The main function of a financial advisor is to evaluate the economic performance of certain companies and industries for business firms and other organizations that have the money to make valuable investments.

Other tasks financial advisors have include:

" Compiling data for financial reports

" Analyzing social and economic data

" Examining market conditions

" Working with detailed financial records

" Creating statistical diagrams and charts

" Advising clients on financial matters

" Making investment presentations

Advisers use Form ADV to register as an investment adviser with the SEC. Form ADV also is used for state registration. Generally, an investment adviser that manages $25 million or more in client assets must register with the SEC. Advisers that manage less than $25 million must register with the state securities regulator where the adviser's principal place of business is located.

Form ADV has two parts. Part 1 contains information about the adviser's education, business and disciplinary history within the last ten years. Part 1 is filed electronically with the SEC. Part 2 includes information on an adviser's services, fees, and investment strategies. Currently, the SEC does not require advisers to file Part 2 electronically.

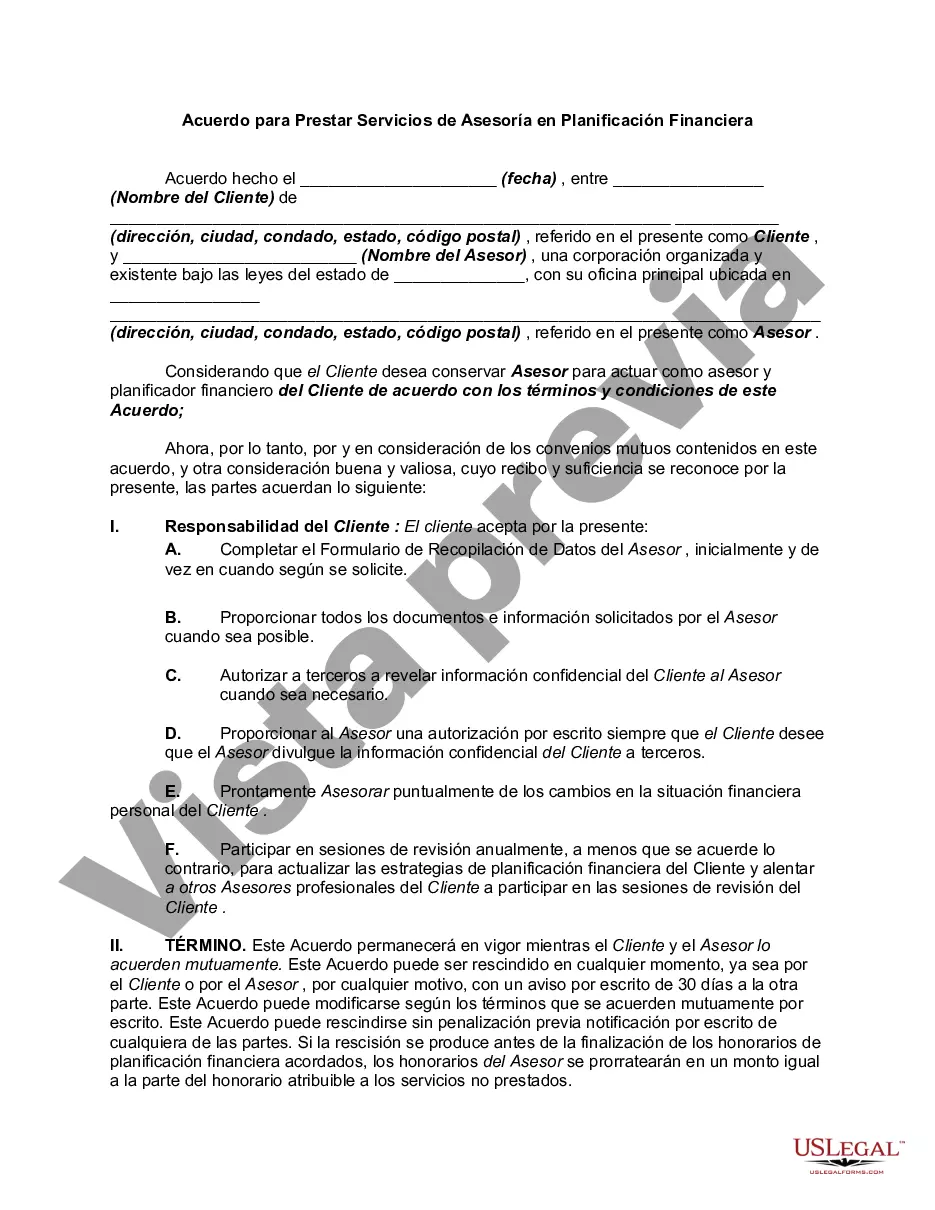

The Tarrant Texas Agreement to Provide Financial Planning Advisory Services is a comprehensive document that outlines the agreement between a financial planning firm and its clients. This agreement is designed to lay out the terms and conditions under which the financial planning services will be provided and ensure a clear understanding between both parties. Financial planning advisory services are essential for individuals and businesses seeking expert guidance in managing their finances and achieving their long-term financial goals. The Tarrant Texas Agreement to Provide Financial Planning Advisory Services serves as a legal contract that details the scope of services, fees, responsibilities, and rights of both the financial planning firm and the client. Some of the key elements that may be covered in the agreement include: 1. Scope of Services: The agreement should clearly define the financial planning services that will be provided. This may include investment management, retirement planning, tax planning, estate planning, risk management, and other related services. 2. Fees and Payment Terms: The agreement should specify the fees for the financial planning services, such as hourly rates, fixed fees, or a percentage of assets under management. It should also outline the payment terms, whether it's a one-time fee, monthly retainer, or other arrangements. 3. Client Responsibilities: The agreement may outline the responsibilities of the client, such as providing accurate and complete information about their financial situation, goals, and risk tolerance. It may also specify the client's obligation to promptly inform the financial planning firm of any changes that may affect the planning process. 4. Privacy and Confidentiality: The agreement should address the handling of confidential client information and ensure that the financial planning firm will take appropriate measures to protect client privacy. 5. Termination and Amendment: The agreement may include provisions for termination by either party with or without cause. It should also outline the process for amending the agreement if necessary. It's crucial to note that there may be variations of the Tarrant Texas Agreement to Provide Financial Planning Advisory Services depending on the specific services offered by the financial planning firm. For instance, if the firm specializes in working with small businesses, there might be a separate agreement tailored specifically for business financial planning services. Similarly, if the firm provides comprehensive financial planning services for high-net-worth individuals, there may be a distinct agreement addressing their unique needs and requirements. Overall, the Tarrant Texas Agreement to Provide Financial Planning Advisory Services acts as a roadmap, ensuring that both the financial planning firm and the client have a clear understanding of the services to be provided, fees charged, and respective responsibilities. By formalizing this agreement, both parties can establish a solid foundation for a successful financial planning relationship.The Tarrant Texas Agreement to Provide Financial Planning Advisory Services is a comprehensive document that outlines the agreement between a financial planning firm and its clients. This agreement is designed to lay out the terms and conditions under which the financial planning services will be provided and ensure a clear understanding between both parties. Financial planning advisory services are essential for individuals and businesses seeking expert guidance in managing their finances and achieving their long-term financial goals. The Tarrant Texas Agreement to Provide Financial Planning Advisory Services serves as a legal contract that details the scope of services, fees, responsibilities, and rights of both the financial planning firm and the client. Some of the key elements that may be covered in the agreement include: 1. Scope of Services: The agreement should clearly define the financial planning services that will be provided. This may include investment management, retirement planning, tax planning, estate planning, risk management, and other related services. 2. Fees and Payment Terms: The agreement should specify the fees for the financial planning services, such as hourly rates, fixed fees, or a percentage of assets under management. It should also outline the payment terms, whether it's a one-time fee, monthly retainer, or other arrangements. 3. Client Responsibilities: The agreement may outline the responsibilities of the client, such as providing accurate and complete information about their financial situation, goals, and risk tolerance. It may also specify the client's obligation to promptly inform the financial planning firm of any changes that may affect the planning process. 4. Privacy and Confidentiality: The agreement should address the handling of confidential client information and ensure that the financial planning firm will take appropriate measures to protect client privacy. 5. Termination and Amendment: The agreement may include provisions for termination by either party with or without cause. It should also outline the process for amending the agreement if necessary. It's crucial to note that there may be variations of the Tarrant Texas Agreement to Provide Financial Planning Advisory Services depending on the specific services offered by the financial planning firm. For instance, if the firm specializes in working with small businesses, there might be a separate agreement tailored specifically for business financial planning services. Similarly, if the firm provides comprehensive financial planning services for high-net-worth individuals, there may be a distinct agreement addressing their unique needs and requirements. Overall, the Tarrant Texas Agreement to Provide Financial Planning Advisory Services acts as a roadmap, ensuring that both the financial planning firm and the client have a clear understanding of the services to be provided, fees charged, and respective responsibilities. By formalizing this agreement, both parties can establish a solid foundation for a successful financial planning relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.