Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

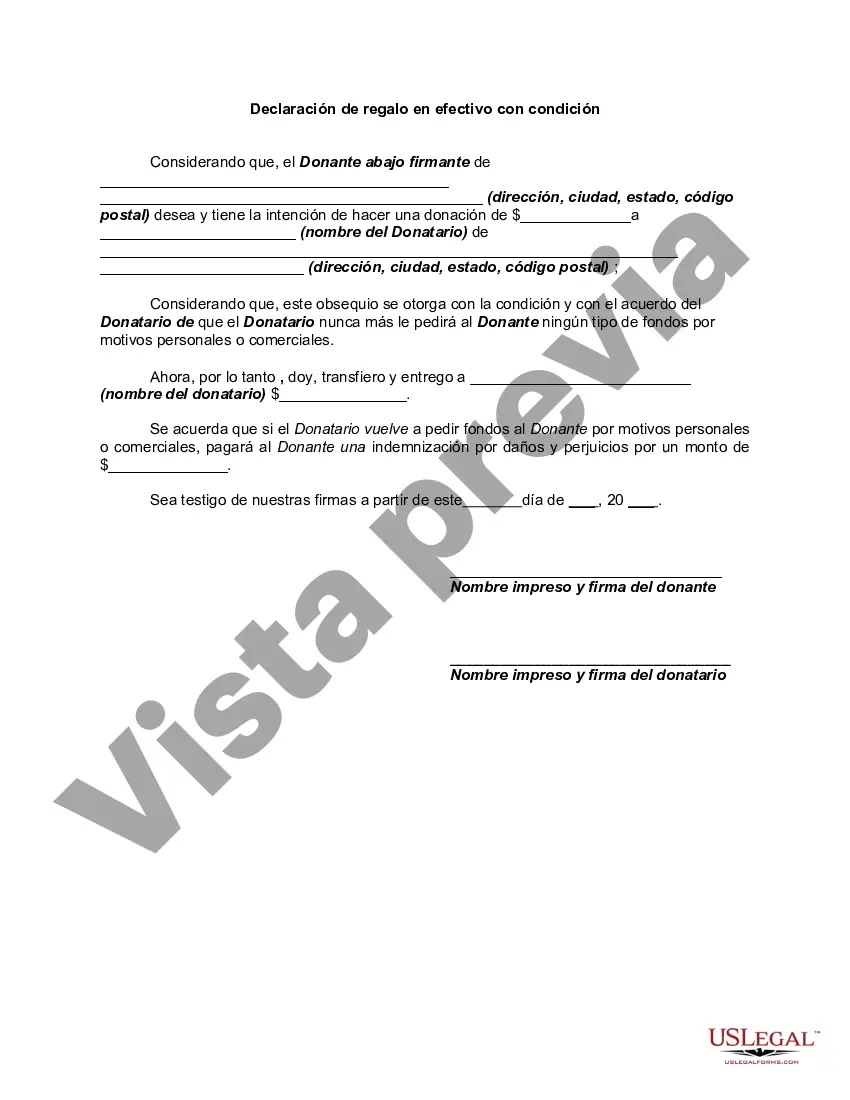

The Clark Nevada Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions of gifting a sum of money with certain restrictions or conditions imposed on the recipient. This declaration is commonly used in the state of Nevada to ensure that the gift is used for specific purposes or to protect the interests of the giver. One type of Clark Nevada Declaration of Cash Gift with Condition is the Education Gift Declaration. In this scenario, the giver provides a cash gift to the recipient with the condition that it is only to be used for educational purposes. This could include funding tuition fees, purchasing textbooks, or covering any other educational expenses. Another type of this declaration is the Medical Expense Gift Declaration. Here, the giver provides a cash gift to assist the recipient with medical expenses, such as healthcare bills, prescription medications, or treatments but with a specific condition that it should be used solely for those purposes. Additionally, there is the Housing Assistance Gift Declaration, whereby the giver offers a cash gift to aid the recipient in meeting housing-related expenses, such as rent or mortgage payments, utilities, or home repairs, under the condition that the funds are solely used for such purposes. Furthermore, the Elderly Care Gift Declaration is a type that can be used to provide financial support to an elderly individual for their care needs, such as nursing home fees, medical supplies, or in-home care services. It is important to note that each Clark Nevada Declaration of Cash Gift with Condition may vary in its specific terms, restrictions, and conditions. These declarations serve as legal protection to ensure that the cash gift is used for the intended purpose and prevents any misuse or misunderstanding. Overall, the Clark Nevada Declaration of Cash Gift with Condition is a customizable document that allows the giver to establish specific guidelines for the use of the gifted funds, ensuring the recipient utilizes them according to the agreed-upon conditions.The Clark Nevada Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions of gifting a sum of money with certain restrictions or conditions imposed on the recipient. This declaration is commonly used in the state of Nevada to ensure that the gift is used for specific purposes or to protect the interests of the giver. One type of Clark Nevada Declaration of Cash Gift with Condition is the Education Gift Declaration. In this scenario, the giver provides a cash gift to the recipient with the condition that it is only to be used for educational purposes. This could include funding tuition fees, purchasing textbooks, or covering any other educational expenses. Another type of this declaration is the Medical Expense Gift Declaration. Here, the giver provides a cash gift to assist the recipient with medical expenses, such as healthcare bills, prescription medications, or treatments but with a specific condition that it should be used solely for those purposes. Additionally, there is the Housing Assistance Gift Declaration, whereby the giver offers a cash gift to aid the recipient in meeting housing-related expenses, such as rent or mortgage payments, utilities, or home repairs, under the condition that the funds are solely used for such purposes. Furthermore, the Elderly Care Gift Declaration is a type that can be used to provide financial support to an elderly individual for their care needs, such as nursing home fees, medical supplies, or in-home care services. It is important to note that each Clark Nevada Declaration of Cash Gift with Condition may vary in its specific terms, restrictions, and conditions. These declarations serve as legal protection to ensure that the cash gift is used for the intended purpose and prevents any misuse or misunderstanding. Overall, the Clark Nevada Declaration of Cash Gift with Condition is a customizable document that allows the giver to establish specific guidelines for the use of the gifted funds, ensuring the recipient utilizes them according to the agreed-upon conditions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.