In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

San Jose, California, often referred to as the "Capital of Silicon Valley," is a vibrant city located in the heart of the technology industry. Known for its economic prosperity and diverse population, San Jose is the third-largest city in California and the tenth-largest in the United States. This city offers a high standard of living and a plethora of opportunities for businesses and individuals alike. The financial health and stability of San Jose play a crucial role in its continued growth and development. To ensure transparency and accountability, various accounting firms provide comprehensive reports on the city's financial statements. These reports are vital tools for evaluating the financial performance and overall fiscal well-being of San Jose. 1. Review of Financial Statements: A review report is a type of report that provides limited assurance regarding the financial statements of an organization, including that of San Jose, California. During a review engagement, an accounting firm performs analytical procedures and inquiries to obtain a reasonable basis for expressing limited assurance that the financial statements are free from material misstatements. This report serves to provide stakeholders with an overview of the financial position, results of operations, and cash flows of San Jose. 2. Compilation of Financial Statements: A compilation report involves the collection, classification, and presentation of financial information derived from San Jose's accounting records. The accounting firm compiles these financial statements without providing any assurance on its accuracy or adherence to accounting principles. The purpose of a compilation is to present the financial information in a structured form, making it easier for stakeholders to understand and analyze. The primary objective of both the review and compilation engagements is to provide reliable financial information to users, such as government authorities, investors, and citizens, who want to make informed decisions based on San Jose's financial health. Compliance with accounting standards and regulations ensures credibility and integrity of these reports. Accounting firms conducting these engagements employ a range of methodologies, including data analysis techniques, interviews with key personnel, and examination of supporting documents. The reports are prepared in compliance with generally accepted accounting principles (GAAP) and may include key financial ratios, trend analysis, and explanatory notes to facilitate a thorough understanding of San Jose's financial position. In conclusion, the San Jose California Report from Review of Financial Statements and Compilation by an Accounting Firm is a comprehensive assessment of the city's financial performance. Through the review and compilation engagements, accounting firms provide stakeholders with a clear picture of San Jose's fiscal health, aiding in decision-making processes and ensuring accountability.San Jose, California, often referred to as the "Capital of Silicon Valley," is a vibrant city located in the heart of the technology industry. Known for its economic prosperity and diverse population, San Jose is the third-largest city in California and the tenth-largest in the United States. This city offers a high standard of living and a plethora of opportunities for businesses and individuals alike. The financial health and stability of San Jose play a crucial role in its continued growth and development. To ensure transparency and accountability, various accounting firms provide comprehensive reports on the city's financial statements. These reports are vital tools for evaluating the financial performance and overall fiscal well-being of San Jose. 1. Review of Financial Statements: A review report is a type of report that provides limited assurance regarding the financial statements of an organization, including that of San Jose, California. During a review engagement, an accounting firm performs analytical procedures and inquiries to obtain a reasonable basis for expressing limited assurance that the financial statements are free from material misstatements. This report serves to provide stakeholders with an overview of the financial position, results of operations, and cash flows of San Jose. 2. Compilation of Financial Statements: A compilation report involves the collection, classification, and presentation of financial information derived from San Jose's accounting records. The accounting firm compiles these financial statements without providing any assurance on its accuracy or adherence to accounting principles. The purpose of a compilation is to present the financial information in a structured form, making it easier for stakeholders to understand and analyze. The primary objective of both the review and compilation engagements is to provide reliable financial information to users, such as government authorities, investors, and citizens, who want to make informed decisions based on San Jose's financial health. Compliance with accounting standards and regulations ensures credibility and integrity of these reports. Accounting firms conducting these engagements employ a range of methodologies, including data analysis techniques, interviews with key personnel, and examination of supporting documents. The reports are prepared in compliance with generally accepted accounting principles (GAAP) and may include key financial ratios, trend analysis, and explanatory notes to facilitate a thorough understanding of San Jose's financial position. In conclusion, the San Jose California Report from Review of Financial Statements and Compilation by an Accounting Firm is a comprehensive assessment of the city's financial performance. Through the review and compilation engagements, accounting firms provide stakeholders with a clear picture of San Jose's fiscal health, aiding in decision-making processes and ensuring accountability.

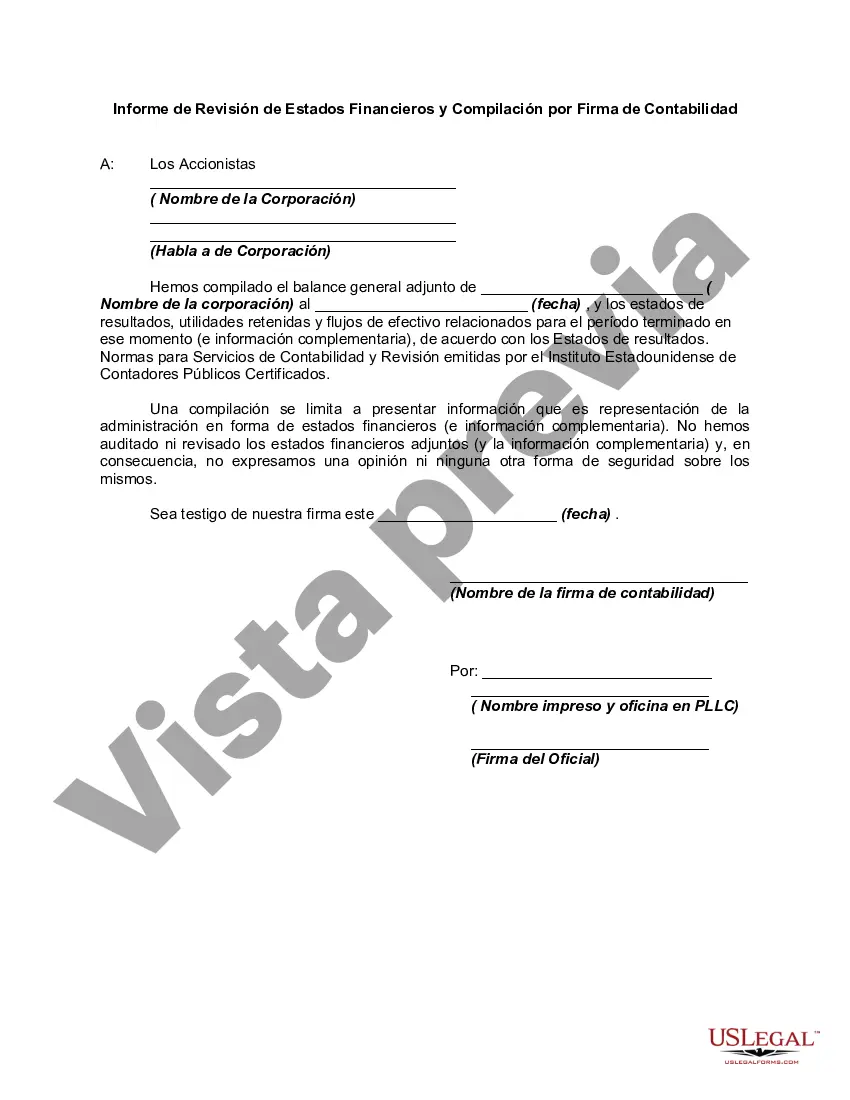

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.