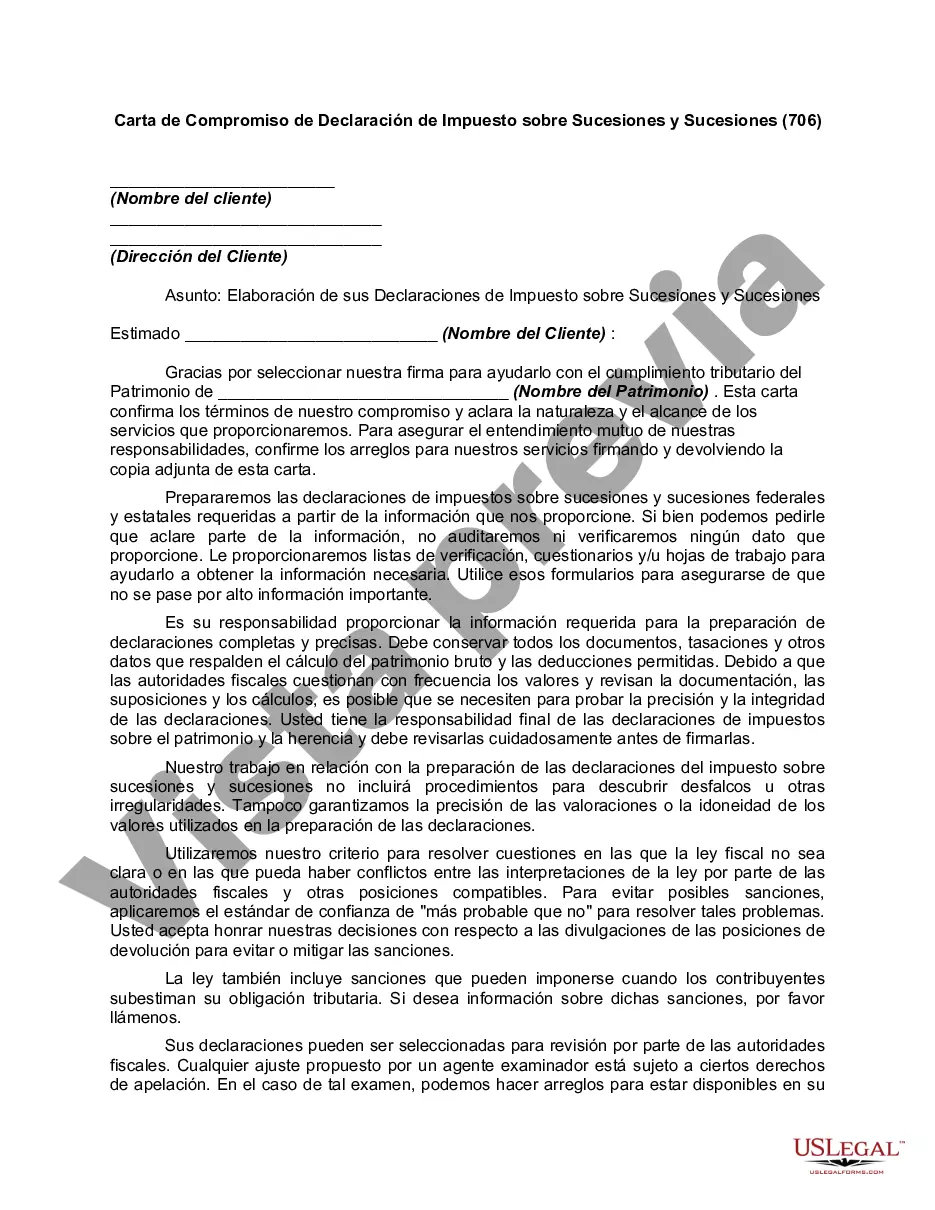

The number 706 refers to Form 706 which is used to file the United States Estate (and Generation-Skipping Transfer) Tax Return. Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A Mecklenburg North Carolina Estate and Inheritance Tax Return Engagement Letter — 706 is a legally binding document that outlines the responsibilities and obligations of an estate tax return preparer and the executor or personal representative of an estate. It is a crucial document in the process of filing and submitting an estate tax return to the North Carolina Department of Revenue. Keywords: Mecklenburg North Carolina, Estate and Inheritance Tax Return Engagement Letter, 706, executor, personal representative, estate tax return preparer, North Carolina Department of Revenue. The Engagement Letter — 706 is a comprehensive document that ensures clarity and agreement between the preparer and the executor regarding the preparation and submission of the estate tax return. Through this letter, both parties establish a professional relationship with defined roles and responsibilities. Some key elements typically included in the Mecklenburg North Carolina Estate and Inheritance Tax Return Engagement Letter — 706 are: 1. Introduction and Background: The engagement letter will begin by introducing the preparer and the executor, stating their names, addresses, and roles in the estate administration process. It may also include a brief explanation of the estate's circumstances and the purpose of the engagement. 2. Scope of Services: This section outlines the specific services that the preparer will provide, such as preparing and filing the estate tax return Form 706, gathering necessary documents, and providing advice and guidance throughout the process. 3. Responsibilities of the Preparer: The engagement letter will clearly outline the preparer's responsibilities, including conducting necessary research, calculating the estate taxes due, ensuring compliance with relevant tax laws, and ensuring accuracy and completeness of the return. 4. Responsibilities of the Executor: Similarly, the executor's responsibilities will be addressed, such as providing accurate and complete information about the estate, timely provision of required documents, and responding to inquiries and requests for additional information. 5. Confidentiality: This section ensures the confidentiality of sensitive personal and financial information exchanged during the engagement, emphasizing the preparer's commitment to privacy, professional ethics, and non-disclosure of information to third parties without consent or legal obligation. 6. Fee Arrangements: The engagement letter will specify the compensation terms and payment schedule. This usually includes an hourly rate or a flat fee for services rendered, along with any additional expenses that may be incurred during the preparation of the estate tax return. Different types of Mecklenburg North Carolina Estate and Inheritance Tax Return Engagement Letters — 706 may vary based on the complexity of the estate, the experience and expertise of the preparer, and any specific requests or requirements of the executor. Overall, the Mecklenburg North Carolina Estate and Inheritance Tax Return Engagement Letter — 706 serves as a foundation for a transparent and collaborative relationship between the estate tax return preparer and the executor, ensuring compliance with state tax laws while efficiently managing the estate's tax obligations.A Mecklenburg North Carolina Estate and Inheritance Tax Return Engagement Letter — 706 is a legally binding document that outlines the responsibilities and obligations of an estate tax return preparer and the executor or personal representative of an estate. It is a crucial document in the process of filing and submitting an estate tax return to the North Carolina Department of Revenue. Keywords: Mecklenburg North Carolina, Estate and Inheritance Tax Return Engagement Letter, 706, executor, personal representative, estate tax return preparer, North Carolina Department of Revenue. The Engagement Letter — 706 is a comprehensive document that ensures clarity and agreement between the preparer and the executor regarding the preparation and submission of the estate tax return. Through this letter, both parties establish a professional relationship with defined roles and responsibilities. Some key elements typically included in the Mecklenburg North Carolina Estate and Inheritance Tax Return Engagement Letter — 706 are: 1. Introduction and Background: The engagement letter will begin by introducing the preparer and the executor, stating their names, addresses, and roles in the estate administration process. It may also include a brief explanation of the estate's circumstances and the purpose of the engagement. 2. Scope of Services: This section outlines the specific services that the preparer will provide, such as preparing and filing the estate tax return Form 706, gathering necessary documents, and providing advice and guidance throughout the process. 3. Responsibilities of the Preparer: The engagement letter will clearly outline the preparer's responsibilities, including conducting necessary research, calculating the estate taxes due, ensuring compliance with relevant tax laws, and ensuring accuracy and completeness of the return. 4. Responsibilities of the Executor: Similarly, the executor's responsibilities will be addressed, such as providing accurate and complete information about the estate, timely provision of required documents, and responding to inquiries and requests for additional information. 5. Confidentiality: This section ensures the confidentiality of sensitive personal and financial information exchanged during the engagement, emphasizing the preparer's commitment to privacy, professional ethics, and non-disclosure of information to third parties without consent or legal obligation. 6. Fee Arrangements: The engagement letter will specify the compensation terms and payment schedule. This usually includes an hourly rate or a flat fee for services rendered, along with any additional expenses that may be incurred during the preparation of the estate tax return. Different types of Mecklenburg North Carolina Estate and Inheritance Tax Return Engagement Letters — 706 may vary based on the complexity of the estate, the experience and expertise of the preparer, and any specific requests or requirements of the executor. Overall, the Mecklenburg North Carolina Estate and Inheritance Tax Return Engagement Letter — 706 serves as a foundation for a transparent and collaborative relationship between the estate tax return preparer and the executor, ensuring compliance with state tax laws while efficiently managing the estate's tax obligations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.