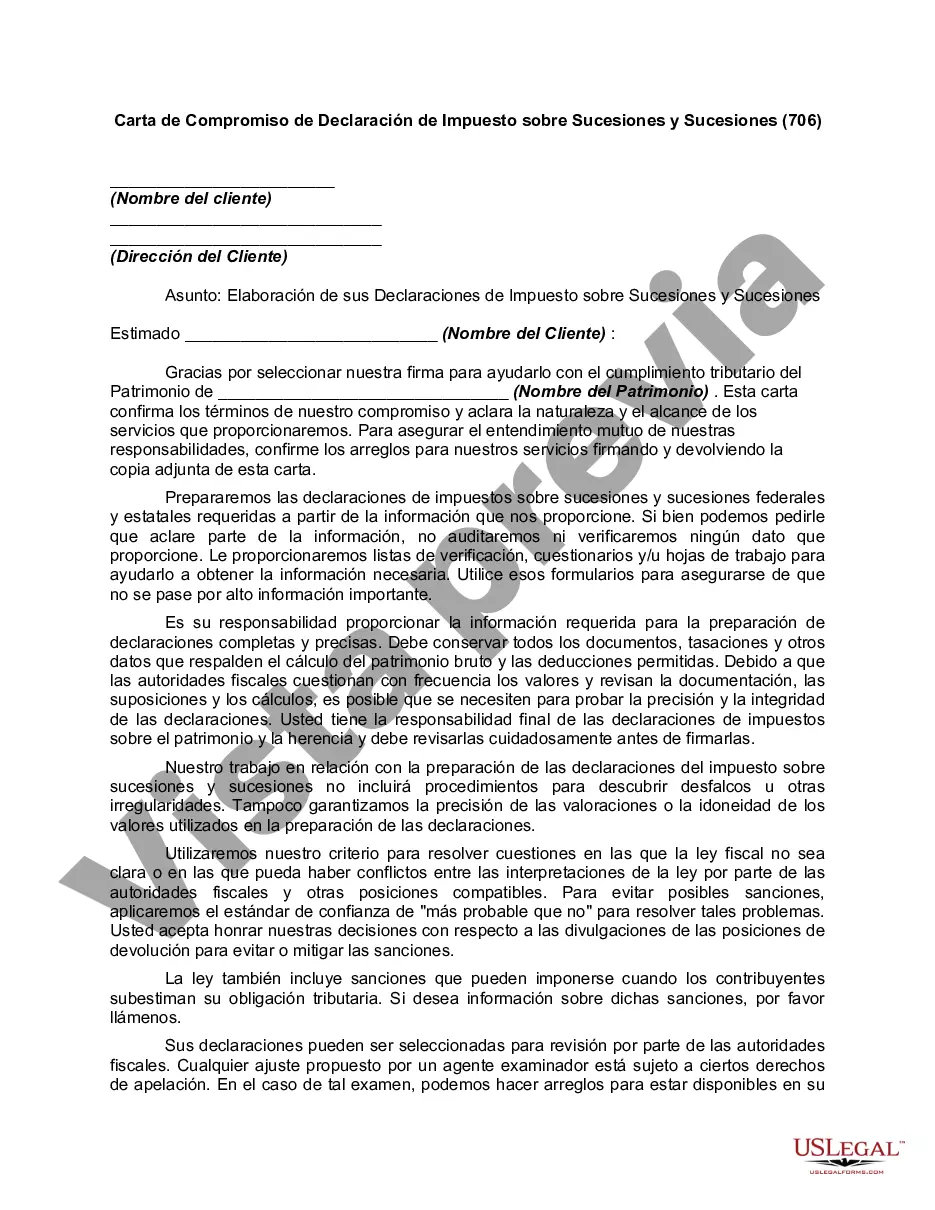

The number 706 refers to Form 706 which is used to file the United States Estate (and Generation-Skipping Transfer) Tax Return. Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Salt Lake City, Utah is known for its stunning landscape, thriving economy, and rich history. The state of Utah has specific laws and regulations governing estate and inheritance taxes. Therefore, engaging a knowledgeable tax professional or accountant is crucial when dealing with Salt Lake Utah Estate and Inheritance Tax Return Engagement Letter — 706. An Estate and Inheritance Tax Return Engagement Letter — 706 is a legal document that outlines the responsibilities, terms, and conditions between a tax professional and their client regarding the preparation and submission of IRS Form 706. This form is used to report and calculate federal estate taxes owed after a person's passing, particularly for individuals who had significant assets and properties. The engagement letter serves as a contract between the tax professional and the client, ensuring transparency, clarity, and mutual understanding. It includes vital information such as the taxpayer's name, address, date of death, and the appointed executor or administrator of the estate. It also outlines the tax professional's responsibilities, including gathering necessary documents, organizing financial records, and accurately completing the IRS Form 706. There may be different types of engagement letters related to Salt Lake Utah Estate and Inheritance Tax Return — 706, depending on specific circumstances. Some common categories include: 1. Standard Estate and Inheritance Tax Return Engagement Letter — 706: This engagement letter covers the regular preparation and submission of Form 706 for estate taxes owed after an individual's passing. It encompasses all necessary tasks related to calculating and reporting the estate's taxable value and associated tax liability. 2. Complex Estate and Inheritance Tax Return Engagement Letter — 706: In cases where the estate is considered complex, involving intricate financial assets, multiple beneficiaries, or unique estate planning strategies, this type of engagement letter is employed. It outlines the tax professional's additional responsibilities and expertise required to handle complicated tax issues effectively. 3. Extension Request Estate and Inheritance Tax Return Engagement Letter — 706: If the appointed executor or administrator needs more time to gather accurate information, such as determining the estate's value or preparing required documentation, they may opt for an extension request. This engagement letter would detail the tax professional's role in guiding the extension process and the subsequent filing of Form 706. 4. Post-Filing Audit Support Estate and Inheritance Tax Return Engagement Letter — 706: In some cases, the IRS may audit an estate's tax return to ensure compliance with tax laws. This engagement letter caters to the tax professional's role in providing support and representation during the audit process, including addressing inquiries, providing additional documentation, and resolving any discrepancies or issues that may arise. While the specific types of engagement letters may vary, they all share the common goal of ensuring accurate, timely, and compliant estate tax reporting in Salt Lake City, Utah. It is crucial for individuals dealing with estate and inheritance taxes to consult with a qualified tax professional or accountant who is well-versed in Utah's tax laws and regulations.Salt Lake City, Utah is known for its stunning landscape, thriving economy, and rich history. The state of Utah has specific laws and regulations governing estate and inheritance taxes. Therefore, engaging a knowledgeable tax professional or accountant is crucial when dealing with Salt Lake Utah Estate and Inheritance Tax Return Engagement Letter — 706. An Estate and Inheritance Tax Return Engagement Letter — 706 is a legal document that outlines the responsibilities, terms, and conditions between a tax professional and their client regarding the preparation and submission of IRS Form 706. This form is used to report and calculate federal estate taxes owed after a person's passing, particularly for individuals who had significant assets and properties. The engagement letter serves as a contract between the tax professional and the client, ensuring transparency, clarity, and mutual understanding. It includes vital information such as the taxpayer's name, address, date of death, and the appointed executor or administrator of the estate. It also outlines the tax professional's responsibilities, including gathering necessary documents, organizing financial records, and accurately completing the IRS Form 706. There may be different types of engagement letters related to Salt Lake Utah Estate and Inheritance Tax Return — 706, depending on specific circumstances. Some common categories include: 1. Standard Estate and Inheritance Tax Return Engagement Letter — 706: This engagement letter covers the regular preparation and submission of Form 706 for estate taxes owed after an individual's passing. It encompasses all necessary tasks related to calculating and reporting the estate's taxable value and associated tax liability. 2. Complex Estate and Inheritance Tax Return Engagement Letter — 706: In cases where the estate is considered complex, involving intricate financial assets, multiple beneficiaries, or unique estate planning strategies, this type of engagement letter is employed. It outlines the tax professional's additional responsibilities and expertise required to handle complicated tax issues effectively. 3. Extension Request Estate and Inheritance Tax Return Engagement Letter — 706: If the appointed executor or administrator needs more time to gather accurate information, such as determining the estate's value or preparing required documentation, they may opt for an extension request. This engagement letter would detail the tax professional's role in guiding the extension process and the subsequent filing of Form 706. 4. Post-Filing Audit Support Estate and Inheritance Tax Return Engagement Letter — 706: In some cases, the IRS may audit an estate's tax return to ensure compliance with tax laws. This engagement letter caters to the tax professional's role in providing support and representation during the audit process, including addressing inquiries, providing additional documentation, and resolving any discrepancies or issues that may arise. While the specific types of engagement letters may vary, they all share the common goal of ensuring accurate, timely, and compliant estate tax reporting in Salt Lake City, Utah. It is crucial for individuals dealing with estate and inheritance taxes to consult with a qualified tax professional or accountant who is well-versed in Utah's tax laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.