In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Mecklenburg County, located in the state of North Carolina, is a prominent and vibrant region known for its economic growth, cultural diversity, and natural beauty. This detailed description will focus on Mecklenburg County in North Carolina and its financial aspects by considering various types of reports that may arise from reviews of financial statements and compilations conducted by accounting firms. Mecklenburg County is the most populous county in North Carolina and is home to the bustling city of Charlotte, which serves as the county seat. With a population of over 1 million residents, Mecklenburg County is an important economic hub and a thriving center for business, finance, and technology. When it comes to financial reporting, organizations and governments in Mecklenburg County typically engage accounting firms to review their financial statements and compile valuable reports that provide stakeholders with accurate and reliable financial information. These reports play a crucial role in assessing the financial health, performance, and compliance of various entities operating within the county. One type of report that may be generated from a review of financial statements is called an "Independent Auditor's Report." This report is prepared by an accounting firm after conducting an external audit of an entity's financial statements. The auditor's report provides an opinion on the fairness and accuracy of the financial statements, highlighting any material misstatements, errors, or inconsistencies discovered during the audit. Another type of report commonly encountered is a "Compilation Report." Unlike a review or audit, a compilation entails the preparation of financial statements by an accounting firm based on information provided by the entity without any auditing or review procedures. The compilation report states that the financial statements have been compiled by the accounting firm in accordance with applicable accounting principles, but it does not provide assurance on the accuracy or completeness of the information contained within. In addition to these standard reports, Mecklenburg County may also witness specialized reports, such as "Forensic Accounting Reports." These reports are typically prepared by accounting firms specializing in forensic accounting, which involves the investigation of financial fraud, embezzlement, or other financial irregularities. Forensic accounting reports provide insight into fraudulent activities, irregular transactions, or discrepancies discovered during the investigation. It is important to note that the specific type of report generated during a review of financial statements or compilation may vary depending on the purpose, industry, or regulatory requirements of the entity being assessed. However, regardless of the type of report, accounting firms in Mecklenburg County play a vital role in ensuring transparency, accountability, and financial integrity for organizations and government agencies by providing accurate and reliable financial information to stakeholders. To conclude, Mecklenburg County in North Carolina is a dynamic and economically significant region. Reports arising from reviews of financial statements and compilations by accounting firms, such as the Independent Auditor's Report, Compilation Report, and Forensic Accounting Report, among others, contribute to maintaining financial transparency and promoting trust within the county's business and governmental sectors.Mecklenburg County, located in the state of North Carolina, is a prominent and vibrant region known for its economic growth, cultural diversity, and natural beauty. This detailed description will focus on Mecklenburg County in North Carolina and its financial aspects by considering various types of reports that may arise from reviews of financial statements and compilations conducted by accounting firms. Mecklenburg County is the most populous county in North Carolina and is home to the bustling city of Charlotte, which serves as the county seat. With a population of over 1 million residents, Mecklenburg County is an important economic hub and a thriving center for business, finance, and technology. When it comes to financial reporting, organizations and governments in Mecklenburg County typically engage accounting firms to review their financial statements and compile valuable reports that provide stakeholders with accurate and reliable financial information. These reports play a crucial role in assessing the financial health, performance, and compliance of various entities operating within the county. One type of report that may be generated from a review of financial statements is called an "Independent Auditor's Report." This report is prepared by an accounting firm after conducting an external audit of an entity's financial statements. The auditor's report provides an opinion on the fairness and accuracy of the financial statements, highlighting any material misstatements, errors, or inconsistencies discovered during the audit. Another type of report commonly encountered is a "Compilation Report." Unlike a review or audit, a compilation entails the preparation of financial statements by an accounting firm based on information provided by the entity without any auditing or review procedures. The compilation report states that the financial statements have been compiled by the accounting firm in accordance with applicable accounting principles, but it does not provide assurance on the accuracy or completeness of the information contained within. In addition to these standard reports, Mecklenburg County may also witness specialized reports, such as "Forensic Accounting Reports." These reports are typically prepared by accounting firms specializing in forensic accounting, which involves the investigation of financial fraud, embezzlement, or other financial irregularities. Forensic accounting reports provide insight into fraudulent activities, irregular transactions, or discrepancies discovered during the investigation. It is important to note that the specific type of report generated during a review of financial statements or compilation may vary depending on the purpose, industry, or regulatory requirements of the entity being assessed. However, regardless of the type of report, accounting firms in Mecklenburg County play a vital role in ensuring transparency, accountability, and financial integrity for organizations and government agencies by providing accurate and reliable financial information to stakeholders. To conclude, Mecklenburg County in North Carolina is a dynamic and economically significant region. Reports arising from reviews of financial statements and compilations by accounting firms, such as the Independent Auditor's Report, Compilation Report, and Forensic Accounting Report, among others, contribute to maintaining financial transparency and promoting trust within the county's business and governmental sectors.

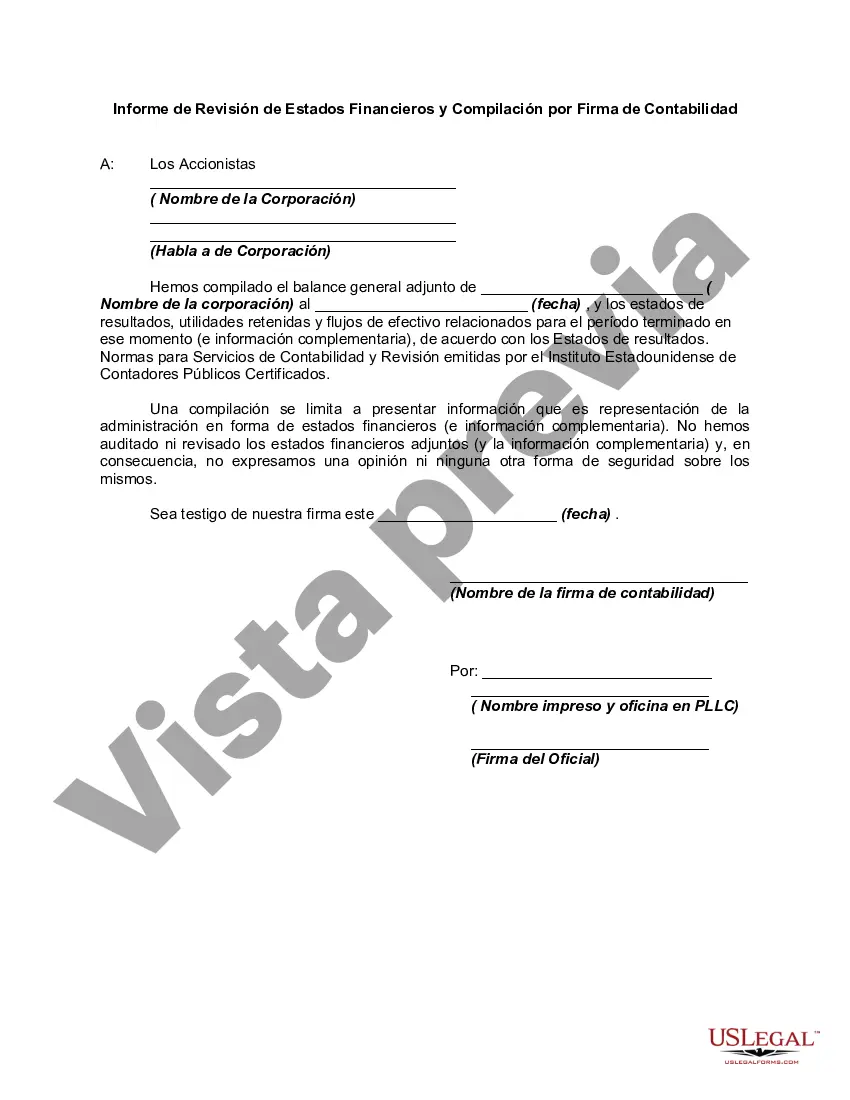

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.