Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

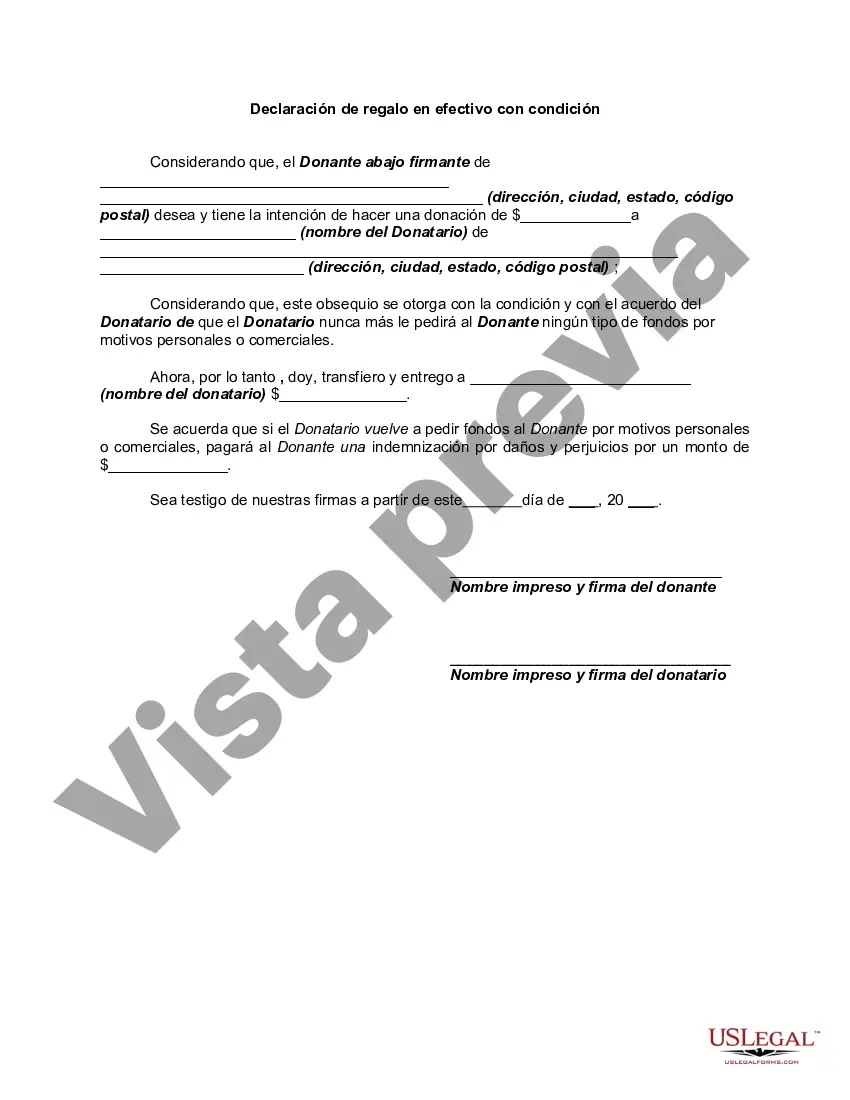

The Alameda California Declaration of Cash Gift with Condition is a legally binding document that outlines the terms and conditions associated with a monetary gift in the Alameda, California area. This declaration is used to ensure transparency and full comprehension of the rights and responsibilities between the donor and recipient of the cash gift. The declaration typically includes important information such as the names and contact details of both the donor and recipient, the amount of the cash gift, and the specific conditions attached to the gift. These conditions can vary depending on the purpose of the gift or the intentions of the donor and may include requirements related to the use of the funds, timeframes for its utilization, and any restrictions on how the gift is to be spent. It is essential to understand that the Alameda California Declaration of Cash Gift with Condition exists to protect the interests of both parties involved. By clearly stating the conditions, it reduces the likelihood of misunderstandings or conflicts arising in the future regarding the intended purpose of the cash gift. Types of Alameda California Declarations of Cash Gift with Condition may include: 1. Educational Gift with Condition: This type of declaration places conditions on the use of the cash gift for educational purposes. For instance, the gift could be designated for college tuition fees or specific education-related expenses. 2. Charitable Gift with Condition: This declaration specifies that the cash gift is to be used for specific charitable purposes or donated to a designated charitable organization. 3. Family Gifting Agreement with Condition: In this case, the declaration may outline conditions related to the utilization of the cash gift for the benefit of the entire family, such as covering medical expenses or purchasing a new family home. 4. Business or Entrepreneurial Gift with Condition: This type of declaration could involve a cash gift given to support the establishment of a new business venture or provide financial assistance for a specific business purpose. The document would outline the conditions and expectations associated with the gift. Ultimately, the Alameda California Declaration of Cash Gift with Condition serves as a reliable legal document that safeguards the interests of both the donor and recipient. It ensures that both parties are fully aware of their rights, obligations, and expectations regarding the cash gift.The Alameda California Declaration of Cash Gift with Condition is a legally binding document that outlines the terms and conditions associated with a monetary gift in the Alameda, California area. This declaration is used to ensure transparency and full comprehension of the rights and responsibilities between the donor and recipient of the cash gift. The declaration typically includes important information such as the names and contact details of both the donor and recipient, the amount of the cash gift, and the specific conditions attached to the gift. These conditions can vary depending on the purpose of the gift or the intentions of the donor and may include requirements related to the use of the funds, timeframes for its utilization, and any restrictions on how the gift is to be spent. It is essential to understand that the Alameda California Declaration of Cash Gift with Condition exists to protect the interests of both parties involved. By clearly stating the conditions, it reduces the likelihood of misunderstandings or conflicts arising in the future regarding the intended purpose of the cash gift. Types of Alameda California Declarations of Cash Gift with Condition may include: 1. Educational Gift with Condition: This type of declaration places conditions on the use of the cash gift for educational purposes. For instance, the gift could be designated for college tuition fees or specific education-related expenses. 2. Charitable Gift with Condition: This declaration specifies that the cash gift is to be used for specific charitable purposes or donated to a designated charitable organization. 3. Family Gifting Agreement with Condition: In this case, the declaration may outline conditions related to the utilization of the cash gift for the benefit of the entire family, such as covering medical expenses or purchasing a new family home. 4. Business or Entrepreneurial Gift with Condition: This type of declaration could involve a cash gift given to support the establishment of a new business venture or provide financial assistance for a specific business purpose. The document would outline the conditions and expectations associated with the gift. Ultimately, the Alameda California Declaration of Cash Gift with Condition serves as a reliable legal document that safeguards the interests of both the donor and recipient. It ensures that both parties are fully aware of their rights, obligations, and expectations regarding the cash gift.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.