In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Miami-Dade Florida is a county located in the southeastern part of the state of Florida. It encompasses numerous cities and towns, including Miami, the county seat and largest city. Known for its vibrant culture, sandy beaches, and bustling nightlife, Miami-Dade is a popular tourist destination and a major economic hub in the region. Miami-Dade County, being one of the most populous counties in the United States, requires efficient management of its finances and resources. To ensure transparency and accountability, the county engages accounting firms to conduct reviews of financial statements and offer compilation services. A Review of Financial Statements by an accounting firm involves an evaluation of the financial records and transactions of Miami-Dade County, as presented by its management. The review aims to provide limited assurance regarding the accuracy, completeness, and compliance of the financial statements with the Generally Accepted Accounting Principles (GAAP). The accounting firm performs analytical procedures, inquiries, and other relevant procedures to obtain a reasonable basis for expressing negative assurance. The accounting firm's Review Report highlights the scope of their review, including the financial statements audited, management's responsibility for the financial statements, and the firm's responsibility for conducting an independent review. It may also include a statement expressing their lack of knowledge regarding any material modifications that should be made to the financial statements for them to conform to GAAP. On the other hand, a Compilation by an accounting firm involves the preparation of financial statements based on information provided by Miami-Dade County's management. Unlike a review, a compilation does not involve performing substantial procedures or providing any assurance regarding the accuracy of the financial statements. Instead, the focus is on presenting the information in an appropriate financial statement format without expressing any form of assurance. The accounting firm's Compilation Report outlines the nature and objectives of the compilation engagement, management's responsibility for the financial statements, and the firm's responsibility to collect, classify, and summarize the financial data provided. It clarifies that no assurance is being provided on the financial statements' accuracy or conformity to GAAP. Different types of Miami-Dade County financial reports from review and compilation engagements may vary based on the specific financial statements being evaluated. For instance, the review or compilation report could focus on the comprehensive annual financial report (CAR), the budgetary reports, or any other specific financial documents required by Miami-Dade County. In conclusion, Miami-Dade Florida relies on accounting firms to conduct reviews and provide compilation services for its financial statements. These engagements aim to ensure the accuracy, transparency, and conformity to GAAP in the county's financial reports. The different types of reports can encompass various financial documents essential for effective financial management in Miami-Dade County.Miami-Dade Florida is a county located in the southeastern part of the state of Florida. It encompasses numerous cities and towns, including Miami, the county seat and largest city. Known for its vibrant culture, sandy beaches, and bustling nightlife, Miami-Dade is a popular tourist destination and a major economic hub in the region. Miami-Dade County, being one of the most populous counties in the United States, requires efficient management of its finances and resources. To ensure transparency and accountability, the county engages accounting firms to conduct reviews of financial statements and offer compilation services. A Review of Financial Statements by an accounting firm involves an evaluation of the financial records and transactions of Miami-Dade County, as presented by its management. The review aims to provide limited assurance regarding the accuracy, completeness, and compliance of the financial statements with the Generally Accepted Accounting Principles (GAAP). The accounting firm performs analytical procedures, inquiries, and other relevant procedures to obtain a reasonable basis for expressing negative assurance. The accounting firm's Review Report highlights the scope of their review, including the financial statements audited, management's responsibility for the financial statements, and the firm's responsibility for conducting an independent review. It may also include a statement expressing their lack of knowledge regarding any material modifications that should be made to the financial statements for them to conform to GAAP. On the other hand, a Compilation by an accounting firm involves the preparation of financial statements based on information provided by Miami-Dade County's management. Unlike a review, a compilation does not involve performing substantial procedures or providing any assurance regarding the accuracy of the financial statements. Instead, the focus is on presenting the information in an appropriate financial statement format without expressing any form of assurance. The accounting firm's Compilation Report outlines the nature and objectives of the compilation engagement, management's responsibility for the financial statements, and the firm's responsibility to collect, classify, and summarize the financial data provided. It clarifies that no assurance is being provided on the financial statements' accuracy or conformity to GAAP. Different types of Miami-Dade County financial reports from review and compilation engagements may vary based on the specific financial statements being evaluated. For instance, the review or compilation report could focus on the comprehensive annual financial report (CAR), the budgetary reports, or any other specific financial documents required by Miami-Dade County. In conclusion, Miami-Dade Florida relies on accounting firms to conduct reviews and provide compilation services for its financial statements. These engagements aim to ensure the accuracy, transparency, and conformity to GAAP in the county's financial reports. The different types of reports can encompass various financial documents essential for effective financial management in Miami-Dade County.

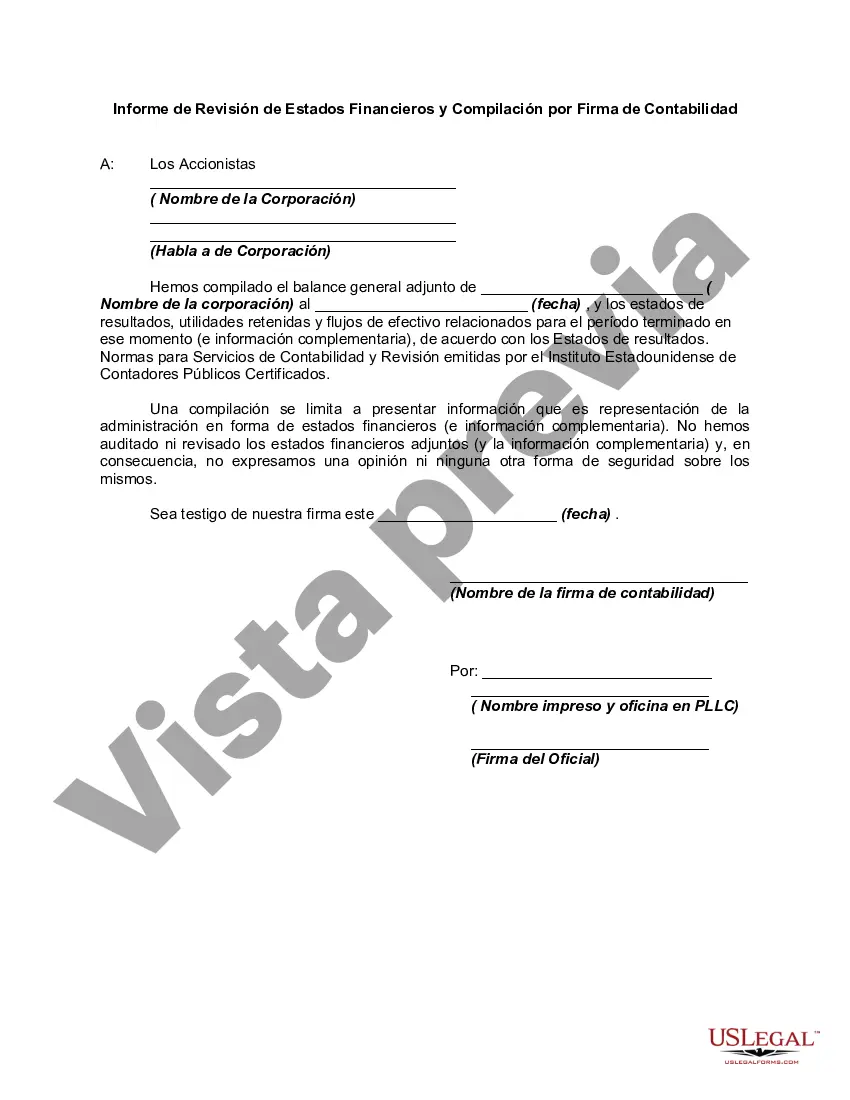

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.