Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

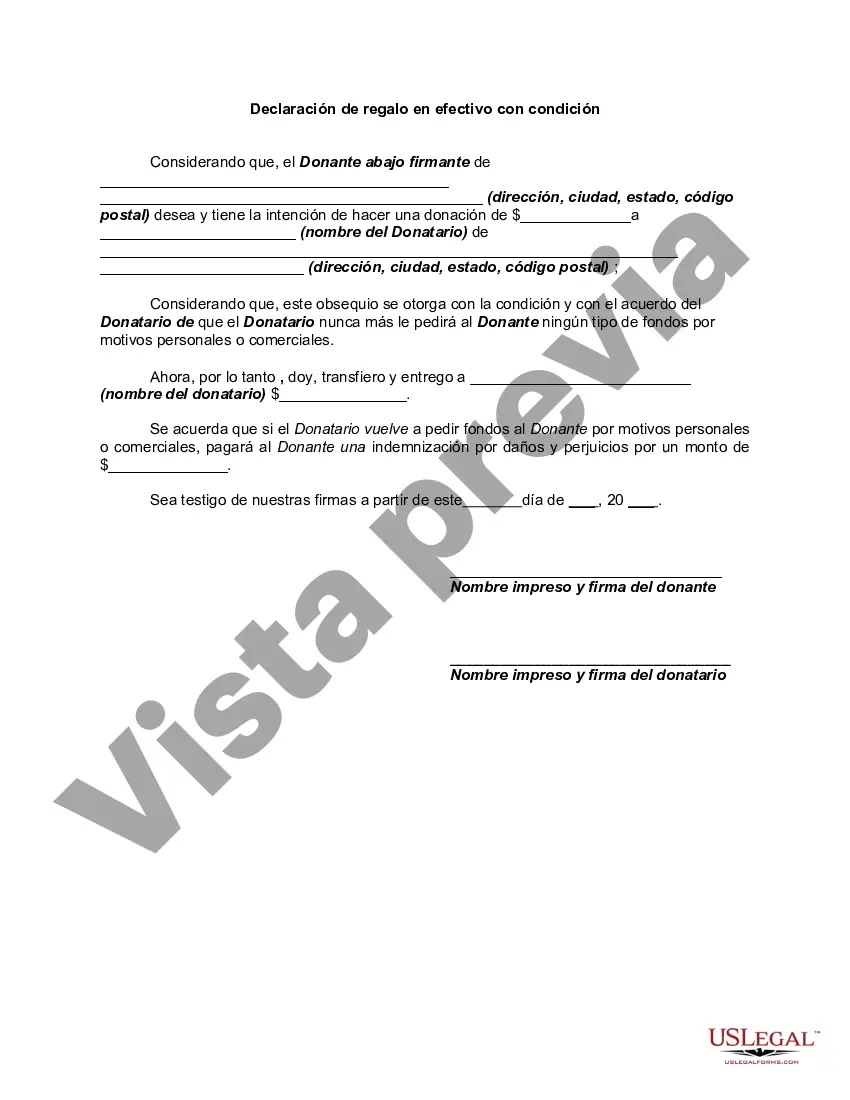

The Montgomery Maryland Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions of a financial gift given by an individual or entity to another party in Montgomery County, Maryland. This declaration ensures transparency and clarity regarding the cash gift, as well as the obligations and restrictions associated with it. Keywords: Montgomery Maryland, Declaration of Cash Gift with Condition, legal document, financial gift, individual, entity, Montgomery County, Maryland, transparency, clarity, obligations, restrictions. Types of Montgomery Maryland Declaration of Cash Gift with Condition: 1. Personal Cash Gift: This type of declaration typically involves an individual providing a cash gift to another individual under specific conditions. For instance, it may be stipulated that the gift is to be used towards education expenses or the purchase of a home. 2. Corporate Cash Gift: In this case, a corporation or business entity offers a cash gift to another party, such as a non-profit organization or a charitable cause. The declaration will outline the purpose of the gift and any conditions that must be met for its use. 3. Estate Planning Cash Gift: This type of declaration pertains to cash gifts included in an individual's estate plan. It may detail how the gift is to be distributed or utilized by the beneficiary, and may contain specific conditions or restrictions. 4. Educational Cash Gift: Educational institutions, such as schools or universities, may receive cash gifts from individuals or organizations. The declaration will specify the purpose of the gift, ensuring it is used to benefit the educational institution or students in a specific manner. 5. Charitable Cash Gift: Charitable organizations often receive cash gifts from philanthropic individuals or foundations. The declaration will outline the conditions and restrictions associated with the gift, ensuring it aligns with the organization's mission and goals. In conclusion, the Montgomery Maryland Declaration of Cash Gift with Condition is a crucial legal document that facilitates the proper transfer of cash gifts while maintaining transparency and ensuring that the gift is used in accordance with agreed-upon conditions. With various types available based on the nature and purpose of the cash gift, this declaration provides a comprehensive framework for both the giver and receiver, enabling them to achieve their desired outcomes.The Montgomery Maryland Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions of a financial gift given by an individual or entity to another party in Montgomery County, Maryland. This declaration ensures transparency and clarity regarding the cash gift, as well as the obligations and restrictions associated with it. Keywords: Montgomery Maryland, Declaration of Cash Gift with Condition, legal document, financial gift, individual, entity, Montgomery County, Maryland, transparency, clarity, obligations, restrictions. Types of Montgomery Maryland Declaration of Cash Gift with Condition: 1. Personal Cash Gift: This type of declaration typically involves an individual providing a cash gift to another individual under specific conditions. For instance, it may be stipulated that the gift is to be used towards education expenses or the purchase of a home. 2. Corporate Cash Gift: In this case, a corporation or business entity offers a cash gift to another party, such as a non-profit organization or a charitable cause. The declaration will outline the purpose of the gift and any conditions that must be met for its use. 3. Estate Planning Cash Gift: This type of declaration pertains to cash gifts included in an individual's estate plan. It may detail how the gift is to be distributed or utilized by the beneficiary, and may contain specific conditions or restrictions. 4. Educational Cash Gift: Educational institutions, such as schools or universities, may receive cash gifts from individuals or organizations. The declaration will specify the purpose of the gift, ensuring it is used to benefit the educational institution or students in a specific manner. 5. Charitable Cash Gift: Charitable organizations often receive cash gifts from philanthropic individuals or foundations. The declaration will outline the conditions and restrictions associated with the gift, ensuring it aligns with the organization's mission and goals. In conclusion, the Montgomery Maryland Declaration of Cash Gift with Condition is a crucial legal document that facilitates the proper transfer of cash gifts while maintaining transparency and ensuring that the gift is used in accordance with agreed-upon conditions. With various types available based on the nature and purpose of the cash gift, this declaration provides a comprehensive framework for both the giver and receiver, enabling them to achieve their desired outcomes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.