Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

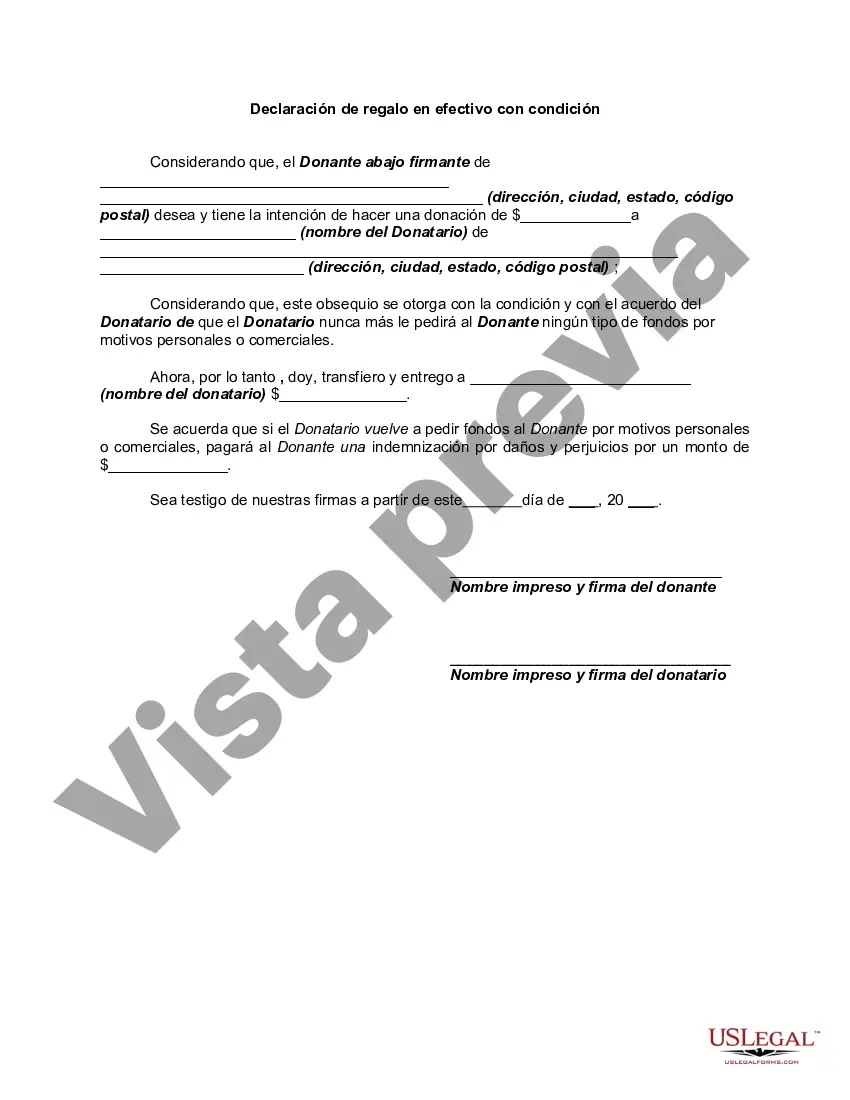

The Lima Arizona Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions under which a cash gift is being given to an individual or organization in Lima, Arizona. This declaration serves as a written agreement between the donor and the recipient, ensuring both parties are aware of and abide by the specified conditions. Keywords: Lima Arizona, Declaration of Cash Gift, Condition, Legal document, Terms and Conditions, Cash gift, Donor, Recipient, Agreement. In Lima, Arizona, there are two main types of Declarations of Cash Gift with Condition that are commonly used: 1. Individual-Recipient Declaration of Cash Gift with Condition: This type of declaration is used when an individual is receiving a cash gift with specific conditions attached to it. The document identifies the donor, recipient, and the amount of the cash gift. It then outlines the conditions the recipient must meet in order to receive the gift, such as achieving certain milestones, completing specific tasks, or adhering to certain guidelines. 2. Organization-Recipient Declaration of Cash Gift with Condition: This type of declaration is used when an organization or non-profit entity based in Lima, Arizona, is the recipient of a cash gift with conditions. Similar to the individual-recipient declaration, this document specifies the donor, recipient organization, and the amount of the cash gift. It then details the conditions the organization must fulfill in order to receive the funds, which may include executing specific projects, providing regular progress reports, or utilizing the gift for a designated purpose. Both types of declarations aim to establish a clear understanding between the donor and the recipient regarding the expectations and obligations associated with the cash gift. By outlining the conditions, the declaration ensures transparency and accountability, protecting both parties' interests and ensuring the gift's purpose is fulfilled according to the donor's intentions. It is important for all parties involved to carefully review and understand the terms and conditions within the Lima Arizona Declaration of Cash Gift with Condition before signing. This document serves as a legally binding agreement and can be used as evidence in the event of any dispute or disagreement. Consulting with legal professionals is advised to ensure that the declaration conforms to state laws and protects the rights and interests of both the donor and recipient.The Lima Arizona Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions under which a cash gift is being given to an individual or organization in Lima, Arizona. This declaration serves as a written agreement between the donor and the recipient, ensuring both parties are aware of and abide by the specified conditions. Keywords: Lima Arizona, Declaration of Cash Gift, Condition, Legal document, Terms and Conditions, Cash gift, Donor, Recipient, Agreement. In Lima, Arizona, there are two main types of Declarations of Cash Gift with Condition that are commonly used: 1. Individual-Recipient Declaration of Cash Gift with Condition: This type of declaration is used when an individual is receiving a cash gift with specific conditions attached to it. The document identifies the donor, recipient, and the amount of the cash gift. It then outlines the conditions the recipient must meet in order to receive the gift, such as achieving certain milestones, completing specific tasks, or adhering to certain guidelines. 2. Organization-Recipient Declaration of Cash Gift with Condition: This type of declaration is used when an organization or non-profit entity based in Lima, Arizona, is the recipient of a cash gift with conditions. Similar to the individual-recipient declaration, this document specifies the donor, recipient organization, and the amount of the cash gift. It then details the conditions the organization must fulfill in order to receive the funds, which may include executing specific projects, providing regular progress reports, or utilizing the gift for a designated purpose. Both types of declarations aim to establish a clear understanding between the donor and the recipient regarding the expectations and obligations associated with the cash gift. By outlining the conditions, the declaration ensures transparency and accountability, protecting both parties' interests and ensuring the gift's purpose is fulfilled according to the donor's intentions. It is important for all parties involved to carefully review and understand the terms and conditions within the Lima Arizona Declaration of Cash Gift with Condition before signing. This document serves as a legally binding agreement and can be used as evidence in the event of any dispute or disagreement. Consulting with legal professionals is advised to ensure that the declaration conforms to state laws and protects the rights and interests of both the donor and recipient.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.