The main function of a financial advisor is to evaluate the economic performance of certain companies and industries for business firms and other organizations that have the money to make valuable investments.

Other tasks financial advisors have include:

" Compiling data for financial reports

" Analyzing social and economic data

" Examining market conditions

" Working with detailed financial records

" Creating statistical diagrams and charts

" Advising clients on financial matters

" Making investment presentations

Advisers use Form ADV to register as an investment adviser with the SEC. Form ADV also is used for state registration. Generally, an investment adviser that manages $25 million or more in client assets must register with the SEC. Advisers that manage less than $25 million must register with the state securities regulator where the adviser's principal place of business is located.

Form ADV has two parts. Part 1 contains information about the adviser's education, business and disciplinary history within the last ten years. Part 1 is filed electronically with the SEC. Part 2 includes information on an adviser's services, fees, and investment strategies. Currently, the SEC does not require advisers to file Part 2 electronically.

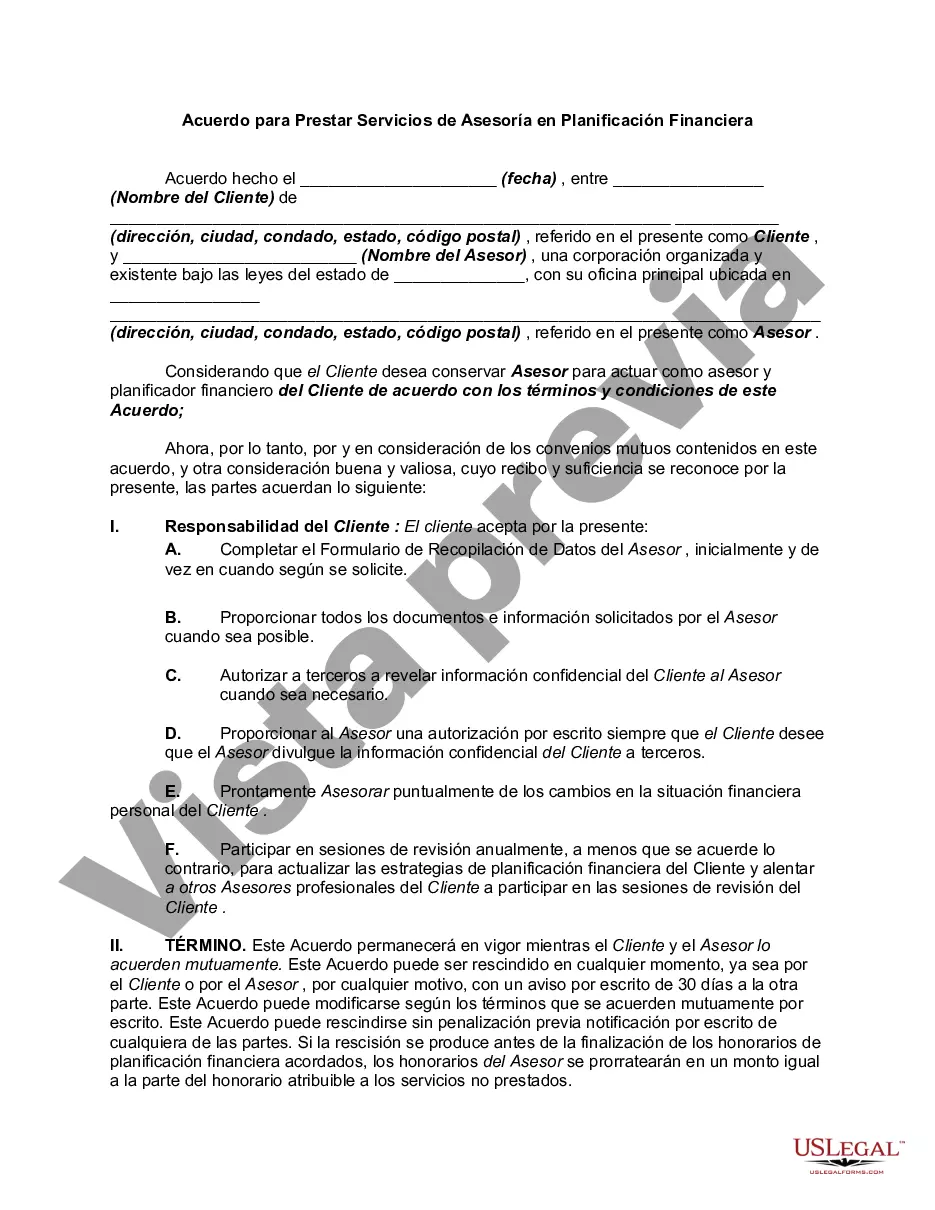

The Montgomery County, Maryland Agreement to Provide Financial Planning Advisory Services is a comprehensive document that outlines the terms and conditions between a financial planning advisory firm and its clients. This agreement is designed to protect both parties and ensure a transparent and mutually beneficial relationship. One type of Montgomery Maryland Agreement to Provide Financial Planning Advisory Services is the Standard Agreement. This type of agreement is suitable for clients seeking a broad range of financial planning services, including retirement planning, investment management, tax planning, estate planning, and risk assessment. It covers the scope of services, compensation structure, confidentiality, termination, and dispute resolution. Another type of Montgomery Maryland Agreement to Provide Financial Planning Advisory Services is the Limited Scope Agreement. This agreement is suitable for clients who require assistance with a specific aspect of financial planning, such as investment management or tax planning. It outlines the exact services to be provided and the associated fees, ensuring clarity and avoiding any misunderstandings. The Montgomery Maryland Agreement to Provide Financial Planning Advisory Services covers various key areas. Firstly, it defines the responsibilities of both the advisory firm and the client. It clearly outlines the scope of services, specifying the areas of financial planning to be addressed, such as budgeting, debt management, education planning, insurance analysis, and more. Furthermore, the agreement highlights the compensation structure in detail. It clearly states how the advisor will be compensated for their services, whether through a percentage of assets under management, hourly rates, or a flat fee. It also outlines any additional costs that may be incurred, such as brokerage fees or administrative charges. Confidentiality is crucial in the financial planning industry, and the Montgomery Maryland Agreement to Provide Financial Planning Advisory Services includes provisions to safeguard the client's personal and financial information. It ensures that the advisor will not disclose any confidential information to third parties, unless required by law or with the client's explicit consent. Termination and dispute resolution clauses are also included in the agreement to ensure that both parties have a clear understanding of the process. It outlines the conditions under which either party can terminate the agreement and the steps to be taken in case of a dispute. Overall, the Montgomery Maryland Agreement to Provide Financial Planning Advisory Services is a comprehensive and legally binding document that serves to protect both the client and the advisory firm. By clearly defining the rights, responsibilities, and expectations of each party, it establishes a foundation for a successful and beneficial relationship.The Montgomery County, Maryland Agreement to Provide Financial Planning Advisory Services is a comprehensive document that outlines the terms and conditions between a financial planning advisory firm and its clients. This agreement is designed to protect both parties and ensure a transparent and mutually beneficial relationship. One type of Montgomery Maryland Agreement to Provide Financial Planning Advisory Services is the Standard Agreement. This type of agreement is suitable for clients seeking a broad range of financial planning services, including retirement planning, investment management, tax planning, estate planning, and risk assessment. It covers the scope of services, compensation structure, confidentiality, termination, and dispute resolution. Another type of Montgomery Maryland Agreement to Provide Financial Planning Advisory Services is the Limited Scope Agreement. This agreement is suitable for clients who require assistance with a specific aspect of financial planning, such as investment management or tax planning. It outlines the exact services to be provided and the associated fees, ensuring clarity and avoiding any misunderstandings. The Montgomery Maryland Agreement to Provide Financial Planning Advisory Services covers various key areas. Firstly, it defines the responsibilities of both the advisory firm and the client. It clearly outlines the scope of services, specifying the areas of financial planning to be addressed, such as budgeting, debt management, education planning, insurance analysis, and more. Furthermore, the agreement highlights the compensation structure in detail. It clearly states how the advisor will be compensated for their services, whether through a percentage of assets under management, hourly rates, or a flat fee. It also outlines any additional costs that may be incurred, such as brokerage fees or administrative charges. Confidentiality is crucial in the financial planning industry, and the Montgomery Maryland Agreement to Provide Financial Planning Advisory Services includes provisions to safeguard the client's personal and financial information. It ensures that the advisor will not disclose any confidential information to third parties, unless required by law or with the client's explicit consent. Termination and dispute resolution clauses are also included in the agreement to ensure that both parties have a clear understanding of the process. It outlines the conditions under which either party can terminate the agreement and the steps to be taken in case of a dispute. Overall, the Montgomery Maryland Agreement to Provide Financial Planning Advisory Services is a comprehensive and legally binding document that serves to protect both the client and the advisory firm. By clearly defining the rights, responsibilities, and expectations of each party, it establishes a foundation for a successful and beneficial relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.