Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Lima Arizona Engagement Letter for Review by Accounting Firm with Form of Review Report: An engagement letter for review by an accounting firm in Lima, Arizona is a crucial document that outlines the terms, conditions, and responsibilities of both the accounting firm and the client in conducting a review engagement. This engagement letter serves as a formal agreement between the accounting firm and the client ensuring clarity and understanding of the review process. The purpose of this engagement letter is to establish a professional relationship, define the scope of the review engagement, and ensure all parties involved are aware of their roles and obligations. The engagement letter also outlines the specific timelines, deliverables, and fees associated with the review engagement. The Lima Arizona Engagement Letter for Review by Accounting Firm may cover a range of services, such as: 1. Compilation of financial statements: This engagement letter outlines the accounting firm's responsibility to compile financial statements based on the client's trial balance and other supporting documentation provided. 2. Review of financial statements: This engagement letter focuses on the accounting firm's role in conducting a limited review of the financial statements. This includes performing analytical procedures, making inquiries regarding the financial information, and providing a review report expressing limited assurance. 3. Compliance with relevant standards: The engagement letter highlights the accounting firm's commitment to conduct the review engagement in accordance with Generally Accepted Auditing Standards (GAS) and applicable regulatory requirements. 4. Responsibilities of the client: The engagement letter clearly defines the client's responsibility to provide accurate and complete financial records, internal controls, and other relevant information necessary for the review engagement. The client is also expected to acknowledge any limitations or risks associated with the review engagement. The Lima Arizona Engagement Letter for Review by Accounting Firm usually includes a Form of Review Report. This report summarizes the findings of the review engagement and expresses the accounting firm's conclusions based on the limited assurance provided. It highlights any significant matters discovered during the review and provides recommendations or suggestions to the client for improvement. In conclusion, the Lima Arizona Engagement Letter for Review by Accounting Firm with Form of Review Report is a crucial document that outlines the terms, conditions, and responsibilities of both the accounting firm and the client in conducting a review engagement. It ensures a transparent and professional relationship between the two parties while providing the necessary information for the accounting firm to carry out their review procedures effectively and deliver the appropriate report.Lima Arizona Engagement Letter for Review by Accounting Firm with Form of Review Report: An engagement letter for review by an accounting firm in Lima, Arizona is a crucial document that outlines the terms, conditions, and responsibilities of both the accounting firm and the client in conducting a review engagement. This engagement letter serves as a formal agreement between the accounting firm and the client ensuring clarity and understanding of the review process. The purpose of this engagement letter is to establish a professional relationship, define the scope of the review engagement, and ensure all parties involved are aware of their roles and obligations. The engagement letter also outlines the specific timelines, deliverables, and fees associated with the review engagement. The Lima Arizona Engagement Letter for Review by Accounting Firm may cover a range of services, such as: 1. Compilation of financial statements: This engagement letter outlines the accounting firm's responsibility to compile financial statements based on the client's trial balance and other supporting documentation provided. 2. Review of financial statements: This engagement letter focuses on the accounting firm's role in conducting a limited review of the financial statements. This includes performing analytical procedures, making inquiries regarding the financial information, and providing a review report expressing limited assurance. 3. Compliance with relevant standards: The engagement letter highlights the accounting firm's commitment to conduct the review engagement in accordance with Generally Accepted Auditing Standards (GAS) and applicable regulatory requirements. 4. Responsibilities of the client: The engagement letter clearly defines the client's responsibility to provide accurate and complete financial records, internal controls, and other relevant information necessary for the review engagement. The client is also expected to acknowledge any limitations or risks associated with the review engagement. The Lima Arizona Engagement Letter for Review by Accounting Firm usually includes a Form of Review Report. This report summarizes the findings of the review engagement and expresses the accounting firm's conclusions based on the limited assurance provided. It highlights any significant matters discovered during the review and provides recommendations or suggestions to the client for improvement. In conclusion, the Lima Arizona Engagement Letter for Review by Accounting Firm with Form of Review Report is a crucial document that outlines the terms, conditions, and responsibilities of both the accounting firm and the client in conducting a review engagement. It ensures a transparent and professional relationship between the two parties while providing the necessary information for the accounting firm to carry out their review procedures effectively and deliver the appropriate report.

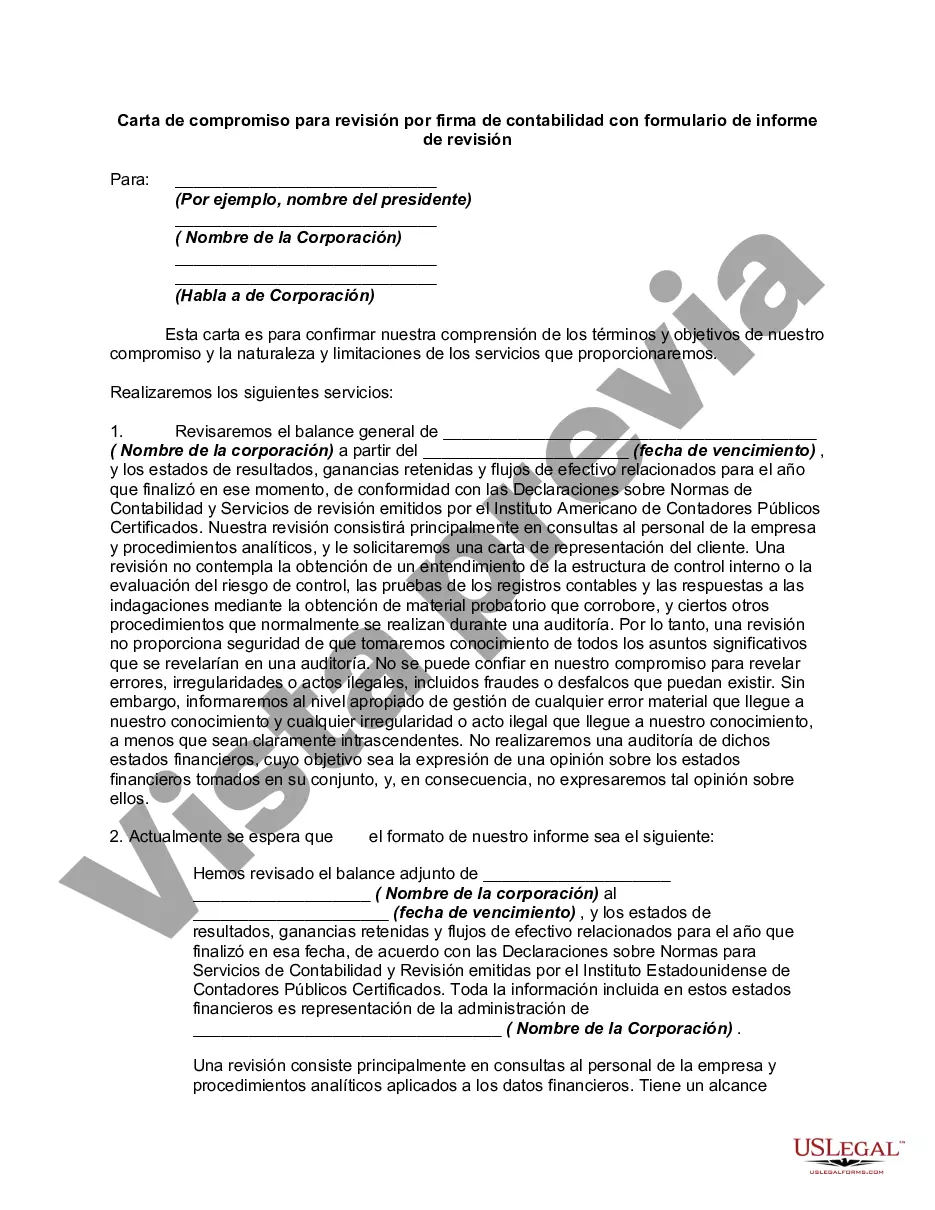

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.