legal contract that ensures transparency, trust, and professionalism in offering financial planning services. The main objective of the Harris Texas Agreement is to establish a solid partnership between the firm and its clients, guiding them towards achieving their financial goals while considering their individual financial circumstances, risk tolerance, and investment preferences. The agreement ensures that the recommended strategies align with the client's best interest, promoting financial growth and security. Key services covered under the Harris Texas Agreement include: 1. Wealth assessment and goal setting: Harris Texas carries out a detailed assessment of the client's current financial situation, analyzing their assets, liabilities, income, and expenses. Based on this information, the firm helps the client establish realistic financial goals, both short and long term. 2. Investment portfolio management: Harris Texas provides expert advice and guidance on investment strategies and asset allocation, taking into account the client's risk profile and investment preferences. The agreement outlines the mutual understanding of how the client's portfolio will be managed, considering factors such as diversification, risk management, and market analysis. 3. Retirement planning: In this section, the agreement focuses on creating a personalized retirement plan for the client. It includes strategies for maximizing retirement savings, projecting future income needs, addressing potential risks, and exploring suitable retirement investment options. 4. Estate planning: Harris Texas assists clients in developing a comprehensive estate plan, including wills, trusts, and beneficiary designations. This section of the agreement covers strategies to minimize estate taxes, outline charitable giving desires, and ensure the smooth transfer of assets to intended beneficiaries. 5. Tax planning: The agreement addresses tax-efficient strategies to minimize the client's tax liability while maintaining compliance with tax laws and regulations. It includes guidance on reducibility of eligible expenses, tax-efficient investments, and considering tax implications when making financial decisions. Additional types of Harris Texas Agreements to Provide Financial Planning Advisory Services may include: 1. Harris Texas Agreement for Business Financial Planning: This agreement specifically caters to clients who own or operate small businesses and require financial planning advice tailored to their unique circumstances. It focuses on issues such as cash flow management, business succession planning, and employee benefits. 2. Harris Texas Agreement for High Net Worth Individuals: This specialized agreement is designed for wealthy clients with substantial financial assets. It deals with complex issues such as tax planning, charitable giving, philanthropy, legacy planning, and intergenerational wealth transfer. 3. Harris Texas Agreement for Investment Advisory Services: This agreement focuses solely on investment advisory services, catering to clients who seek professional advice primarily on managing their investment portfolios. It outlines the advisory relationship, investment philosophies, and responsibilities of both parties. In summary, the Harris Texas Agreement to Provide Financial Planning Advisory Services is a crucial document that outlines the terms, responsibilities, and expectations between a financial planning advisory firm and its clients. It highlights various services provided, including wealth assessment, investment portfolio management, retirement planning, estate planning, and tax planning. Additionally, different types of agreements exist to cater to specific client needs, such as business financial planning, high net worth individuals, and investment advisory services.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.