The main function of a financial advisor is to evaluate the economic performance of certain companies and industries for business firms and other organizations that have the money to make valuable investments.

Other tasks financial advisors have include:

" Compiling data for financial reports

" Analyzing social and economic data

" Examining market conditions

" Working with detailed financial records

" Creating statistical diagrams and charts

" Advising clients on financial matters

" Making investment presentations

Advisers use Form ADV to register as an investment adviser with the SEC. Form ADV also is used for state registration. Generally, an investment adviser that manages $25 million or more in client assets must register with the SEC. Advisers that manage less than $25 million must register with the state securities regulator where the adviser's principal place of business is located.

Form ADV has two parts. Part 1 contains information about the adviser's education, business and disciplinary history within the last ten years. Part 1 is filed electronically with the SEC. Part 2 includes information on an adviser's services, fees, and investment strategies. Currently, the SEC does not require advisers to file Part 2 electronically.

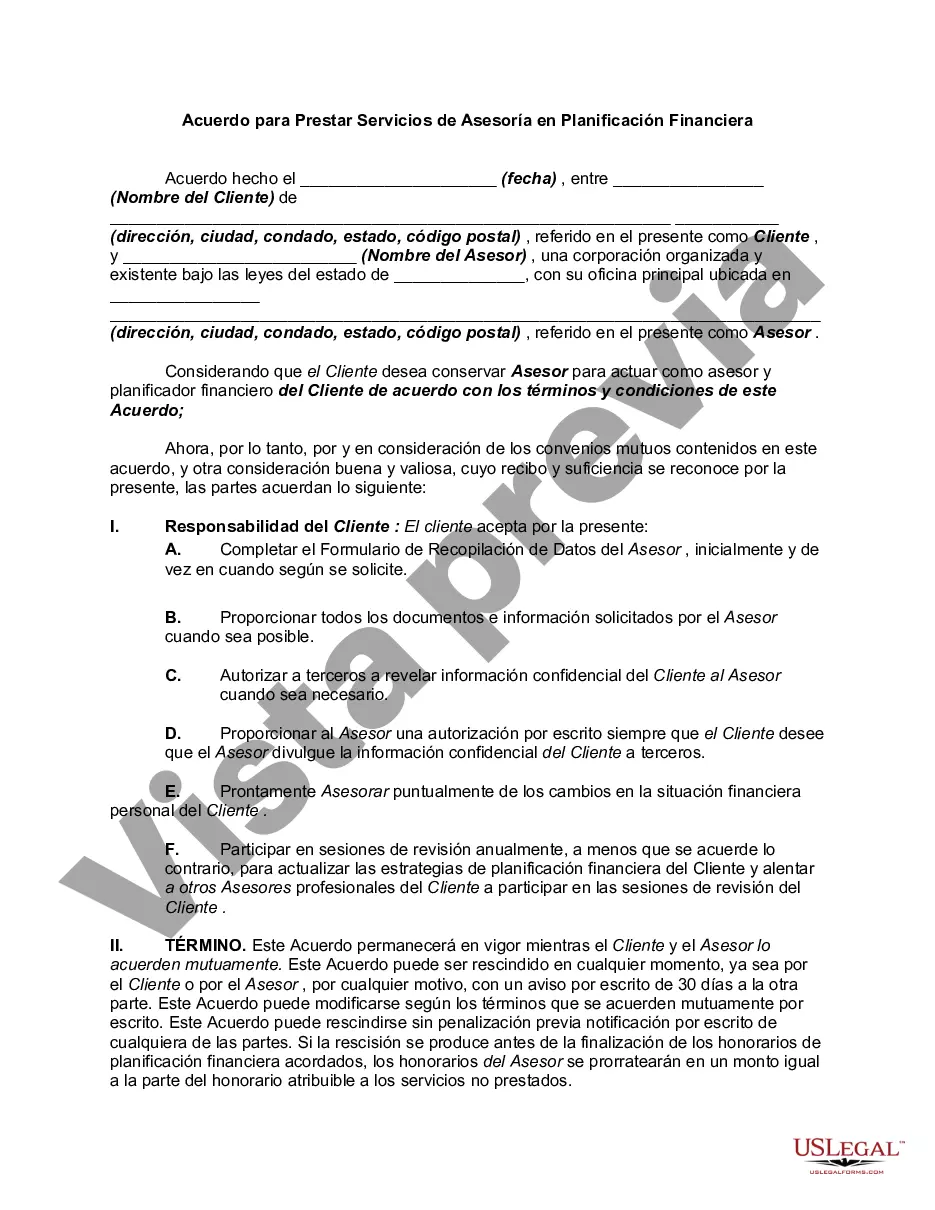

Kings New York Agreement to Provide Financial Planning Advisory Services is a comprehensive and reliable financial planning service offered by Kings New York, a renowned financial firm based in New York City. This agreement outlines the terms, conditions, and scope of services provided by Kings New York to assist individuals, families, and businesses in achieving their financial goals. Kings New York Agreement offers a wide range of financial planning advisory services, personalized to meet the unique needs of each client. The primary goal of this agreement is to provide expert guidance, strategies, and recommendations to help clients navigate through complex financial situations and achieve financial success. The different types of Kings New York Agreements to Provide Financial Planning Advisory Services include: 1. Personal Financial Planning: This agreement caters to individual clients, focusing on their personal financial goals, such as wealth management, retirement planning, tax planning, investment management, estate planning, and risk management. Kings New York professionals assess the client's current financial situation, develop a tailored plan, and provide ongoing monitoring and adjustments as required. 2. Business Financial Planning: Designed for business owners and entrepreneurs, this agreement encompasses various financial aspects specific to businesses. It includes business planning, financial analysis, cash flow management, mergers and acquisitions, succession planning, risk assessment, and employee benefits. Kings New York professionals work closely with business owners to develop strategic financial plans aligned with their corporate objectives. 3. Estate and Trust Planning: This agreement specializes in helping clients preserve and transfer wealth to future generations while minimizing estate taxes and expenses. Kings New York experts provide guidance on wills, trusts, charitable giving, legacy planning, business succession, and asset protection to ensure effective estate management and smooth wealth transition. 4. Retirement Planning: Focusing on helping individuals secure their financial future, this agreement concentrates on retirement income planning, Social Security optimization, pension analysis, investment allocation, and long-term care planning. Kings New York professionals analyze the client's retirement goals and develop strategies to build a sustainable retirement income stream. 5. Investment Advisory Services: This agreement caters to clients seeking professional investment advice. Kings New York experts conduct a thorough analysis of the client's risk tolerance, investment objectives, and time horizon to create a customized investment portfolio. They continuously monitor the client's investments, making necessary adjustments to maximize returns and minimize risks. 6. Tax Planning: Kings New York Agreement also includes tax planning services to assist clients in optimizing their tax efficiency. This involves proactive tax strategies, year-end tax planning, maximizing tax deductions, minimizing tax liabilities, and developing strategies to address changing tax regulations. Overall, Kings New York Agreement to Provide Financial Planning Advisory Services offers a comprehensive suite of services tailored to meet the diverse financial needs of individuals, families, and businesses. The expertise and personalized approach of Kings New York professionals ensure that clients receive customized solutions that align with their financial goals and objectives.Kings New York Agreement to Provide Financial Planning Advisory Services is a comprehensive and reliable financial planning service offered by Kings New York, a renowned financial firm based in New York City. This agreement outlines the terms, conditions, and scope of services provided by Kings New York to assist individuals, families, and businesses in achieving their financial goals. Kings New York Agreement offers a wide range of financial planning advisory services, personalized to meet the unique needs of each client. The primary goal of this agreement is to provide expert guidance, strategies, and recommendations to help clients navigate through complex financial situations and achieve financial success. The different types of Kings New York Agreements to Provide Financial Planning Advisory Services include: 1. Personal Financial Planning: This agreement caters to individual clients, focusing on their personal financial goals, such as wealth management, retirement planning, tax planning, investment management, estate planning, and risk management. Kings New York professionals assess the client's current financial situation, develop a tailored plan, and provide ongoing monitoring and adjustments as required. 2. Business Financial Planning: Designed for business owners and entrepreneurs, this agreement encompasses various financial aspects specific to businesses. It includes business planning, financial analysis, cash flow management, mergers and acquisitions, succession planning, risk assessment, and employee benefits. Kings New York professionals work closely with business owners to develop strategic financial plans aligned with their corporate objectives. 3. Estate and Trust Planning: This agreement specializes in helping clients preserve and transfer wealth to future generations while minimizing estate taxes and expenses. Kings New York experts provide guidance on wills, trusts, charitable giving, legacy planning, business succession, and asset protection to ensure effective estate management and smooth wealth transition. 4. Retirement Planning: Focusing on helping individuals secure their financial future, this agreement concentrates on retirement income planning, Social Security optimization, pension analysis, investment allocation, and long-term care planning. Kings New York professionals analyze the client's retirement goals and develop strategies to build a sustainable retirement income stream. 5. Investment Advisory Services: This agreement caters to clients seeking professional investment advice. Kings New York experts conduct a thorough analysis of the client's risk tolerance, investment objectives, and time horizon to create a customized investment portfolio. They continuously monitor the client's investments, making necessary adjustments to maximize returns and minimize risks. 6. Tax Planning: Kings New York Agreement also includes tax planning services to assist clients in optimizing their tax efficiency. This involves proactive tax strategies, year-end tax planning, maximizing tax deductions, minimizing tax liabilities, and developing strategies to address changing tax regulations. Overall, Kings New York Agreement to Provide Financial Planning Advisory Services offers a comprehensive suite of services tailored to meet the diverse financial needs of individuals, families, and businesses. The expertise and personalized approach of Kings New York professionals ensure that clients receive customized solutions that align with their financial goals and objectives.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.