Generally, a contract to employ a certified public accountant need not be in writing. However, such contracts often call for services of a highly complex and technical nature, and hence they should be explicit in their terms, and they should be in writing. In particular, a written employment contract is necessary in order to avoid misunderstanding with the employer regarding the amount of the accountant's fee or compensation and the nature of its computation.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

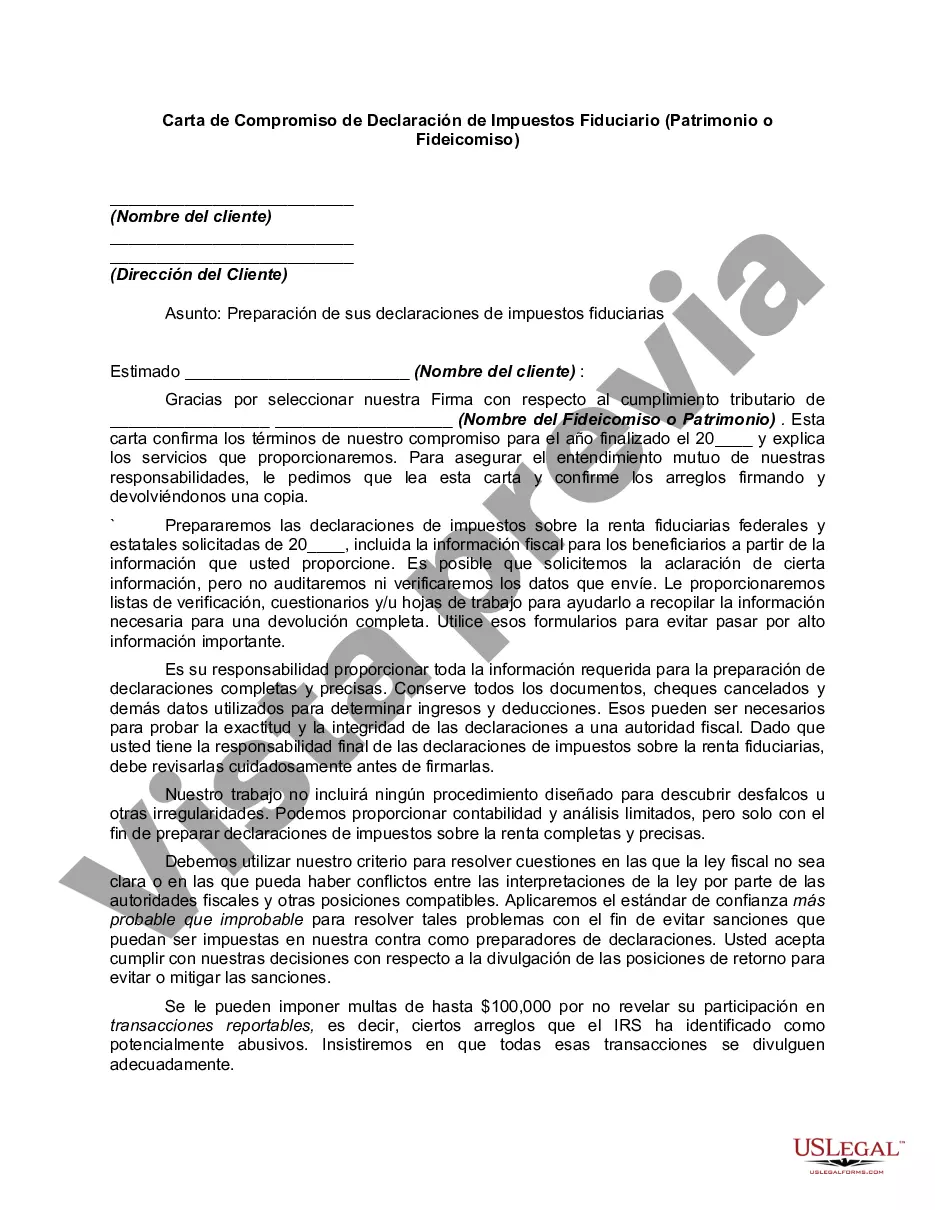

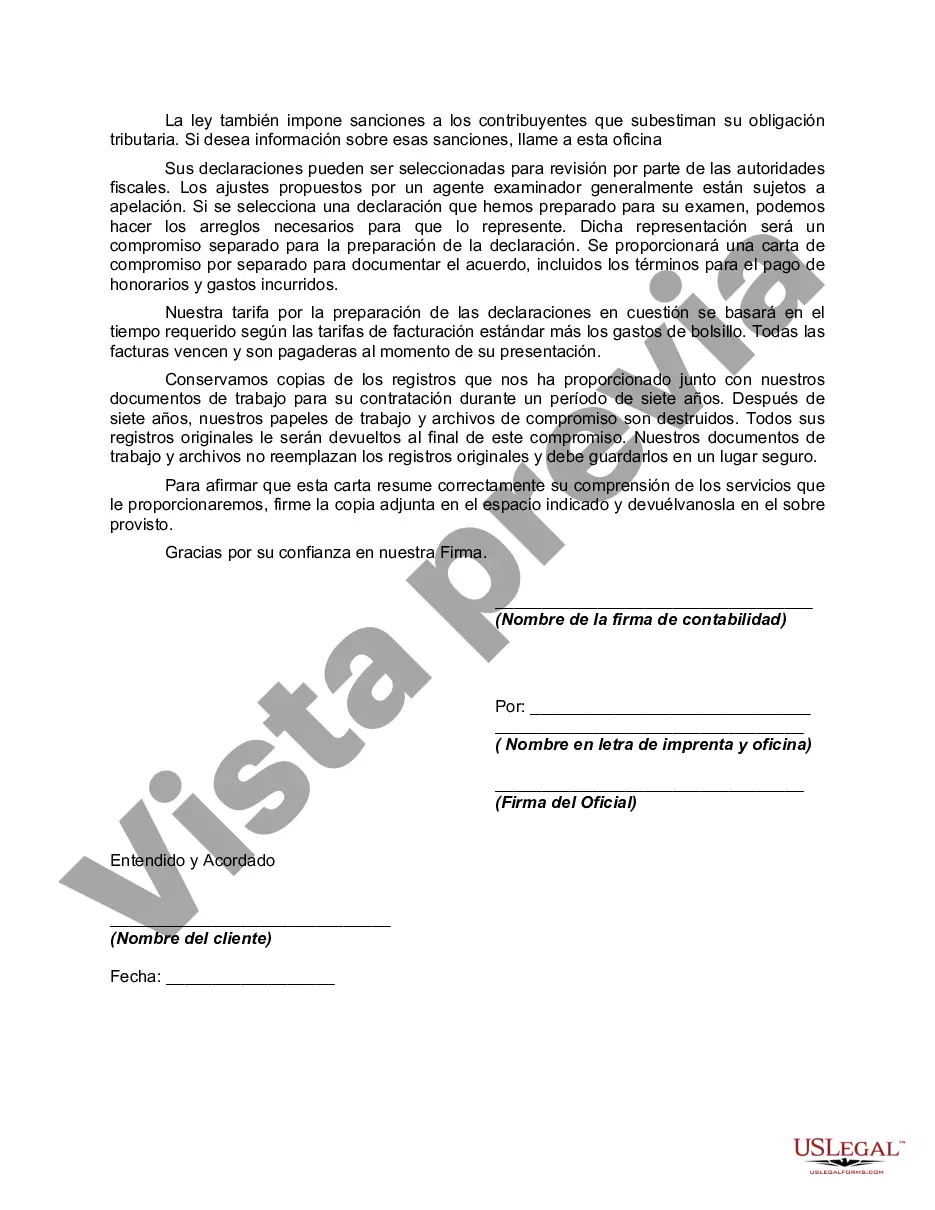

A Salt Lake Utah Fiduciary — Estatothersus— - Tax Return Engagement Letter is a comprehensive document that outlines the specifics of an agreement between a fiduciary practitioner and a client in relation to the preparation and filing of tax returns for estates or trusts located in Salt Lake, Utah. This engagement letter plays a crucial role in establishing a clear understanding between the parties involved, ensuring that both the fiduciary and the client are aware of their respective rights, responsibilities, and obligations. The Salt Lake Utah Fiduciary — Estatothersus— - Tax Return Engagement Letter typically includes the following key elements: 1. Identification: The engagement letter starts by clearly identifying the fiduciary practitioner and the client. Pertinent details such as names, contact information, and addresses are provided to ensure accurate communication throughout the engagement. 2. Objective and Scope: This section explains the purpose of the engagement, emphasizing the fiduciary's responsibility to prepare and file accurate tax returns for the specified estates or trusts located in Salt Lake, Utah. The scope outlines the specific services to be provided, including tax planning, record keeping, and compliance with relevant tax laws. 3. Term and Termination: The engagement letter defines the duration of the agreement, usually covering a specific tax year, and clarifies the conditions under which either party can terminate the engagement. This may include situations like non-payment, breach of contract, or mutual agreement. 4. Responsibilities and Obligations: Both the fiduciary practitioner and the client have certain responsibilities and obligations in ensuring the successful execution of the engagement. This section highlights the client's role in providing complete and accurate information, maintaining records, and promptly responding to requests from the fiduciary. Similarly, the fiduciary outlines their responsibility to utilize reasonable care, competence, and professional judgment in preparing and filing the tax returns. 5. Fees and Payment Terms: The engagement letter specifies the fees associated with the services provided. It outlines the billing method, payment terms, and any additional charges for extraordinary work or out-of-pocket expenses. This section may also mention the consequences of late or non-payment. 6. Confidentiality: Recognizing the sensitive nature of financial and tax-related information, the engagement letter includes a confidentiality clause, stressing the fiduciary's commitment to maintaining client confidentiality and compliance with applicable laws and regulations. 7. Limitation of Liability: This section clarifies the limitations of the fiduciary practitioner's liability in the event of errors, omissions, or other professional shortcomings. It defines the extent to which the fiduciary can be held legally responsible and highlights any applicable disclaimers or indemnification provisions. Types of Salt Lake Utah Fiduciary — Estatothersus— - Tax Return Engagement Letters may vary based on factors such as the complexity of the estate or trust, the nature of the engagement, or the specific requirements of the client. Some possible variations include: — Simple Estate or Trust Tax Return Engagement Letter: Suitable for uncomplicated estates or trusts that have straightforward tax reporting requirements. — Complex Estate or Trust Tax Return Engagement Letter: Geared towards more intricate estates or trusts involving multiple assets, investments, or beneficiaries, requiring a higher level of expertise and diligence. — Tax Planning Engagement Letter: Focusing primarily on strategic tax planning and mitigation strategies for estates or trusts, this type of engagement letter may cover a broader scope of services beyond the preparation and filing of tax returns. In conclusion, a Salt Lake Utah Fiduciary — Estatothersus— - Tax Return Engagement Letter is a vital document that outlines the agreement between a fiduciary practitioner and a client regarding tax return preparation and filing for estates or trusts located in Salt Lake, Utah. By clearly defining the rights, responsibilities, and expectations of both parties, this letter sets the foundation for a mutually beneficial professional relationship.A Salt Lake Utah Fiduciary — Estatothersus— - Tax Return Engagement Letter is a comprehensive document that outlines the specifics of an agreement between a fiduciary practitioner and a client in relation to the preparation and filing of tax returns for estates or trusts located in Salt Lake, Utah. This engagement letter plays a crucial role in establishing a clear understanding between the parties involved, ensuring that both the fiduciary and the client are aware of their respective rights, responsibilities, and obligations. The Salt Lake Utah Fiduciary — Estatothersus— - Tax Return Engagement Letter typically includes the following key elements: 1. Identification: The engagement letter starts by clearly identifying the fiduciary practitioner and the client. Pertinent details such as names, contact information, and addresses are provided to ensure accurate communication throughout the engagement. 2. Objective and Scope: This section explains the purpose of the engagement, emphasizing the fiduciary's responsibility to prepare and file accurate tax returns for the specified estates or trusts located in Salt Lake, Utah. The scope outlines the specific services to be provided, including tax planning, record keeping, and compliance with relevant tax laws. 3. Term and Termination: The engagement letter defines the duration of the agreement, usually covering a specific tax year, and clarifies the conditions under which either party can terminate the engagement. This may include situations like non-payment, breach of contract, or mutual agreement. 4. Responsibilities and Obligations: Both the fiduciary practitioner and the client have certain responsibilities and obligations in ensuring the successful execution of the engagement. This section highlights the client's role in providing complete and accurate information, maintaining records, and promptly responding to requests from the fiduciary. Similarly, the fiduciary outlines their responsibility to utilize reasonable care, competence, and professional judgment in preparing and filing the tax returns. 5. Fees and Payment Terms: The engagement letter specifies the fees associated with the services provided. It outlines the billing method, payment terms, and any additional charges for extraordinary work or out-of-pocket expenses. This section may also mention the consequences of late or non-payment. 6. Confidentiality: Recognizing the sensitive nature of financial and tax-related information, the engagement letter includes a confidentiality clause, stressing the fiduciary's commitment to maintaining client confidentiality and compliance with applicable laws and regulations. 7. Limitation of Liability: This section clarifies the limitations of the fiduciary practitioner's liability in the event of errors, omissions, or other professional shortcomings. It defines the extent to which the fiduciary can be held legally responsible and highlights any applicable disclaimers or indemnification provisions. Types of Salt Lake Utah Fiduciary — Estatothersus— - Tax Return Engagement Letters may vary based on factors such as the complexity of the estate or trust, the nature of the engagement, or the specific requirements of the client. Some possible variations include: — Simple Estate or Trust Tax Return Engagement Letter: Suitable for uncomplicated estates or trusts that have straightforward tax reporting requirements. — Complex Estate or Trust Tax Return Engagement Letter: Geared towards more intricate estates or trusts involving multiple assets, investments, or beneficiaries, requiring a higher level of expertise and diligence. — Tax Planning Engagement Letter: Focusing primarily on strategic tax planning and mitigation strategies for estates or trusts, this type of engagement letter may cover a broader scope of services beyond the preparation and filing of tax returns. In conclusion, a Salt Lake Utah Fiduciary — Estatothersus— - Tax Return Engagement Letter is a vital document that outlines the agreement between a fiduciary practitioner and a client regarding tax return preparation and filing for estates or trusts located in Salt Lake, Utah. By clearly defining the rights, responsibilities, and expectations of both parties, this letter sets the foundation for a mutually beneficial professional relationship.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.