Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

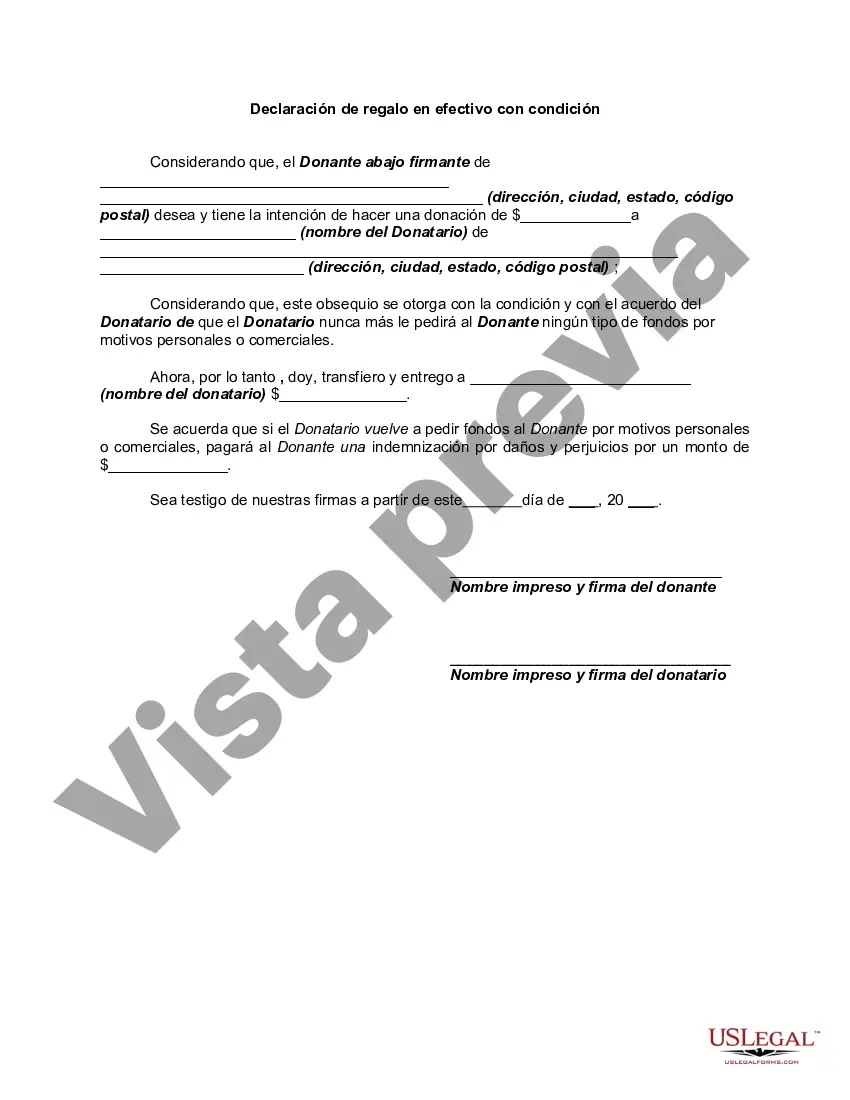

The Franklin Ohio Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions regarding the transfer of a cash gift in Franklin, Ohio. This document ensures that both the donor and recipient understand and agree to the conditions attached to the gift. The keywords related to this topic are "Franklin Ohio Declaration of Cash Gift with Condition," "cash gift," "legal document," and "Franklin, Ohio." There are different types of Franklin Ohio Declaration of Cash Gift with Condition that can be categorized based on the specific conditions attached. Some common types include: 1. Educational Purposes: This type of cash gift is given with the condition that it can only be used for educational purposes, such as funding college tuition fees, purchasing books, or covering educational expenses. 2. Charitable Donations: In this case, the cash gift is intended for charitable purposes, and the recipient must ensure that the funds are utilized for the specified charitable cause or organization. 3. Small Business Start-up: A cash gift with the condition of helping someone start a small business. The recipient must put the funds towards establishing and running a viable business, fulfilling any guidelines set by the donor. 4. Family Financial Assistance: This type of declaration is used for cash gifts given within a family, with the condition that the funds assist in meeting specific financial needs, such as paying off debts, medical bills, or supporting dependent family members. 5. Mortgage Down Payment: This type of cash gift is typically given with the condition of being used exclusively for a down payment on a house or mortgage. The recipient must adhere to the provided guidelines regarding the purpose and timing of the cash gift. 6. Estate Planning: These declarations are related to cash gifts given upon the death of an individual. The donor may conditionally gift a certain amount of cash to heirs or beneficiaries based on predetermined criteria mentioned in the document. It is important to consult legal professionals and adhere to local laws while drafting and executing the Franklin Ohio Declaration of Cash Gift with Condition.The Franklin Ohio Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions regarding the transfer of a cash gift in Franklin, Ohio. This document ensures that both the donor and recipient understand and agree to the conditions attached to the gift. The keywords related to this topic are "Franklin Ohio Declaration of Cash Gift with Condition," "cash gift," "legal document," and "Franklin, Ohio." There are different types of Franklin Ohio Declaration of Cash Gift with Condition that can be categorized based on the specific conditions attached. Some common types include: 1. Educational Purposes: This type of cash gift is given with the condition that it can only be used for educational purposes, such as funding college tuition fees, purchasing books, or covering educational expenses. 2. Charitable Donations: In this case, the cash gift is intended for charitable purposes, and the recipient must ensure that the funds are utilized for the specified charitable cause or organization. 3. Small Business Start-up: A cash gift with the condition of helping someone start a small business. The recipient must put the funds towards establishing and running a viable business, fulfilling any guidelines set by the donor. 4. Family Financial Assistance: This type of declaration is used for cash gifts given within a family, with the condition that the funds assist in meeting specific financial needs, such as paying off debts, medical bills, or supporting dependent family members. 5. Mortgage Down Payment: This type of cash gift is typically given with the condition of being used exclusively for a down payment on a house or mortgage. The recipient must adhere to the provided guidelines regarding the purpose and timing of the cash gift. 6. Estate Planning: These declarations are related to cash gifts given upon the death of an individual. The donor may conditionally gift a certain amount of cash to heirs or beneficiaries based on predetermined criteria mentioned in the document. It is important to consult legal professionals and adhere to local laws while drafting and executing the Franklin Ohio Declaration of Cash Gift with Condition.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.