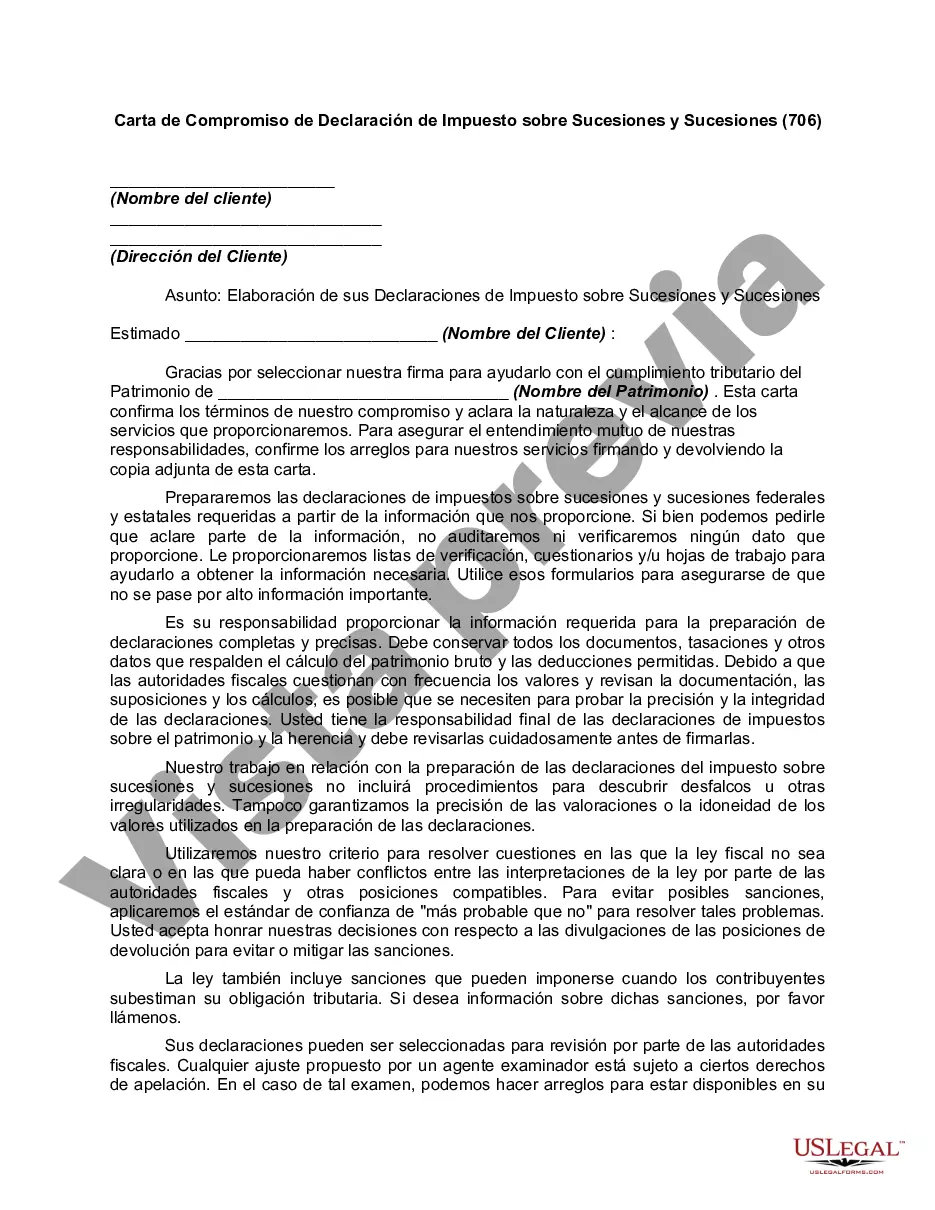

The number 706 refers to Form 706 which is used to file the United States Estate (and Generation-Skipping Transfer) Tax Return. Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 is a document prepared by tax professionals to engage with clients regarding their estate and inheritance tax returns. It serves as an agreement between the tax preparer and the client, outlining the scope of the services to be provided and the responsibilities of both parties. The Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 is specifically designed for handling estate and inheritance tax matters in Houston, Texas. This letter is essential for individuals or families who have recently experienced a loss and need assistance with estate tax filings. Whether you are an executor, administrator, or personal representative of an estate, the Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 provides a comprehensive overview of the tax preparation services offered by tax professionals. It allows you to ensure compliance with the complex tax laws, while also maximizing any available tax deductions and credits. Key elements covered in the Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 typically include: 1. Contact Information: This section provides the necessary details of both the client and the tax preparer. It includes their names, addresses, contact numbers, and email addresses, establishing clear communication channels throughout the process. 2. Engagement Purpose: The engagement letter specifies that the tax preparer will be providing services related to the preparation and filing of estate and inheritance tax returns on behalf of the client. It ensures that both parties are aligned in their understanding of the services required. 3. Scope of Services: This section highlights the specific tasks the tax preparer will undertake, such as gathering required documentation, valuation of assets, tax calculations, and completion of all necessary forms pertaining to estate and inheritance tax returns. 4. Client Responsibilities: The engagement letter outlines the responsibilities of the client, such as providing accurate and complete information, maintaining accurate records, and promptly responding to requests for information or documents throughout the process. 5. Fees and Payment Terms: This section details the fee structure for the tax preparer's services, including any upfront retainer fees or hourly rates. It also specifies the methods of payment and the billing cycle (e.g., monthly, upon completion, etc.). In Houston, Texas, there may be variations of the Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 depending on the specific needs of the client or the complexity of the estate. Some variations may include: — Basic Estate and Inheritance Tax Return Engagement Letter — 706: This is a standard engagement letter for simpler estate tax situations. It covers the primary requirements and scope of services necessary for most estates. — Complex Estate and Inheritance Tax Return Engagement Letter — 706: This letter is specifically tailored for estates with complex assets, multiple beneficiaries, or intricate estate planning structures. It may involve additional services, such as estate tax planning or assistance with IRS audits. In conclusion, the Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 is a crucial document designed to establish a clear understanding between tax preparers and their clients in Houston, Texas. It ensures that both parties are aligned on the services provided, responsibilities, and fees associated with preparing and filing estate and inheritance tax returns.Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 is a document prepared by tax professionals to engage with clients regarding their estate and inheritance tax returns. It serves as an agreement between the tax preparer and the client, outlining the scope of the services to be provided and the responsibilities of both parties. The Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 is specifically designed for handling estate and inheritance tax matters in Houston, Texas. This letter is essential for individuals or families who have recently experienced a loss and need assistance with estate tax filings. Whether you are an executor, administrator, or personal representative of an estate, the Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 provides a comprehensive overview of the tax preparation services offered by tax professionals. It allows you to ensure compliance with the complex tax laws, while also maximizing any available tax deductions and credits. Key elements covered in the Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 typically include: 1. Contact Information: This section provides the necessary details of both the client and the tax preparer. It includes their names, addresses, contact numbers, and email addresses, establishing clear communication channels throughout the process. 2. Engagement Purpose: The engagement letter specifies that the tax preparer will be providing services related to the preparation and filing of estate and inheritance tax returns on behalf of the client. It ensures that both parties are aligned in their understanding of the services required. 3. Scope of Services: This section highlights the specific tasks the tax preparer will undertake, such as gathering required documentation, valuation of assets, tax calculations, and completion of all necessary forms pertaining to estate and inheritance tax returns. 4. Client Responsibilities: The engagement letter outlines the responsibilities of the client, such as providing accurate and complete information, maintaining accurate records, and promptly responding to requests for information or documents throughout the process. 5. Fees and Payment Terms: This section details the fee structure for the tax preparer's services, including any upfront retainer fees or hourly rates. It also specifies the methods of payment and the billing cycle (e.g., monthly, upon completion, etc.). In Houston, Texas, there may be variations of the Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 depending on the specific needs of the client or the complexity of the estate. Some variations may include: — Basic Estate and Inheritance Tax Return Engagement Letter — 706: This is a standard engagement letter for simpler estate tax situations. It covers the primary requirements and scope of services necessary for most estates. — Complex Estate and Inheritance Tax Return Engagement Letter — 706: This letter is specifically tailored for estates with complex assets, multiple beneficiaries, or intricate estate planning structures. It may involve additional services, such as estate tax planning or assistance with IRS audits. In conclusion, the Houston Texas Estate and Inheritance Tax Return Engagement Letter — 706 is a crucial document designed to establish a clear understanding between tax preparers and their clients in Houston, Texas. It ensures that both parties are aligned on the services provided, responsibilities, and fees associated with preparing and filing estate and inheritance tax returns.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.