In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Los Angeles, California, often referred to as the "City of Angels," is a diverse and vibrant city located on the western coast of the United States. It is the second-most populous city in the country, known for its extensive entertainment industry, beautiful beaches, iconic landmarks, and cultural melting pot. A report from the review of financial statements and compilation by an accounting firm for Los Angeles, California provides a comprehensive analysis of the city's financial status. This report focuses on evaluating the financial statements, transactions, and records of various entities within the city to ensure accuracy, compliance, and transparency. It helps stakeholders, including investors, regulators, and government bodies, assess the fiscal health, solvency, and efficiency of Los Angeles. The report covers several key aspects, including revenue sources, expenditures, assets, liabilities, cash flow, and overall financial performance. The accounting firm conducts a thorough analysis of financial statements and supporting documentation, ensuring they comply with relevant accounting standards and regulations such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Different types of reports from the review of financial statements and compilation by accounting firms for Los Angeles, California, include: 1. Comprehensive Financial Report: This detailed report provides a comprehensive overview of the city's financial position, including various financial statements such as the balance sheet, income statement, cash flow statement, and statement of changes in net assets. It includes extensive analysis, footnotes, and supplementary information, providing a holistic view of Los Angeles' financial health. 2. Management Letter: In this report, the accounting firm communicates their findings related to internal control weaknesses, accounting procedures, and potential areas for improvement. It highlights any significant issues or risks identified during the review process and offers recommendations for enhancing financial management practices. 3. Budgetary Compliance Report: This report evaluates the city's compliance with the approved budget and identifies any material deviations. It assesses whether the actual revenues and expenditures align with the approved budget, providing insights into financial performance and potential budgetary challenges faced by Los Angeles. 4. Single Audit Report: This report mainly focuses on entities that receive significant federal funding. It ensures compliance with federal regulations, identifies any material non-compliance issues, and assesses the effectiveness of internal controls related to federal programs. Overall, Los Angeles, California, has a robust financial reporting system in place, supported by accounting firms that provide comprehensive review and compilation reports. These reports play a crucial role in maintaining transparency, accountability, and fiscal stability for the city and its stakeholders.Los Angeles, California, often referred to as the "City of Angels," is a diverse and vibrant city located on the western coast of the United States. It is the second-most populous city in the country, known for its extensive entertainment industry, beautiful beaches, iconic landmarks, and cultural melting pot. A report from the review of financial statements and compilation by an accounting firm for Los Angeles, California provides a comprehensive analysis of the city's financial status. This report focuses on evaluating the financial statements, transactions, and records of various entities within the city to ensure accuracy, compliance, and transparency. It helps stakeholders, including investors, regulators, and government bodies, assess the fiscal health, solvency, and efficiency of Los Angeles. The report covers several key aspects, including revenue sources, expenditures, assets, liabilities, cash flow, and overall financial performance. The accounting firm conducts a thorough analysis of financial statements and supporting documentation, ensuring they comply with relevant accounting standards and regulations such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Different types of reports from the review of financial statements and compilation by accounting firms for Los Angeles, California, include: 1. Comprehensive Financial Report: This detailed report provides a comprehensive overview of the city's financial position, including various financial statements such as the balance sheet, income statement, cash flow statement, and statement of changes in net assets. It includes extensive analysis, footnotes, and supplementary information, providing a holistic view of Los Angeles' financial health. 2. Management Letter: In this report, the accounting firm communicates their findings related to internal control weaknesses, accounting procedures, and potential areas for improvement. It highlights any significant issues or risks identified during the review process and offers recommendations for enhancing financial management practices. 3. Budgetary Compliance Report: This report evaluates the city's compliance with the approved budget and identifies any material deviations. It assesses whether the actual revenues and expenditures align with the approved budget, providing insights into financial performance and potential budgetary challenges faced by Los Angeles. 4. Single Audit Report: This report mainly focuses on entities that receive significant federal funding. It ensures compliance with federal regulations, identifies any material non-compliance issues, and assesses the effectiveness of internal controls related to federal programs. Overall, Los Angeles, California, has a robust financial reporting system in place, supported by accounting firms that provide comprehensive review and compilation reports. These reports play a crucial role in maintaining transparency, accountability, and fiscal stability for the city and its stakeholders.

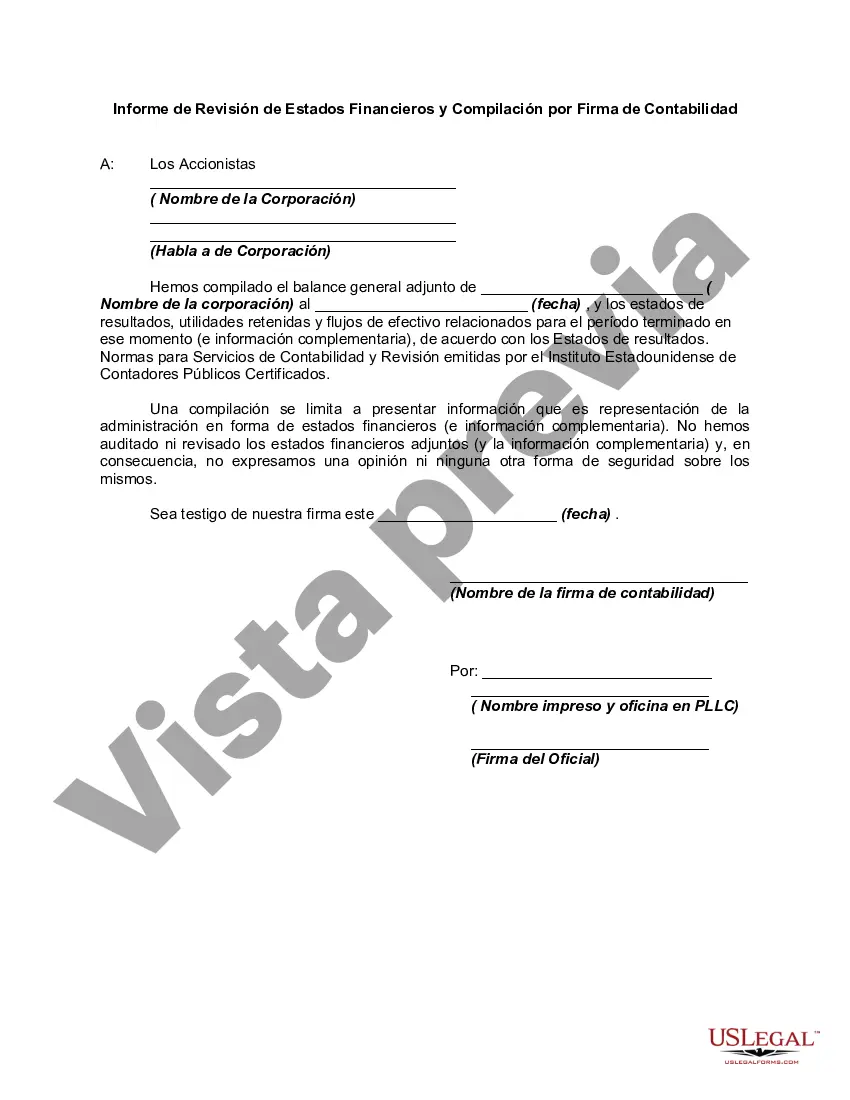

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.