In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Title: Understanding Phoenix, Arizona: A Comprehensive Overview Introduction: This report aims to provide a detailed description of Phoenix, Arizona, a vibrant city known for its rich cultural heritage, thriving business ecosystem, and extensive range of recreational opportunities. Additionally, it will cover the significance of financial statements and the role of accounting firms in conducting reviews and compilations. Keywords: Phoenix Arizona, financial statements, accounting firm. I. Overview of Phoenix, Arizona: 1. Geographical Location: This section will highlight Phoenix's geographic location within the Sonoran Desert and its position as the capital city of Arizona. 2. Climate: Describe Phoenix's dry desert climate, characterized by long, hot summers and mild winters. 3. Cultural Diversity: Showcase the city's diverse population, vibrant arts scene, and various cultural festivals celebrating its multicultural heritage. 4. Economic Growth: Discuss Phoenix's thriving economy, major industries, and its consistent growth as a hub for innovation and entrepreneurship. II. Role of Financial Statements: 1. Definition and Importance: Explain the concept of financial statements, their purpose in presenting an organization's financial performance, and their significance for decision-making processes. 2. Types of Financial Statements: Briefly describe the three main types of financial statements: balance sheet, income statement, and cash flow statement, and explain their respective functions. III. Reports from Review of Financial Statements and Compilation: 1. Review of Financial Statements: — Definition: Outline the review process, a limited form of professional assurance given by accounting firms, providing moderate assurance on the accuracy of financial statements. — Stringent Procedures: Discuss the rigorous examination conducted by accounting firms during a financial statement review to identify potential misstatements or irregularities. — Benefits and Limitations: Highlight the advantages and limitations associated with review reports. 2. Compilation of Financial Statements: — Definition: Define the compilation process, which involves organizing financial data without providing any assurance on its accuracy. — Facilitates Decision-Making: Explain how compiled financial statements assist businesses with internal operations and decision-making processes. — Differences from Review Reports: Compare and contrast compilation reports with review reports, emphasizing the absence of assurance in compilation reports. IV. Diverse Accounting Firm Services in Phoenix, Arizona: 1. Tax Planning and Compliance: Discuss how accounting firms aid businesses and individuals in complying with tax regulations while optimizing tax liabilities. 2. Auditing Services: Highlight the role of accounting firms in conducting external audits to provide independent assurance on the accuracy and reliability of financial statements. 3. Financial Consulting: Explain how accounting firms offer valuable financial advice, budgeting strategies, and recommendations to enhance organizational efficiency and profitability. 4. Forensic Accounting: Describe the specialized services provided by accounting firms in Phoenix, Arizona, to detect and investigate fraudulent activities. Conclusion: Summarize the key findings of this report, emphasizing the importance of financial statements for business transparency and decision-making. Highlight the significance of review and compilation reports produced by accounting firms in Phoenix, Arizona. Emphasize the crucial role of accounting firms in supporting the city's business ecosystem and overall economic growth. Note: The specific types of financial statements and reports may vary depending on the organization's requirements and the accounting firm's scope of services and engagement. It is recommended to consult with a professional accountant for complete and accurate information.Title: Understanding Phoenix, Arizona: A Comprehensive Overview Introduction: This report aims to provide a detailed description of Phoenix, Arizona, a vibrant city known for its rich cultural heritage, thriving business ecosystem, and extensive range of recreational opportunities. Additionally, it will cover the significance of financial statements and the role of accounting firms in conducting reviews and compilations. Keywords: Phoenix Arizona, financial statements, accounting firm. I. Overview of Phoenix, Arizona: 1. Geographical Location: This section will highlight Phoenix's geographic location within the Sonoran Desert and its position as the capital city of Arizona. 2. Climate: Describe Phoenix's dry desert climate, characterized by long, hot summers and mild winters. 3. Cultural Diversity: Showcase the city's diverse population, vibrant arts scene, and various cultural festivals celebrating its multicultural heritage. 4. Economic Growth: Discuss Phoenix's thriving economy, major industries, and its consistent growth as a hub for innovation and entrepreneurship. II. Role of Financial Statements: 1. Definition and Importance: Explain the concept of financial statements, their purpose in presenting an organization's financial performance, and their significance for decision-making processes. 2. Types of Financial Statements: Briefly describe the three main types of financial statements: balance sheet, income statement, and cash flow statement, and explain their respective functions. III. Reports from Review of Financial Statements and Compilation: 1. Review of Financial Statements: — Definition: Outline the review process, a limited form of professional assurance given by accounting firms, providing moderate assurance on the accuracy of financial statements. — Stringent Procedures: Discuss the rigorous examination conducted by accounting firms during a financial statement review to identify potential misstatements or irregularities. — Benefits and Limitations: Highlight the advantages and limitations associated with review reports. 2. Compilation of Financial Statements: — Definition: Define the compilation process, which involves organizing financial data without providing any assurance on its accuracy. — Facilitates Decision-Making: Explain how compiled financial statements assist businesses with internal operations and decision-making processes. — Differences from Review Reports: Compare and contrast compilation reports with review reports, emphasizing the absence of assurance in compilation reports. IV. Diverse Accounting Firm Services in Phoenix, Arizona: 1. Tax Planning and Compliance: Discuss how accounting firms aid businesses and individuals in complying with tax regulations while optimizing tax liabilities. 2. Auditing Services: Highlight the role of accounting firms in conducting external audits to provide independent assurance on the accuracy and reliability of financial statements. 3. Financial Consulting: Explain how accounting firms offer valuable financial advice, budgeting strategies, and recommendations to enhance organizational efficiency and profitability. 4. Forensic Accounting: Describe the specialized services provided by accounting firms in Phoenix, Arizona, to detect and investigate fraudulent activities. Conclusion: Summarize the key findings of this report, emphasizing the importance of financial statements for business transparency and decision-making. Highlight the significance of review and compilation reports produced by accounting firms in Phoenix, Arizona. Emphasize the crucial role of accounting firms in supporting the city's business ecosystem and overall economic growth. Note: The specific types of financial statements and reports may vary depending on the organization's requirements and the accounting firm's scope of services and engagement. It is recommended to consult with a professional accountant for complete and accurate information.

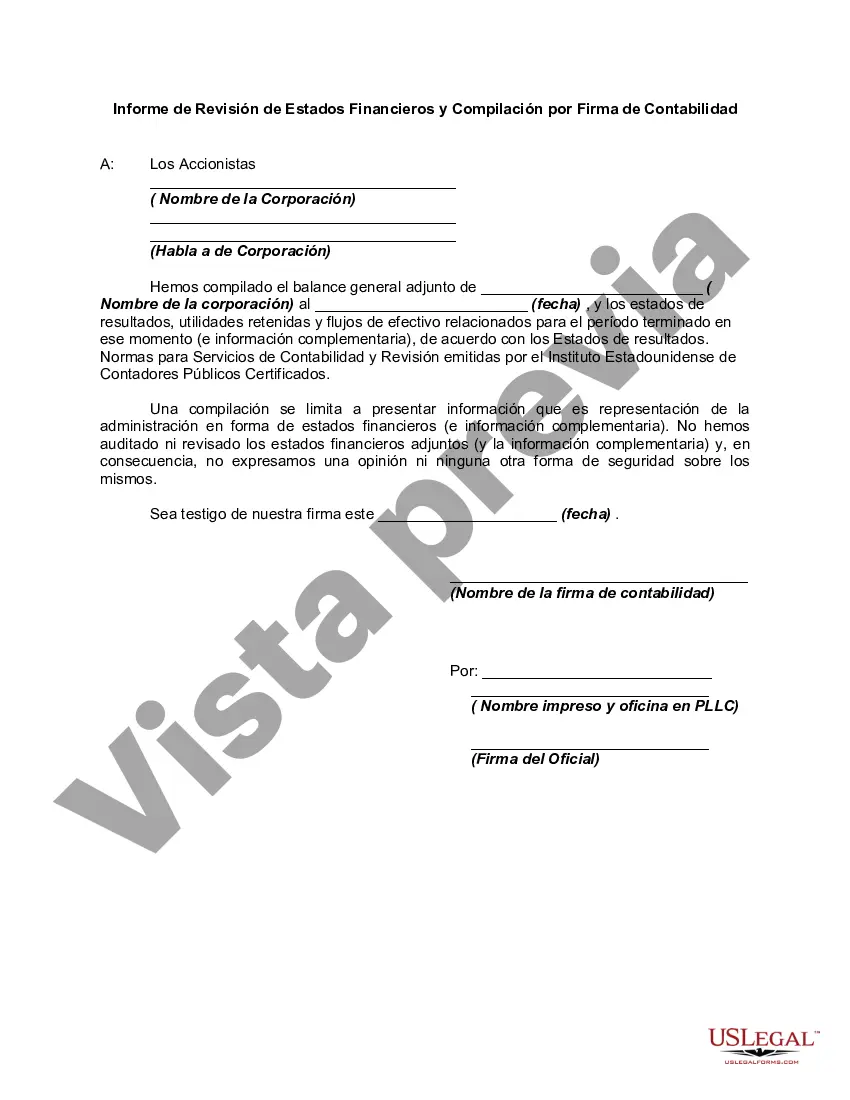

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.