Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Hennepin Minnesota Engagement Letter is an essential document used by accounting firms to establish a professional relationship with their clients. This letter outlines the terms and conditions of the engagement and acts as a legal agreement between the accounting firm and the client. It provides a comprehensive understanding of the scope of services to be rendered, the responsibilities of both parties, and the fees or compensation involved. Specifically tailored to meet the requirements of businesses in Hennepin County, Minnesota, the Hennepin Minnesota Engagement Letter addresses the unique aspects of local business practices, tax regulations, and accounting standards. This document ensures that the accounting firm's services are aligned with the specific needs and compliance requirements of businesses operating in Hennepin County. The engagement letter typically includes the following key components: 1. Introduction: The letter begins with a formal introduction, identifying the accounting firm and the client, along with their respective addresses. 2. Objective: This section outlines the purpose of the engagement and the services to be provided by the accounting firm. It includes a description of the specific work to be performed, such as assurance services or review engagements. 3. Responsibilities: The engagement letter clearly stipulates the responsibilities of both the accounting firm and the client. It delineates the client's obligation to provide accurate and complete information to the accounting firm, as well as the firm's commitment to maintain confidentiality and exercise professional judgment. 4. Scope of Services: This section outlines the specific areas to be addressed during the engagement, such as financial statement review, compliance examination, or other agreed-upon procedures. It also clarifies any exclusions or limitations related to the engagement. 5. Timeline and Completion: The engagement letter includes an estimated timeline for completing the engagement and determines the date by which the accounting firm plans to issue the final review report. 6. Fees and Billing: This section outlines the fee structure for the services to be provided, including any additional charges or disbursements. It also clarifies the payment terms and the frequency of billing. Different types of Hennepin Minnesota Engagement Letters for Review by Accounting Firm with Form of Review Report may include variations specific to the nature of the review engagement. This can include engagement letters for specific industries or sectors prevalent in Hennepin County, such as manufacturing, healthcare, or real estate. It may also encompass engagement letters for different levels of review engagement, such as a limited review or an agreed-upon procedures engagement. In conclusion, the Hennepin Minnesota Engagement Letter for Review by Accounting Firm with Form of Review Report serves as a vital legal document that establishes a professional relationship between accounting firms and their clients in Hennepin County. This letter ensures clear communication, sets expectations, and establishes the foundation for a successful client-accountant collaboration.The Hennepin Minnesota Engagement Letter is an essential document used by accounting firms to establish a professional relationship with their clients. This letter outlines the terms and conditions of the engagement and acts as a legal agreement between the accounting firm and the client. It provides a comprehensive understanding of the scope of services to be rendered, the responsibilities of both parties, and the fees or compensation involved. Specifically tailored to meet the requirements of businesses in Hennepin County, Minnesota, the Hennepin Minnesota Engagement Letter addresses the unique aspects of local business practices, tax regulations, and accounting standards. This document ensures that the accounting firm's services are aligned with the specific needs and compliance requirements of businesses operating in Hennepin County. The engagement letter typically includes the following key components: 1. Introduction: The letter begins with a formal introduction, identifying the accounting firm and the client, along with their respective addresses. 2. Objective: This section outlines the purpose of the engagement and the services to be provided by the accounting firm. It includes a description of the specific work to be performed, such as assurance services or review engagements. 3. Responsibilities: The engagement letter clearly stipulates the responsibilities of both the accounting firm and the client. It delineates the client's obligation to provide accurate and complete information to the accounting firm, as well as the firm's commitment to maintain confidentiality and exercise professional judgment. 4. Scope of Services: This section outlines the specific areas to be addressed during the engagement, such as financial statement review, compliance examination, or other agreed-upon procedures. It also clarifies any exclusions or limitations related to the engagement. 5. Timeline and Completion: The engagement letter includes an estimated timeline for completing the engagement and determines the date by which the accounting firm plans to issue the final review report. 6. Fees and Billing: This section outlines the fee structure for the services to be provided, including any additional charges or disbursements. It also clarifies the payment terms and the frequency of billing. Different types of Hennepin Minnesota Engagement Letters for Review by Accounting Firm with Form of Review Report may include variations specific to the nature of the review engagement. This can include engagement letters for specific industries or sectors prevalent in Hennepin County, such as manufacturing, healthcare, or real estate. It may also encompass engagement letters for different levels of review engagement, such as a limited review or an agreed-upon procedures engagement. In conclusion, the Hennepin Minnesota Engagement Letter for Review by Accounting Firm with Form of Review Report serves as a vital legal document that establishes a professional relationship between accounting firms and their clients in Hennepin County. This letter ensures clear communication, sets expectations, and establishes the foundation for a successful client-accountant collaboration.

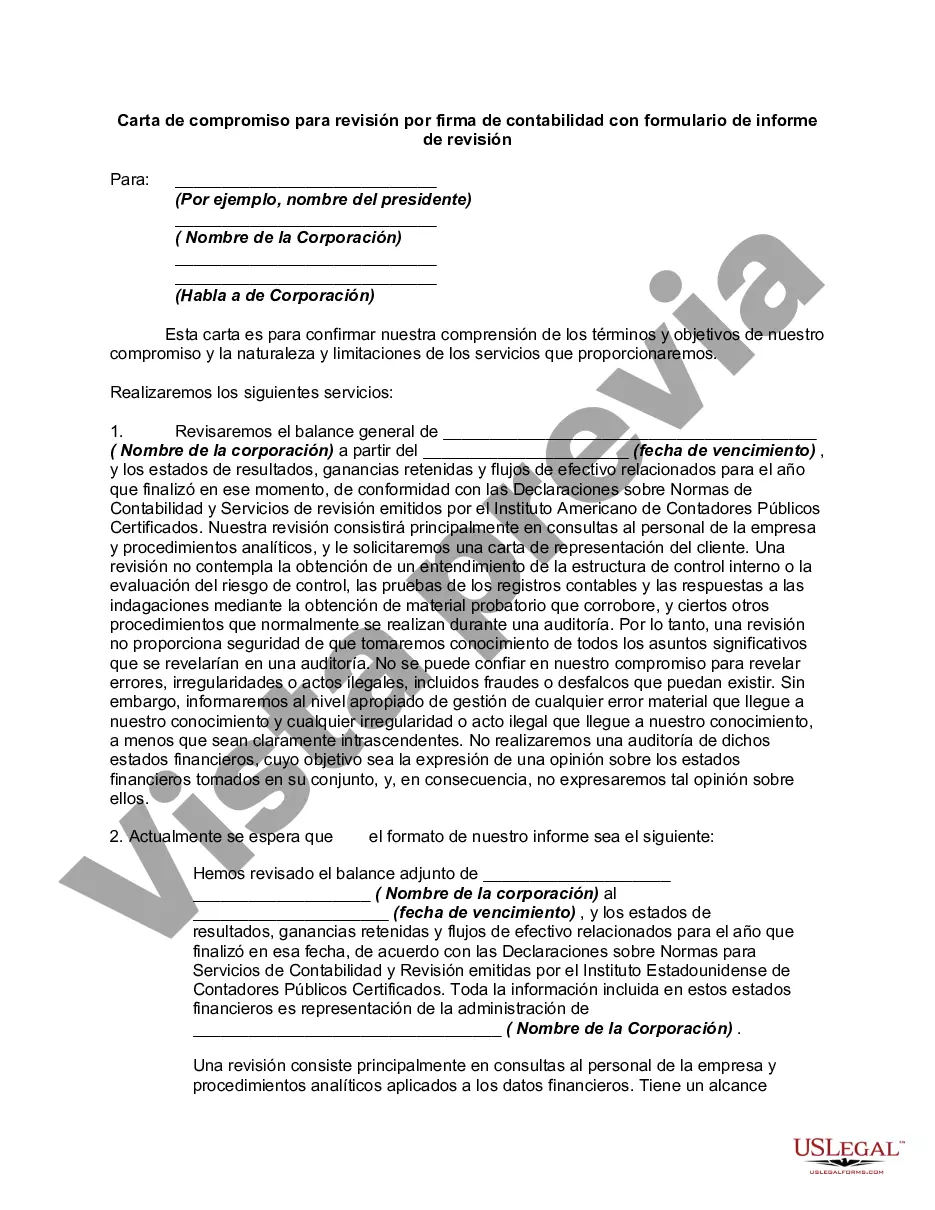

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.