Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

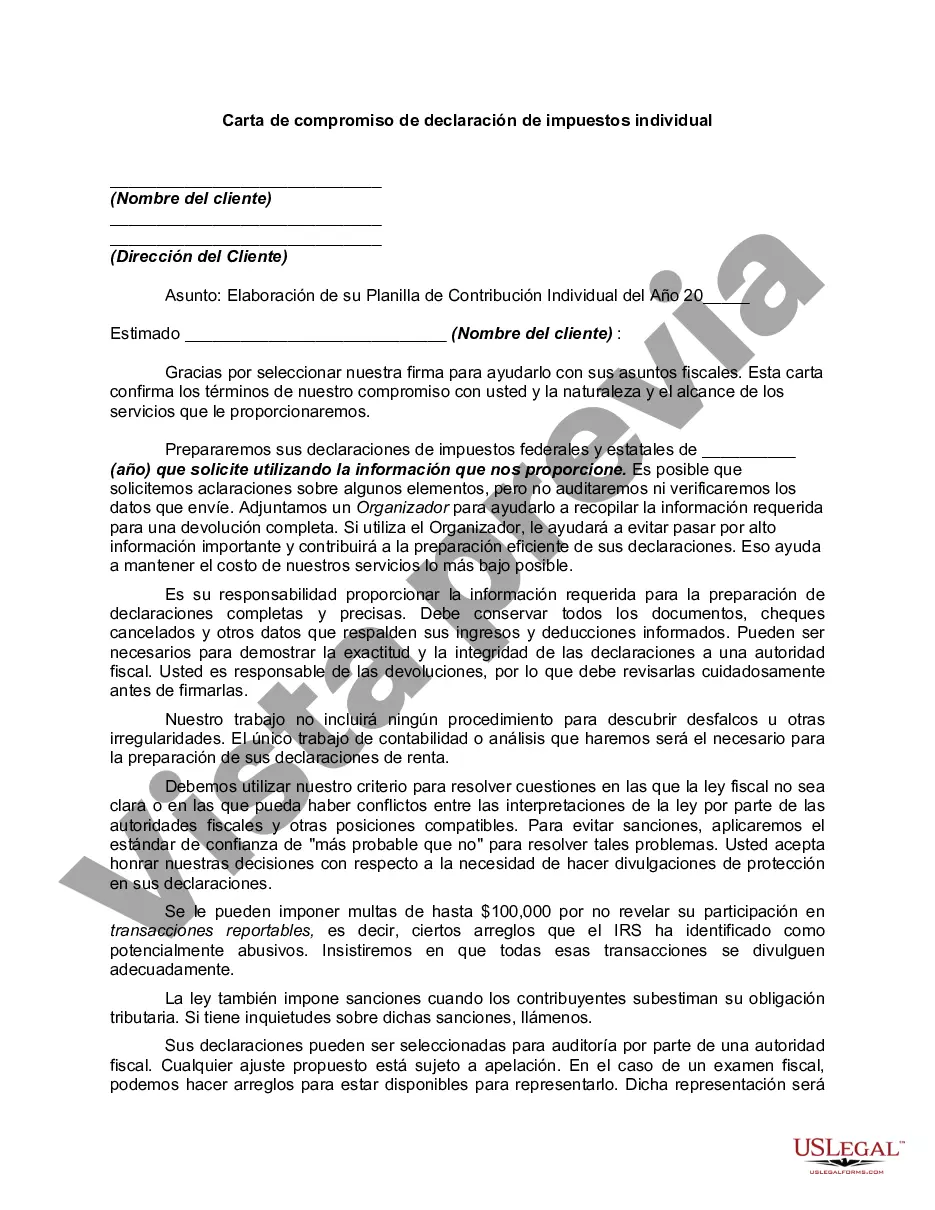

San Diego California Individual Tax Return Engagement Letter is a document that outlines the agreement between a taxpayer and their tax preparer or certified public accountant (CPA) regarding the preparation and filing of their individual tax return to San Diego, California. This engagement letter serves as a binding contract that defines the scope of work, responsibilities, and expectations of both parties during the tax preparation process. It is a crucial communication tool that ensures transparency and safeguards the interests of both the taxpayer and the tax professional. This engagement letter typically includes important details such as the taxpayer's name, contact information, and social security number, as well as the tax preparer's or CPA's name, contact information, and identification number. It also specifies the year for which the tax return is being prepared, as well as any additional tax schedules or forms that may be required to complete the return accurately. The San Diego California Individual Tax Return Engagement Letter outlines the services that will be provided by the tax preparer or CPA, which usually includes gathering and organizing all relevant tax documents, preparing and filing the tax return with the appropriate tax authorities, and providing any necessary advice or guidance related to the taxpayer's specific tax situation. It also establishes the taxpayer's responsibility to provide accurate and complete information to the tax preparer, and to promptly respond to any inquiries or requests for additional documentation. In addition to the standard San Diego California Individual Tax Return Engagement Letter, there may be variations or specific types of engagement letters that cater to unique circumstances or additional services. Some of these may include: 1. San Diego California Individual Tax Return Engagement Letter — Business Owners: For individuals who own a business in San Diego and require additional tax services specifically related to their business income, deductions, and compliance requirements. 2. San Diego California Individual Tax Return Engagement Letter — Rental Property Owners: For individuals who own rental properties in San Diego, this engagement letter may address specific issues related to rental income, expenses, and depreciation. 3. San Diego California Individual Tax Return Engagement Letter — High Net Worth Individuals: This engagement letter is aimed at individuals with considerable assets, investments, or complex financial portfolios requiring specialized tax expertise and planning. 4. San Diego California Individual Tax Return Engagement Letter — Self-Employed Professionals: This engagement letter is tailored for self-employed individuals or independent contractors operating their businesses in San Diego, addressing the unique tax considerations and compliance requirements for this group. Overall, the San Diego California Individual Tax Return Engagement Letter is a crucial document for taxpayers and tax professionals alike. It ensures clear communication, sets expectations, and establishes a framework for a smooth and efficient tax preparation process while adhering to the relevant tax laws and regulations in San Diego, California.San Diego California Individual Tax Return Engagement Letter is a document that outlines the agreement between a taxpayer and their tax preparer or certified public accountant (CPA) regarding the preparation and filing of their individual tax return to San Diego, California. This engagement letter serves as a binding contract that defines the scope of work, responsibilities, and expectations of both parties during the tax preparation process. It is a crucial communication tool that ensures transparency and safeguards the interests of both the taxpayer and the tax professional. This engagement letter typically includes important details such as the taxpayer's name, contact information, and social security number, as well as the tax preparer's or CPA's name, contact information, and identification number. It also specifies the year for which the tax return is being prepared, as well as any additional tax schedules or forms that may be required to complete the return accurately. The San Diego California Individual Tax Return Engagement Letter outlines the services that will be provided by the tax preparer or CPA, which usually includes gathering and organizing all relevant tax documents, preparing and filing the tax return with the appropriate tax authorities, and providing any necessary advice or guidance related to the taxpayer's specific tax situation. It also establishes the taxpayer's responsibility to provide accurate and complete information to the tax preparer, and to promptly respond to any inquiries or requests for additional documentation. In addition to the standard San Diego California Individual Tax Return Engagement Letter, there may be variations or specific types of engagement letters that cater to unique circumstances or additional services. Some of these may include: 1. San Diego California Individual Tax Return Engagement Letter — Business Owners: For individuals who own a business in San Diego and require additional tax services specifically related to their business income, deductions, and compliance requirements. 2. San Diego California Individual Tax Return Engagement Letter — Rental Property Owners: For individuals who own rental properties in San Diego, this engagement letter may address specific issues related to rental income, expenses, and depreciation. 3. San Diego California Individual Tax Return Engagement Letter — High Net Worth Individuals: This engagement letter is aimed at individuals with considerable assets, investments, or complex financial portfolios requiring specialized tax expertise and planning. 4. San Diego California Individual Tax Return Engagement Letter — Self-Employed Professionals: This engagement letter is tailored for self-employed individuals or independent contractors operating their businesses in San Diego, addressing the unique tax considerations and compliance requirements for this group. Overall, the San Diego California Individual Tax Return Engagement Letter is a crucial document for taxpayers and tax professionals alike. It ensures clear communication, sets expectations, and establishes a framework for a smooth and efficient tax preparation process while adhering to the relevant tax laws and regulations in San Diego, California.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.