Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

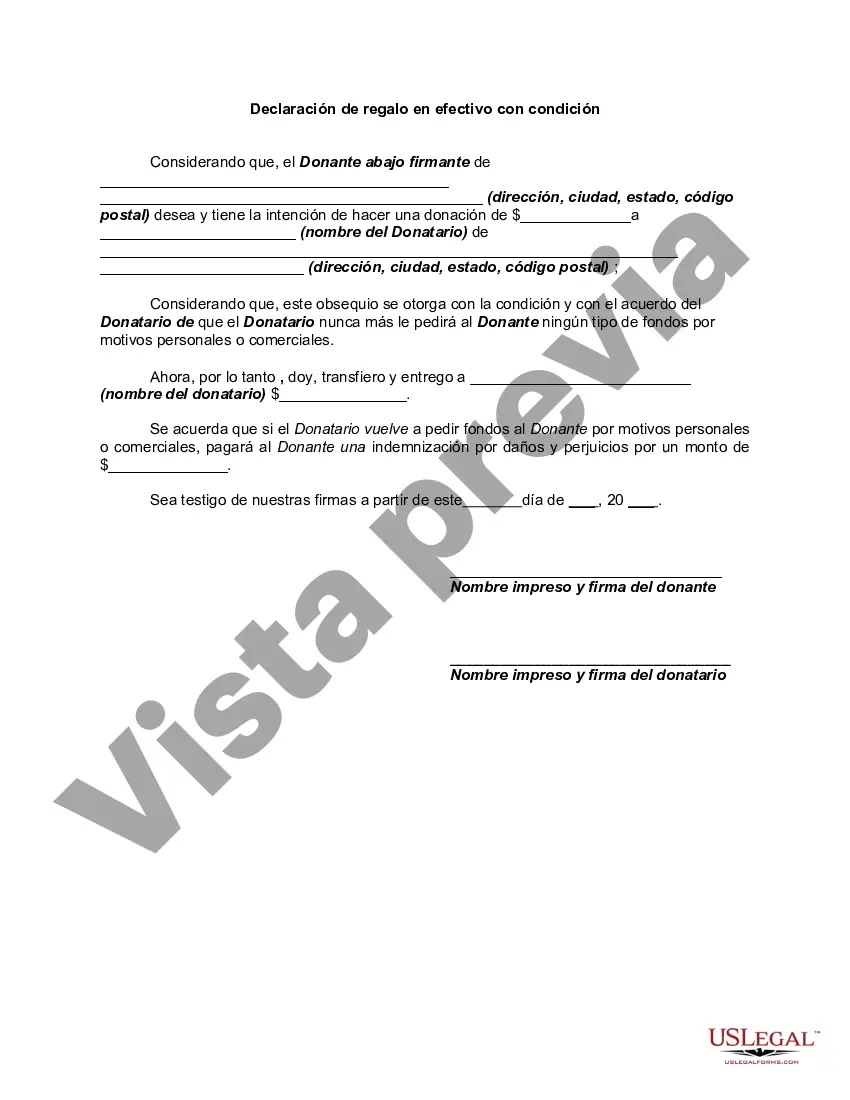

The Miami-Dade Florida Declaration of Cash Gift with Condition is a legal document used in Miami-Dade County, Florida, to outline the terms and conditions of a cash gift that is being given and received. This declaration serves as a written agreement between the donor (the individual giving the cash gift) and the recipient (the individual receiving the cash gift), ensuring both parties are fully aware of their rights and responsibilities. The Miami-Dade Florida Declaration of Cash Gift with Condition includes various provisions that define the purpose and conditions of the cash gift. It typically covers important details such as the amount of the gift, the purpose for which the money is being given, and any specific conditions or restrictions placed upon its use. By signing this declaration, the donor asserts their intention to provide a cash gift to the recipient. In return, the recipient agrees to comply with the stated conditions and use the cash gift as specified within the document. This legal agreement helps protect both parties involved and ensures transparency and clarity throughout the gift-giving process. It is important to note that there may be different types or variations of the Miami-Dade Florida Declaration of Cash Gift with Condition. These can include, but are not limited to: 1. Conditional Cash Gift Declaration: This type of declaration outlines specific conditions or requirements that must be met by the recipient for them to receive the cash gift. These conditions may include achieving a certain academic or professional milestone, completing a project or task, or fulfilling any other specific requirement agreed upon by both parties. 2. Inheritance Cash Gift Declaration: This declaration is used when a cash gift is given as part of an inheritance. It specifies the conditions under which the recipient can access and use the gifted funds, ensuring compliance with any specific requirements set forth by the donor's estate plan. 3. Charitable Cash Gift Declaration: In certain cases, individuals may choose to donate a cash gift to a charitable organization located in Miami-Dade County. This type of declaration establishes the conditions under which the cash gift will be used by the charitable organization, ensuring the funds are used for the intended charitable purposes. It is important to consult with a legal professional or attorney experienced in Miami-Dade County's specific regulations and laws to ensure that the Miami-Dade Florida Declaration of Cash Gift with Condition accurately reflects the intentions and circumstances of the parties involved while complying with all applicable legal requirements.The Miami-Dade Florida Declaration of Cash Gift with Condition is a legal document used in Miami-Dade County, Florida, to outline the terms and conditions of a cash gift that is being given and received. This declaration serves as a written agreement between the donor (the individual giving the cash gift) and the recipient (the individual receiving the cash gift), ensuring both parties are fully aware of their rights and responsibilities. The Miami-Dade Florida Declaration of Cash Gift with Condition includes various provisions that define the purpose and conditions of the cash gift. It typically covers important details such as the amount of the gift, the purpose for which the money is being given, and any specific conditions or restrictions placed upon its use. By signing this declaration, the donor asserts their intention to provide a cash gift to the recipient. In return, the recipient agrees to comply with the stated conditions and use the cash gift as specified within the document. This legal agreement helps protect both parties involved and ensures transparency and clarity throughout the gift-giving process. It is important to note that there may be different types or variations of the Miami-Dade Florida Declaration of Cash Gift with Condition. These can include, but are not limited to: 1. Conditional Cash Gift Declaration: This type of declaration outlines specific conditions or requirements that must be met by the recipient for them to receive the cash gift. These conditions may include achieving a certain academic or professional milestone, completing a project or task, or fulfilling any other specific requirement agreed upon by both parties. 2. Inheritance Cash Gift Declaration: This declaration is used when a cash gift is given as part of an inheritance. It specifies the conditions under which the recipient can access and use the gifted funds, ensuring compliance with any specific requirements set forth by the donor's estate plan. 3. Charitable Cash Gift Declaration: In certain cases, individuals may choose to donate a cash gift to a charitable organization located in Miami-Dade County. This type of declaration establishes the conditions under which the cash gift will be used by the charitable organization, ensuring the funds are used for the intended charitable purposes. It is important to consult with a legal professional or attorney experienced in Miami-Dade County's specific regulations and laws to ensure that the Miami-Dade Florida Declaration of Cash Gift with Condition accurately reflects the intentions and circumstances of the parties involved while complying with all applicable legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.