A limited liability company (LLC) is a separate legal entity that can conduct business just like a corporation with many of the advantages of a partnership. It is taxed as a partnership. Its owners are called members and receive income from the LLC just as a partner would. There is no tax on the LLC entity itself. The members are not personally liable for the debts and obligations of the entity like partners would be. Basically, an LLC combines the tax advantages of a partnership with the limited liability feature of a corporation.

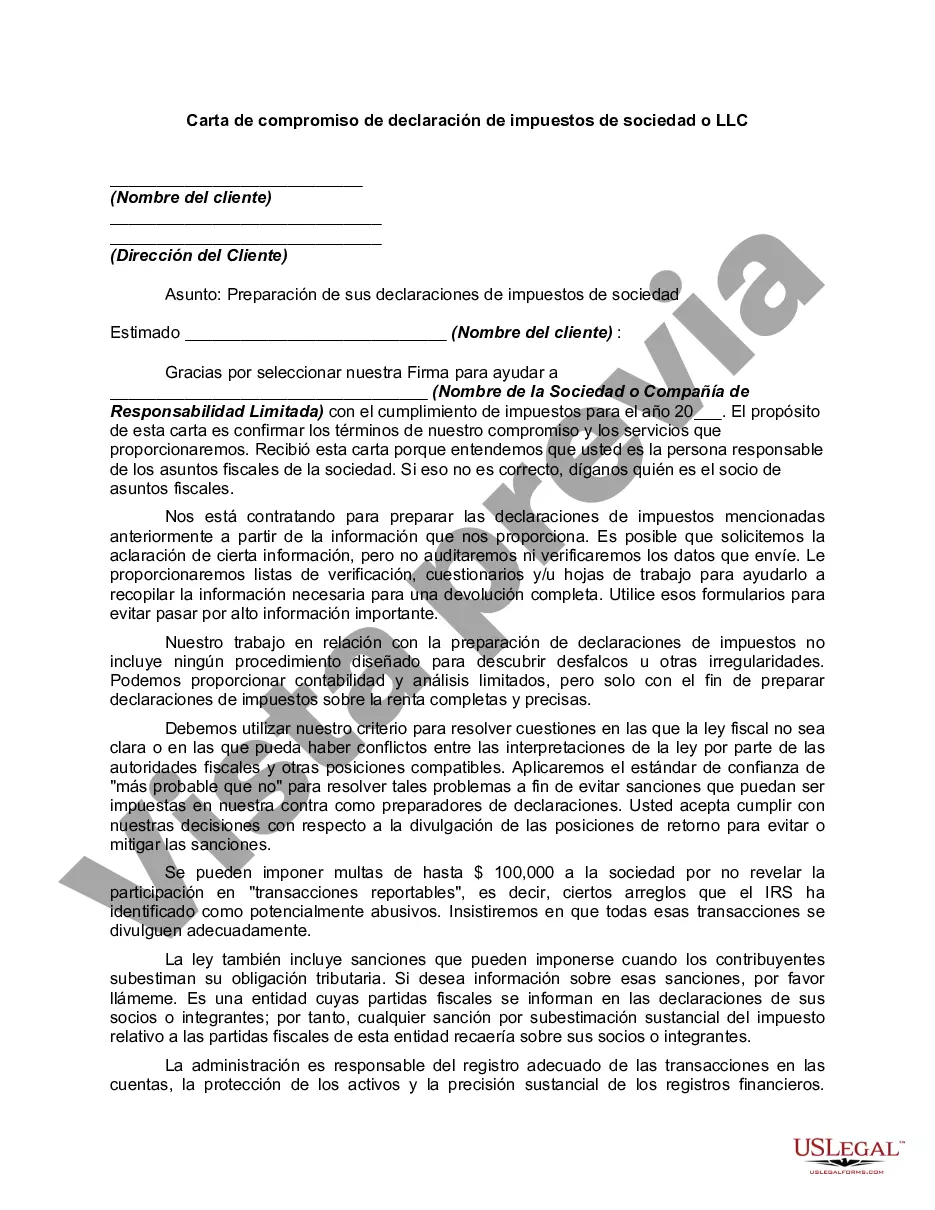

Fairfax Virginia Partnership or LLC Tax Return Engagement Letter is a detailed document that outlines the terms and conditions between a tax preparer or CPA firm and a partnership or LLC entity located in Fairfax, Virginia. It serves as a legal agreement and sets the scope of services, as well as the responsibilities and obligations of both parties during the tax return preparation process. This engagement letter is crucial as it helps establish clear communication, avoid misunderstandings, and ensure compliance with relevant tax laws and regulations. Keywords: Fairfax, Virginia, Partnership, LLC, Tax Return, Engagement Letter, tax preparer, CPA firm, legal agreement, services, responsibilities, obligations, tax return preparation, communication, compliance, tax laws, regulations. There are different types of Fairfax Virginia Partnership or LLC Tax Return Engagement Letters based on the specific needs and requirements of the partnership or LLC. Some types may include: 1. General Partnership or LLC Tax Return Engagement Letter: This type of engagement letter covers basic tax return preparation services for a general partnership or LLC in Fairfax, Virginia. It outlines the services provided, the terms of payment, the responsibilities of both the tax preparer and the partnership or LLC, as well as the limitations of the engagement. 2. Partnership or LLC Tax Return Engagement Letter with Bookkeeping Services: In cases where the partnership or LLC requires bookkeeping services alongside tax return preparation, this engagement letter would specify the additional scope of services, including record keeping, financial statement preparation, and ongoing bookkeeping support. 3. Partnership or LLC Tax Return Engagement Letter for Multi-State Entities: If the partnership or LLC operates in multiple states, such as having branches or business activities outside of Virginia, this type of engagement letter would address the complexities of multi-state tax reporting and compliance. It would outline the services related to state-specific tax returns and any additional research or analysis required. 4. Partnership or LLC Tax Return Engagement Letter with Audit Support: In situations where the partnership or LLC may expect an audit or review of their tax returns, this engagement letter would encompass the provision of support and assistance during the audit process. It would outline the responsibilities of the tax preparer in helping the partnership or LLC respond to inquiries, gather necessary documentation, and represent their interests before tax authorities. 5. Partnership or LLC Tax Return Engagement Letter for Tax Planning: For partnerships or LCS seeking proactive tax planning strategies, this type of engagement letter would extend the services beyond tax return preparation. It would cover consultation and advisory services related to minimizing tax liabilities, taking advantage of tax credits and deductions, and staying updated with changing tax laws. In summary, Fairfax Virginia Partnership or LLC Tax Return Engagement Letters are essential documents that establish the professional relationship between a tax preparer or CPA firm and a partnership or LLC entity located in Fairfax, Virginia. The type of engagement letter may vary depending on the specific needs and requirements of the partnership or LLC, such as bookkeeping services, multi-state operations, audit support, or tax planning.Fairfax Virginia Partnership or LLC Tax Return Engagement Letter is a detailed document that outlines the terms and conditions between a tax preparer or CPA firm and a partnership or LLC entity located in Fairfax, Virginia. It serves as a legal agreement and sets the scope of services, as well as the responsibilities and obligations of both parties during the tax return preparation process. This engagement letter is crucial as it helps establish clear communication, avoid misunderstandings, and ensure compliance with relevant tax laws and regulations. Keywords: Fairfax, Virginia, Partnership, LLC, Tax Return, Engagement Letter, tax preparer, CPA firm, legal agreement, services, responsibilities, obligations, tax return preparation, communication, compliance, tax laws, regulations. There are different types of Fairfax Virginia Partnership or LLC Tax Return Engagement Letters based on the specific needs and requirements of the partnership or LLC. Some types may include: 1. General Partnership or LLC Tax Return Engagement Letter: This type of engagement letter covers basic tax return preparation services for a general partnership or LLC in Fairfax, Virginia. It outlines the services provided, the terms of payment, the responsibilities of both the tax preparer and the partnership or LLC, as well as the limitations of the engagement. 2. Partnership or LLC Tax Return Engagement Letter with Bookkeeping Services: In cases where the partnership or LLC requires bookkeeping services alongside tax return preparation, this engagement letter would specify the additional scope of services, including record keeping, financial statement preparation, and ongoing bookkeeping support. 3. Partnership or LLC Tax Return Engagement Letter for Multi-State Entities: If the partnership or LLC operates in multiple states, such as having branches or business activities outside of Virginia, this type of engagement letter would address the complexities of multi-state tax reporting and compliance. It would outline the services related to state-specific tax returns and any additional research or analysis required. 4. Partnership or LLC Tax Return Engagement Letter with Audit Support: In situations where the partnership or LLC may expect an audit or review of their tax returns, this engagement letter would encompass the provision of support and assistance during the audit process. It would outline the responsibilities of the tax preparer in helping the partnership or LLC respond to inquiries, gather necessary documentation, and represent their interests before tax authorities. 5. Partnership or LLC Tax Return Engagement Letter for Tax Planning: For partnerships or LCS seeking proactive tax planning strategies, this type of engagement letter would extend the services beyond tax return preparation. It would cover consultation and advisory services related to minimizing tax liabilities, taking advantage of tax credits and deductions, and staying updated with changing tax laws. In summary, Fairfax Virginia Partnership or LLC Tax Return Engagement Letters are essential documents that establish the professional relationship between a tax preparer or CPA firm and a partnership or LLC entity located in Fairfax, Virginia. The type of engagement letter may vary depending on the specific needs and requirements of the partnership or LLC, such as bookkeeping services, multi-state operations, audit support, or tax planning.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.