A limited liability company (LLC) is a separate legal entity that can conduct business just like a corporation with many of the advantages of a partnership. It is taxed as a partnership. Its owners are called members and receive income from the LLC just as a partner would. There is no tax on the LLC entity itself. The members are not personally liable for the debts and obligations of the entity like partners would be. Basically, an LLC combines the tax advantages of a partnership with the limited liability feature of a corporation.

Kings New York Partnership or LLC Tax Return Engagement Letter is a document that outlines the terms and conditions between the accounting firm and the partnership or limited liability company (LLC) in relation to tax return preparation services. This engagement letter serves as a binding agreement that clarifies the responsibilities, fees, and expectations of both parties involved in the tax return process. The purpose of the Kings New York Partnership or LLC Tax Return Engagement Letter is to establish a clear understanding of the services to be provided by the accounting firm and to ensure compliance with all applicable laws and regulations. It also helps in managing expectations and mitigating potential misunderstandings between the accounting firm and the partnership or LLC. Keywords: 1. Kings New York Tax Return Engagement Letter 2. Partnership tax return engagement letter 3. LLC tax return engagement letter 4. Kings New York tax return services 5. Accounting firm engagement letter 6. Terms and conditions for tax return preparation 7. Responsibilities of both parties 8. Compliance with regulations 9. Fee structure for tax return services 10. Expectations in tax return process 11. Agreement between accounting firm and partnership or LLC 12. Clear understanding of tax return services Different types of Kings New York Partnership or LLC Tax Return Engagement Letters may vary based on the specific needs and requirements of the partnership or LLC. For instance, there may be engagement letters specifically designed for partnerships, sole proprietors, or single-member LCS. Each engagement letter will differ in terms of scope of services, fee structure, and details related to the respective entity type. It is essential for both the accounting firm and the partnership or LLC to carefully review and understand the terms stated in the engagement letter before proceeding with tax return preparation. This ensures transparency, a smoother tax return process, and a strong working relationship between the accounting firm and the partnership or LLC.Kings New York Partnership or LLC Tax Return Engagement Letter is a document that outlines the terms and conditions between the accounting firm and the partnership or limited liability company (LLC) in relation to tax return preparation services. This engagement letter serves as a binding agreement that clarifies the responsibilities, fees, and expectations of both parties involved in the tax return process. The purpose of the Kings New York Partnership or LLC Tax Return Engagement Letter is to establish a clear understanding of the services to be provided by the accounting firm and to ensure compliance with all applicable laws and regulations. It also helps in managing expectations and mitigating potential misunderstandings between the accounting firm and the partnership or LLC. Keywords: 1. Kings New York Tax Return Engagement Letter 2. Partnership tax return engagement letter 3. LLC tax return engagement letter 4. Kings New York tax return services 5. Accounting firm engagement letter 6. Terms and conditions for tax return preparation 7. Responsibilities of both parties 8. Compliance with regulations 9. Fee structure for tax return services 10. Expectations in tax return process 11. Agreement between accounting firm and partnership or LLC 12. Clear understanding of tax return services Different types of Kings New York Partnership or LLC Tax Return Engagement Letters may vary based on the specific needs and requirements of the partnership or LLC. For instance, there may be engagement letters specifically designed for partnerships, sole proprietors, or single-member LCS. Each engagement letter will differ in terms of scope of services, fee structure, and details related to the respective entity type. It is essential for both the accounting firm and the partnership or LLC to carefully review and understand the terms stated in the engagement letter before proceeding with tax return preparation. This ensures transparency, a smoother tax return process, and a strong working relationship between the accounting firm and the partnership or LLC.

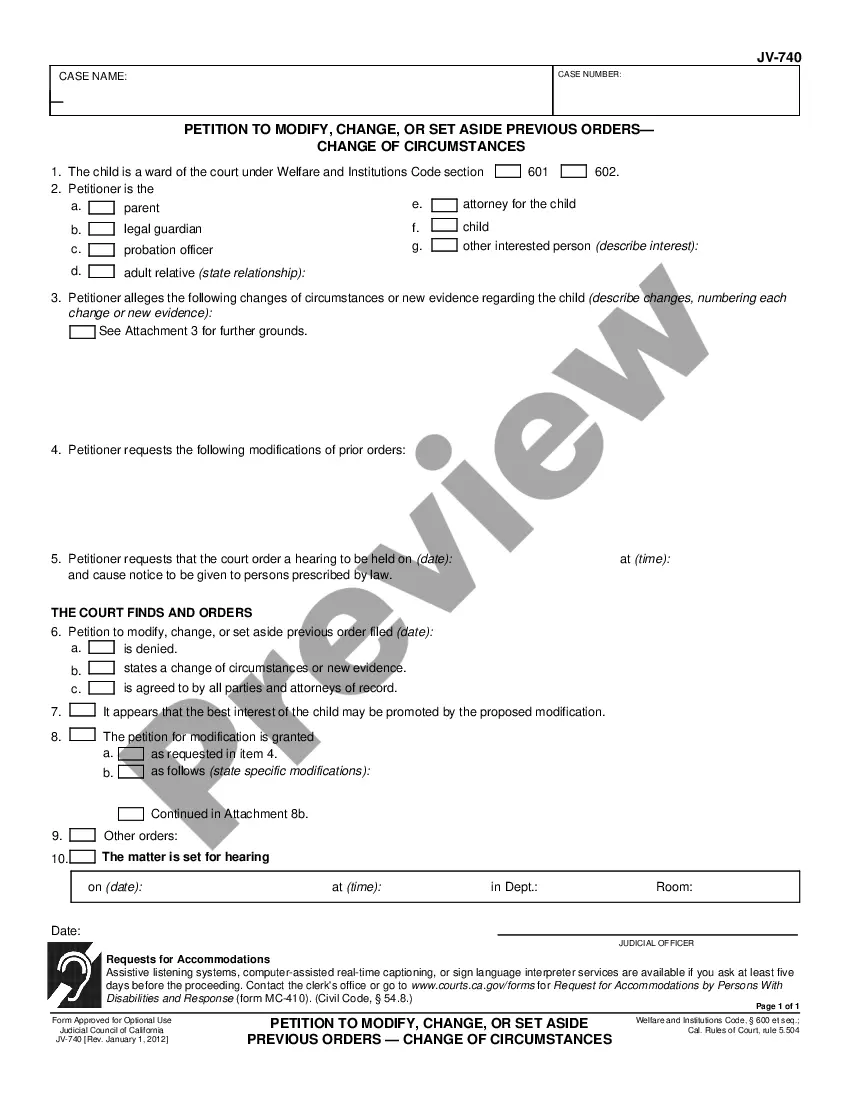

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.