In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Tarrant Texas is a county located in the state of Texas, United States. It is home to a diverse population, bustling cities, and a thriving economy. This article aims to provide a detailed description of Tarrant Texas, focusing on the reports from review of financial statements and compilation conducted by accounting firms within the county. Review of Financial Statements and Compilation by Accounting Firm in Tarrant Texas: 1. Tarrant Texas Report from Review of Financial Statements: The review of financial statements is an audit process undertaken by accounting firms in Tarrant Texas to evaluate the accuracy, completeness, and compliance of financial statements prepared by businesses or organizations within the county. These reports involve an analysis of financial records, transactions, and supporting documents to assess the credibility and reliability of the financial statements. The accountants ensure adherence to relevant accounting principles and standards while identifying any potential discrepancies or errors that may require further investigation. 2. Tarrant Texas Report from Compilation of Financial Statements: In addition to reviews, accounting firms also provide compilation reports for businesses and organizations operating in Tarrant Texas. This type of report involves the preparation of financial statements by the accounting firm based on information provided by the company or organization. It is important to note that unlike a review, compilation reports do not involve an analysis or verification of the financial records. Instead, the accountants compile the data into financial statements as per the provided information and ensure proper presentation, disclosure, and classification of the financial data. 3. Tarrant Texas Report for Governmental Entities: Accounting firms also compile and review financial statements for governmental entities in Tarrant Texas. These reports are tailored to meet the specific needs and requirements of government agencies, ensuring compliance with relevant laws, regulations, and accounting standards. Such reports play a crucial role in maintaining transparency, accountability, and sound financial management within the governmental bodies in Tarrant Texas. 4. Tarrant Texas Report for Non-profit Organizations: Non-profit organizations in Tarrant Texas also rely on accounting firms to compile and review their financial statements. These reports have a unique focus on the financial activities of non-profit organizations, emphasizing compliance with regulations governing the sector. Accountants ensure accurate recording and reporting of donations, grants, and expenditures to demonstrate transparency and provide stakeholders with a clear picture of the organization's financial health. In conclusion, Tarrant Texas is a vibrant county in Texas that relies on accounting firms to provide essential review and compilation reports for financial statements. These reports serve as valuable tools to assess financial integrity, compliance, and transparency for various businesses, governmental entities, and non-profit organizations operating within Tarrant Texas.Tarrant Texas is a county located in the state of Texas, United States. It is home to a diverse population, bustling cities, and a thriving economy. This article aims to provide a detailed description of Tarrant Texas, focusing on the reports from review of financial statements and compilation conducted by accounting firms within the county. Review of Financial Statements and Compilation by Accounting Firm in Tarrant Texas: 1. Tarrant Texas Report from Review of Financial Statements: The review of financial statements is an audit process undertaken by accounting firms in Tarrant Texas to evaluate the accuracy, completeness, and compliance of financial statements prepared by businesses or organizations within the county. These reports involve an analysis of financial records, transactions, and supporting documents to assess the credibility and reliability of the financial statements. The accountants ensure adherence to relevant accounting principles and standards while identifying any potential discrepancies or errors that may require further investigation. 2. Tarrant Texas Report from Compilation of Financial Statements: In addition to reviews, accounting firms also provide compilation reports for businesses and organizations operating in Tarrant Texas. This type of report involves the preparation of financial statements by the accounting firm based on information provided by the company or organization. It is important to note that unlike a review, compilation reports do not involve an analysis or verification of the financial records. Instead, the accountants compile the data into financial statements as per the provided information and ensure proper presentation, disclosure, and classification of the financial data. 3. Tarrant Texas Report for Governmental Entities: Accounting firms also compile and review financial statements for governmental entities in Tarrant Texas. These reports are tailored to meet the specific needs and requirements of government agencies, ensuring compliance with relevant laws, regulations, and accounting standards. Such reports play a crucial role in maintaining transparency, accountability, and sound financial management within the governmental bodies in Tarrant Texas. 4. Tarrant Texas Report for Non-profit Organizations: Non-profit organizations in Tarrant Texas also rely on accounting firms to compile and review their financial statements. These reports have a unique focus on the financial activities of non-profit organizations, emphasizing compliance with regulations governing the sector. Accountants ensure accurate recording and reporting of donations, grants, and expenditures to demonstrate transparency and provide stakeholders with a clear picture of the organization's financial health. In conclusion, Tarrant Texas is a vibrant county in Texas that relies on accounting firms to provide essential review and compilation reports for financial statements. These reports serve as valuable tools to assess financial integrity, compliance, and transparency for various businesses, governmental entities, and non-profit organizations operating within Tarrant Texas.

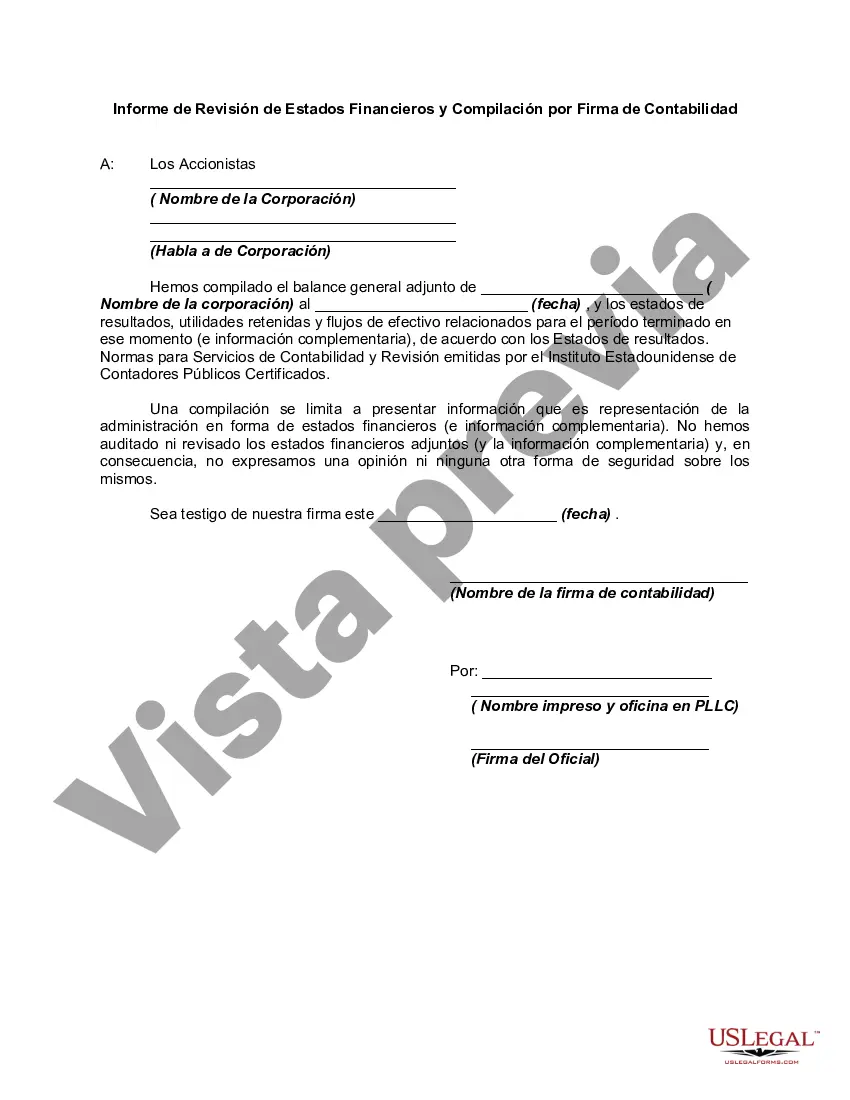

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.