Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

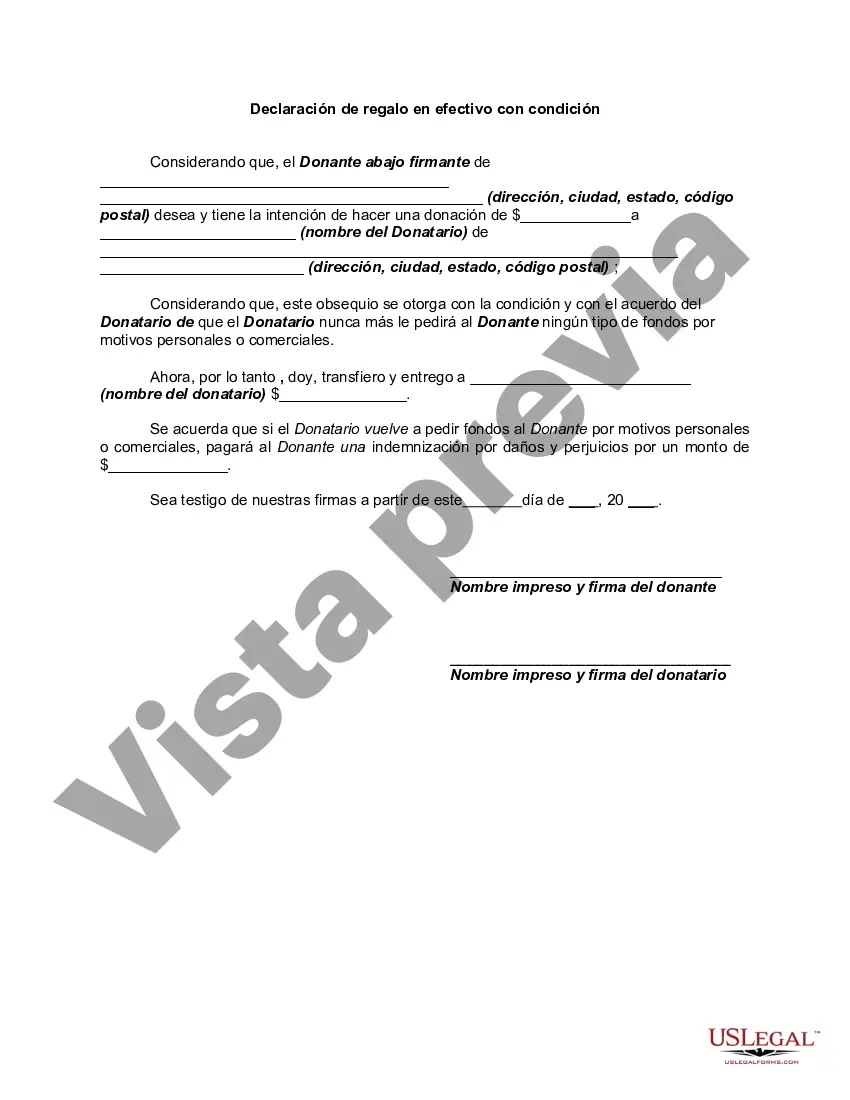

The Contra Costa California Declaration of Cash Gift with Condition is a legal document used to outline the terms and conditions of a cash gift received by an individual or organization in Contra Costa County, California. This declaration ensures that both parties are aware of the conditions attached to the gift and helps prevent any misunderstandings or disputes in the future. Keywords: Contra Costa California, declaration of cash gift, condition, legal document, terms and conditions, cash gift, individual, organization, Contra Costa County. There are different types of Contra Costa California Declarations of Cash Gift with Condition that can be named depending on the specific conditions attached to the gift: 1. Educational Scholarship Cash Gift: This type of declaration is used to outline the conditions attached to a cash gift provided for educational purposes. It may specify that the funds should only be used for tuition fees, textbooks, or other educational expenses, and may require the recipient to provide proof of enrollment or academic progress. 2. Charitable Donation Cash Gift: This declaration is used when a cash gift is given to a charitable organization or non-profit entity in Contra Costa County. It details the conditions under which the funds can be used, such as supporting a specific program or project, and may require periodic reporting from the organization to ensure compliance. 3. Conditional Loan Repayment Cash Gift: In some cases, a cash gift may be given with the expectation that it will be repaid under certain conditions. This type of declaration outlines the terms of repayment, such as a specific timeframe or interest rate, ensuring clarity and agreement between the parties involved. 4. Medical Expense Cash Gift: This declaration is used when a cash gift is provided to help cover medical expenses. It may include conditions such as requiring the recipient to provide proof of medical bills or receipts, and may specify that the funds should only be used for specific medical treatments or procedures. 5. Business Start-up Cash Gift: When a cash gift is given to support the establishment or growth of a business, a declaration is used to outline the conditions attached to the gift. It may include requirements such as submitting a business plan or progress reports, and may state that the funds should be used solely for business-related expenses. In summary, the Contra Costa California Declaration of Cash Gift with Condition is a crucial legal document used in various scenarios to specify the terms and conditions associated with a monetary gift. By clearly communicating expectations and responsibilities, this declaration ensures transparency and helps maintain a harmonious relationship between the giver and recipient.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.