In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Hennepin County, located in Minnesota, is the most populous county in the state and encompasses various cities including Minneapolis, the largest city in Minnesota. The county is known for its diverse economy, cultural attractions, and beautiful natural landscapes. When it comes to financial reporting, Hennepin Minnesota utilizes accounting firms to conduct reviews of financial statements and compilations to ensure transparency and accuracy in financial reporting processes. These reports play a crucial role in providing an overview of the financial health of the county and its various entities. The Review of Financial Statements is a comprehensive assessment performed by an accounting firm to evaluate the accuracy, completeness, and reliability of financial statements. The review identifies areas of concern, potential risks, and compliance with accounting principles and regulations. This report is often sought by stakeholders, such as investors, lenders, and government bodies, to assess the financial stability and performance of Hennepin County. A Compilation, on the other hand, is a report prepared by an accounting firm that presents financial information in a clear and organized manner. This report is typically used when there is a need to compile financial data from various sources into a consolidated document. While a compilation does not provide an opinion or assurance on the accuracy of the financial statements, it offers a useful summary for internal purposes and general use. In addition to the standard Review of Financial Statements and Compilation reports, there can be specialized reports tailored to specific areas of interest. These reports can include: 1. Hennepin County Municipalities' Financial Statements Review: This report focuses on reviewing the financial statements of individual municipalities within Hennepin County, such as Minneapolis, Bloomington, and Eden Prairie, to assess their financial performance, liquidity, and compliance with accounting standards. 2. Hennepin County Nonprofit Organizations' Financial Statements Compilation: Nonprofit organizations play a significant role in the county, and this report compiles the financial statements of these organizations to provide an overview of their financial activities and accountability. 3. Hennepin County School Districts' Financial Statements Review: This report examines the financial statements of school districts within Hennepin County, analyzing their budget allocation, revenue sources, and expenditures to ensure proper financial management for educational purposes. The above reports demonstrate the importance of accurate financial reporting and the role accounting firms play in assessing and compiling financial statements for Hennepin County and its various entities. These reports contribute to maintaining transparency, fiscal responsibility, and informed decision-making within the county.Hennepin County, located in Minnesota, is the most populous county in the state and encompasses various cities including Minneapolis, the largest city in Minnesota. The county is known for its diverse economy, cultural attractions, and beautiful natural landscapes. When it comes to financial reporting, Hennepin Minnesota utilizes accounting firms to conduct reviews of financial statements and compilations to ensure transparency and accuracy in financial reporting processes. These reports play a crucial role in providing an overview of the financial health of the county and its various entities. The Review of Financial Statements is a comprehensive assessment performed by an accounting firm to evaluate the accuracy, completeness, and reliability of financial statements. The review identifies areas of concern, potential risks, and compliance with accounting principles and regulations. This report is often sought by stakeholders, such as investors, lenders, and government bodies, to assess the financial stability and performance of Hennepin County. A Compilation, on the other hand, is a report prepared by an accounting firm that presents financial information in a clear and organized manner. This report is typically used when there is a need to compile financial data from various sources into a consolidated document. While a compilation does not provide an opinion or assurance on the accuracy of the financial statements, it offers a useful summary for internal purposes and general use. In addition to the standard Review of Financial Statements and Compilation reports, there can be specialized reports tailored to specific areas of interest. These reports can include: 1. Hennepin County Municipalities' Financial Statements Review: This report focuses on reviewing the financial statements of individual municipalities within Hennepin County, such as Minneapolis, Bloomington, and Eden Prairie, to assess their financial performance, liquidity, and compliance with accounting standards. 2. Hennepin County Nonprofit Organizations' Financial Statements Compilation: Nonprofit organizations play a significant role in the county, and this report compiles the financial statements of these organizations to provide an overview of their financial activities and accountability. 3. Hennepin County School Districts' Financial Statements Review: This report examines the financial statements of school districts within Hennepin County, analyzing their budget allocation, revenue sources, and expenditures to ensure proper financial management for educational purposes. The above reports demonstrate the importance of accurate financial reporting and the role accounting firms play in assessing and compiling financial statements for Hennepin County and its various entities. These reports contribute to maintaining transparency, fiscal responsibility, and informed decision-making within the county.

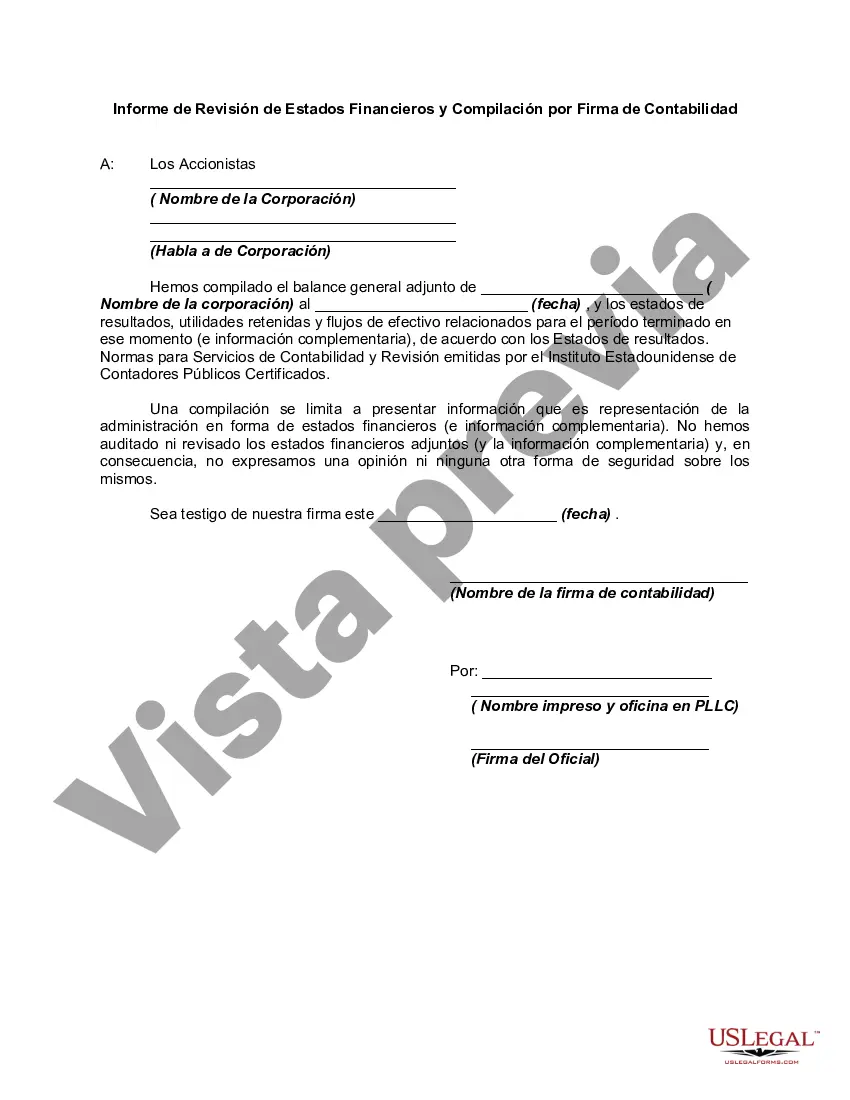

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.