In a compilation engagement, the accountant presents in the form of financial statements information that is the representation of management (owners) without undertaking to express any assurance on the statements. In other words, using management's records, the accountant creates financial statements without gathering evidence or opining about the validity of those underlying records. Because compiled financial statements provide the reader no assurance regarding the statements, they represent the lowest level of financial statement service accountants can provide to their clients. Accordingly, standards governing compilation engagements require that financial statements presented by the accountant to the client or third parties must at least be compiled.

Title: Understanding Wake North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm Introduction: Wake, North Carolina, is a thriving city with a strong economy and numerous businesses. To provide transparency and credibility in financial matters, companies often partner with accounting firms to conduct reviews of their financial statements and compile necessary reports. In this article, we will delve into the significance of Wake North Carolina's reports generated from the review of financial statements and compilations performed by accounting firms, exploring different types and their implications. 1. Wake North Carolina Report from Review of Financial Statements: When a company engages an accounting firm for a review of its financial statements, it aims to gain an objective evaluation of the financial health. The Wake North Carolina Report generated from this review offers insights into potential material misstatements, discrepancies, or irregularities. It provides stakeholders, such as investors, lenders, and management, an independent expert's opinion regarding the reliability of financial information. 2. Wake North Carolina Report from Compilation of Financial Statements: Accounting firms may also be engaged to compile financial statements, where they gather and organize financial data provided by the company's management. The Wake North Carolina Report resulting from this compilation serves as a representation of the information submitted by the company, organized into appropriate financial statement formats. Such reports assist in providing a snapshot of the business's financial position, although they lack the comprehensive analysis performed in a review or audit. 3. Differentiating Types of Wake North Carolina Reports: a) Wake North Carolina Report from Review of Financial Statements — Unmodified Opinion: An unmodified opinion indicates that no material misstatements have been found, and the financial statements present a true and fair picture of the company's financial position and performance. b) Wake North Carolina Report from Review of Financial Statements — Modified Opinion: A modified opinion suggests that certain material misstatements, inconsistencies, or limitations in the financial statements were discovered. The report would detail these findings and highlight any modifications required to ensure accuracy. c) Wake North Carolina Report from Compilation of Financial Statements: A compilation report presents the financial statements compiled by the accounting firm, focusing on the proper presentation and absence of obvious errors. It highlights that the compiled statements are the representation of the company's management and do not undergo extensive verification or analysis. Conclusion: Wake North Carolina Reports resulting from the review and compilation of financial statements play a crucial role in ensuring accurate financial reporting and decision-making. These reports represent an accounting firm's professional evaluation of a company's financial statements, providing stakeholders with essential information to assess a company's financial health and prospects. Whether through unmodified opinions, modified opinions, or compilation reports, Wake North Carolina Reports contribute to building trust, credibility, and transparency in Wake's business community.Title: Understanding Wake North Carolina Report from Review of Financial Statements and Compilation by Accounting Firm Introduction: Wake, North Carolina, is a thriving city with a strong economy and numerous businesses. To provide transparency and credibility in financial matters, companies often partner with accounting firms to conduct reviews of their financial statements and compile necessary reports. In this article, we will delve into the significance of Wake North Carolina's reports generated from the review of financial statements and compilations performed by accounting firms, exploring different types and their implications. 1. Wake North Carolina Report from Review of Financial Statements: When a company engages an accounting firm for a review of its financial statements, it aims to gain an objective evaluation of the financial health. The Wake North Carolina Report generated from this review offers insights into potential material misstatements, discrepancies, or irregularities. It provides stakeholders, such as investors, lenders, and management, an independent expert's opinion regarding the reliability of financial information. 2. Wake North Carolina Report from Compilation of Financial Statements: Accounting firms may also be engaged to compile financial statements, where they gather and organize financial data provided by the company's management. The Wake North Carolina Report resulting from this compilation serves as a representation of the information submitted by the company, organized into appropriate financial statement formats. Such reports assist in providing a snapshot of the business's financial position, although they lack the comprehensive analysis performed in a review or audit. 3. Differentiating Types of Wake North Carolina Reports: a) Wake North Carolina Report from Review of Financial Statements — Unmodified Opinion: An unmodified opinion indicates that no material misstatements have been found, and the financial statements present a true and fair picture of the company's financial position and performance. b) Wake North Carolina Report from Review of Financial Statements — Modified Opinion: A modified opinion suggests that certain material misstatements, inconsistencies, or limitations in the financial statements were discovered. The report would detail these findings and highlight any modifications required to ensure accuracy. c) Wake North Carolina Report from Compilation of Financial Statements: A compilation report presents the financial statements compiled by the accounting firm, focusing on the proper presentation and absence of obvious errors. It highlights that the compiled statements are the representation of the company's management and do not undergo extensive verification or analysis. Conclusion: Wake North Carolina Reports resulting from the review and compilation of financial statements play a crucial role in ensuring accurate financial reporting and decision-making. These reports represent an accounting firm's professional evaluation of a company's financial statements, providing stakeholders with essential information to assess a company's financial health and prospects. Whether through unmodified opinions, modified opinions, or compilation reports, Wake North Carolina Reports contribute to building trust, credibility, and transparency in Wake's business community.

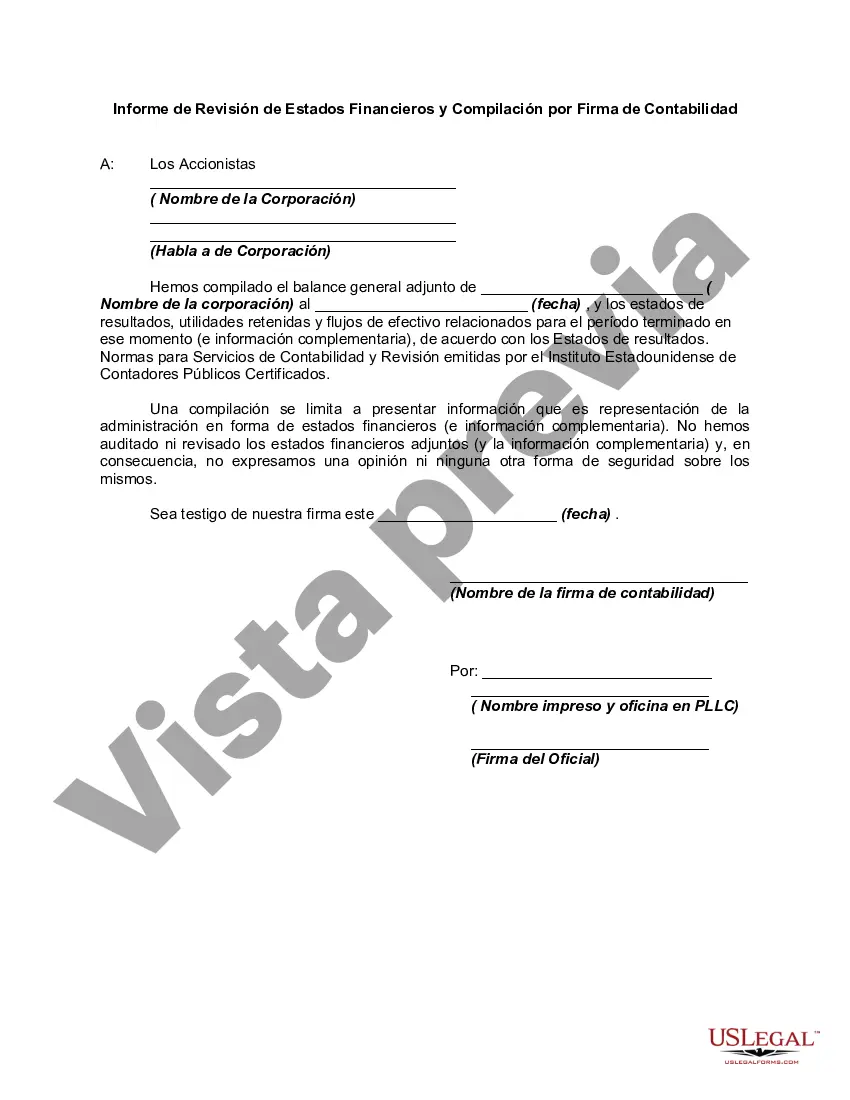

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.