In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Chicago, Illinois is a vibrant and bustling city located in the Midwestern United States. It is known for its rich history, stunning architecture, diverse culture, world-class museums, and thriving business sector. With a population of nearly 3 million people, Chicago is the third most populous city in the country. As part of its financial transparency and accountability, Chicago regularly undergoes reviews of its financial statements by reputable accounting firms. These reports play a crucial role in evaluating the city's financial health and aiding decision-making processes. A Chicago Illinois Report from a Review of Financial Statements by an accounting firm involves a comprehensive analysis of the city's financial records and statements. This process entails examining the accuracy, completeness, and compliance of the financial information provided. The accounting firm rigorously evaluates Chicago's financial activities, including revenue inflow, expenditure outflow, assets, liabilities, and equity. The Review Report covers various sections, providing a holistic overview of Chicago's financial status. These sections may include an introductory letter, management's responsibility for the financial statements, auditor's responsibility, opinion on financial statements, financial highlights, significant accounting policies, notes to financial statements, supplementary information, and other required disclosures. Furthermore, the Compilation Report by an accounting firm focuses on the compilation of Chicago's financial statements. This report involves assembling financial data from various sources and presenting it in the form of financial statements without providing an opinion or assurance on the accuracy and compliance of the information. While the primary purpose of these reports is to ensure transparency, accountability, and adherence to financial regulations, they also help stakeholders make informed decisions about Chicago's financial position. Investors, lenders, city officials, and members of the public rely on these reports to assess the city's financial performance, identify any potential risks, and make strategic decisions accordingly. Moreover, Chicago Illinois Reports from Review of Financial Statements and Compilation by Accounting Firm serve as a benchmark for evaluating the city's financial performance over time. These reports provide historical data, allowing for year-to-year comparisons and analysis of trends. They also serve as a foundation for future financial planning, budgeting, and forecasting. In summary, Chicago Illinois Reports from Review of Financial Statements and Compilation by Accounting Firm are crucial mechanisms in assessing the city's financial health, ensuring transparency, and aiding decision-making processes. These reports provide an in-depth analysis of Chicago's financial records, offering valuable insights and information for stakeholders. By relying on these reports, individuals can gain a comprehensive understanding of Chicago's financial position and its impact on various stakeholders.Chicago, Illinois is a vibrant and bustling city located in the Midwestern United States. It is known for its rich history, stunning architecture, diverse culture, world-class museums, and thriving business sector. With a population of nearly 3 million people, Chicago is the third most populous city in the country. As part of its financial transparency and accountability, Chicago regularly undergoes reviews of its financial statements by reputable accounting firms. These reports play a crucial role in evaluating the city's financial health and aiding decision-making processes. A Chicago Illinois Report from a Review of Financial Statements by an accounting firm involves a comprehensive analysis of the city's financial records and statements. This process entails examining the accuracy, completeness, and compliance of the financial information provided. The accounting firm rigorously evaluates Chicago's financial activities, including revenue inflow, expenditure outflow, assets, liabilities, and equity. The Review Report covers various sections, providing a holistic overview of Chicago's financial status. These sections may include an introductory letter, management's responsibility for the financial statements, auditor's responsibility, opinion on financial statements, financial highlights, significant accounting policies, notes to financial statements, supplementary information, and other required disclosures. Furthermore, the Compilation Report by an accounting firm focuses on the compilation of Chicago's financial statements. This report involves assembling financial data from various sources and presenting it in the form of financial statements without providing an opinion or assurance on the accuracy and compliance of the information. While the primary purpose of these reports is to ensure transparency, accountability, and adherence to financial regulations, they also help stakeholders make informed decisions about Chicago's financial position. Investors, lenders, city officials, and members of the public rely on these reports to assess the city's financial performance, identify any potential risks, and make strategic decisions accordingly. Moreover, Chicago Illinois Reports from Review of Financial Statements and Compilation by Accounting Firm serve as a benchmark for evaluating the city's financial performance over time. These reports provide historical data, allowing for year-to-year comparisons and analysis of trends. They also serve as a foundation for future financial planning, budgeting, and forecasting. In summary, Chicago Illinois Reports from Review of Financial Statements and Compilation by Accounting Firm are crucial mechanisms in assessing the city's financial health, ensuring transparency, and aiding decision-making processes. These reports provide an in-depth analysis of Chicago's financial records, offering valuable insights and information for stakeholders. By relying on these reports, individuals can gain a comprehensive understanding of Chicago's financial position and its impact on various stakeholders.

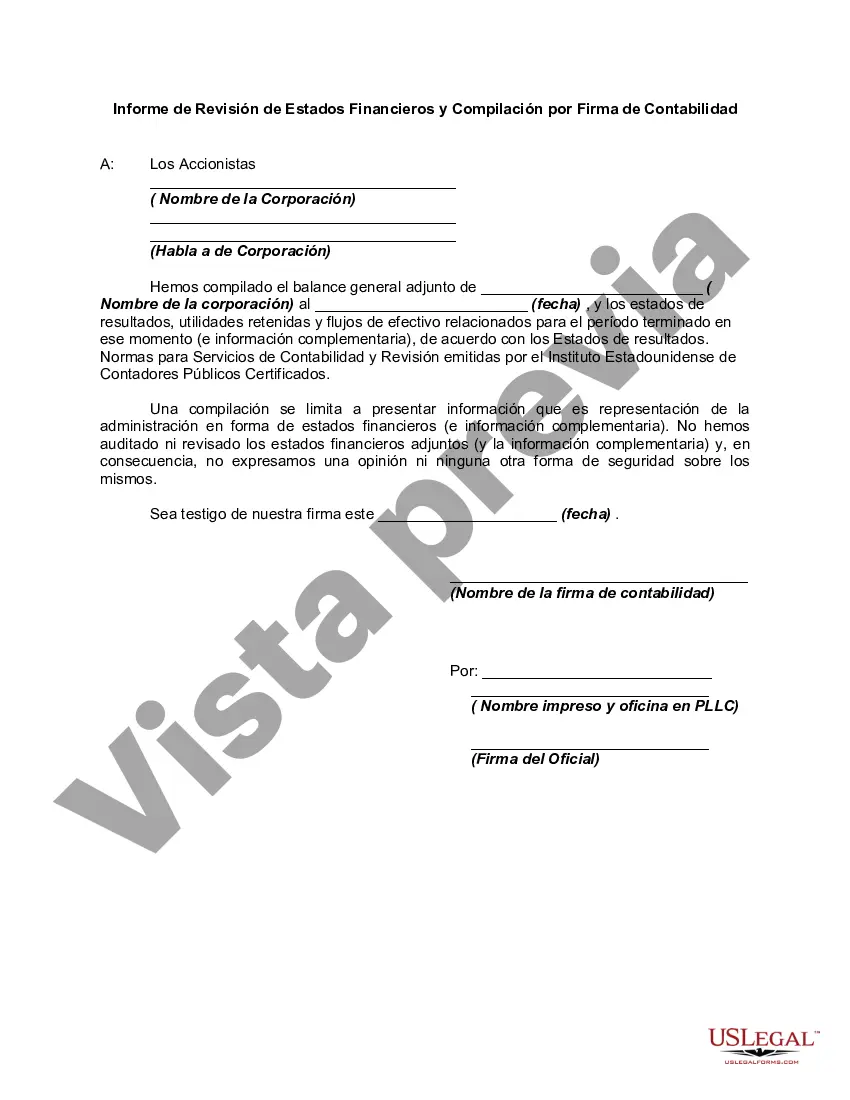

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.