Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

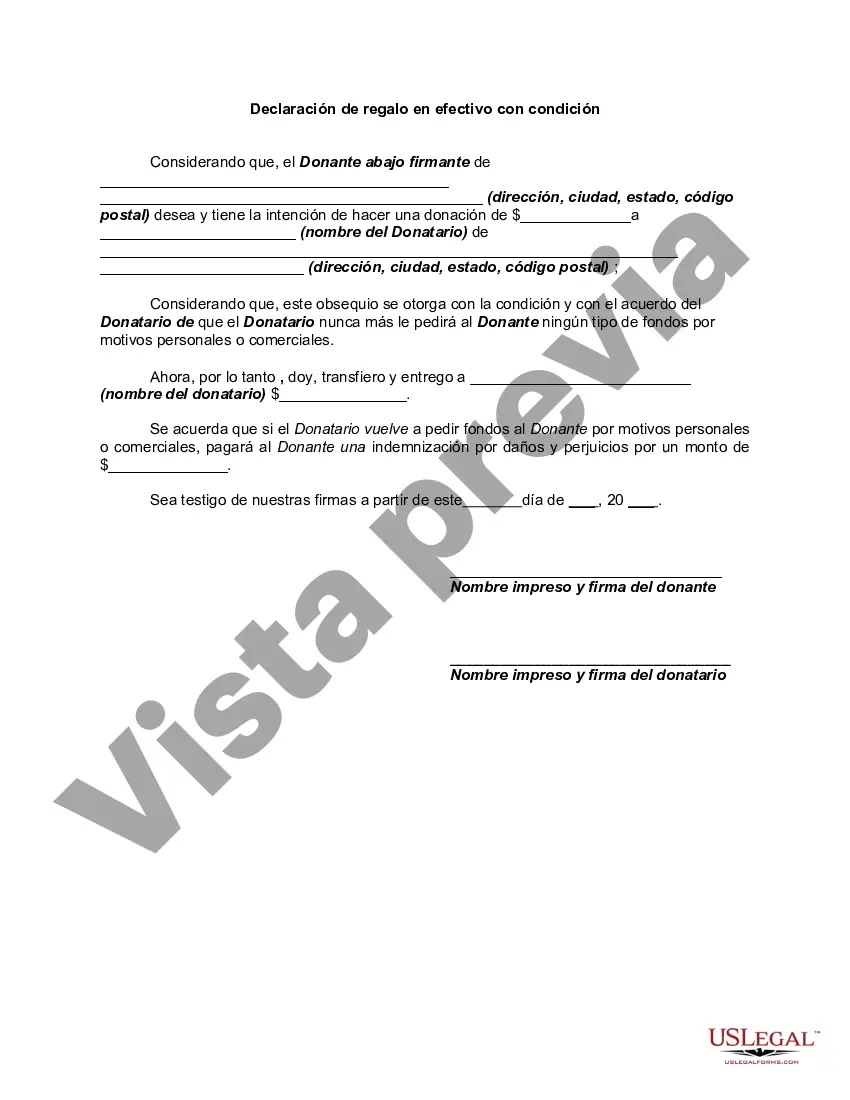

The Riverside California Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions associated with the gifting of a cash amount in the Riverside County area. This declaration is crucial in ensuring that both the giver and recipient understand their responsibilities and obligations related to the gift. Keywords: Riverside California, Declaration of Cash Gift, Condition, legal document, terms and conditions, gifting, cash amount, Riverside County, responsibilities, obligations. There are various types of Riverside California Declaration of Cash Gift with Condition, which may vary depending on the specific conditions attached to the gift. Some common types include: 1. Conditional Terms: This type of declaration is used when the cash gift is given with certain conditions that must be met by the recipient. These conditions could range from specific usage requirements to achieving certain goals or milestones. 2. Tax Implication Conditions: This type of declaration is important when the cash gift exceeds the annual gift tax exclusion amount set by the Internal Revenue Service (IRS). The document may state that the recipient is responsible for any tax liability arising from the cash gift. 3. Reporting and Accountability: In cases where the gift is being given for a specific purpose, such as educational expenses or charitable contributions, the declaration may include provisions requiring the recipient to provide periodic reports or receipts to show how the cash gift was utilized. 4. Repayment Conditions: Occasionally, a declaration may be used when the cash gift is given as a loan or with an expectation of repayment. This type of declaration specifies the terms of repayment, including interest rates, payment schedule, and legal consequences for defaulting on the loan. 5. Revocation Conditions: In certain instances, the giver may wish to have the option to revoke or reclaim the cash gift if certain conditions or circumstances arise. This type of declaration outlines the specific conditions under which the giver can exercise their right to revoke the gift. It is important to consult with a legal professional to ensure that the Riverside California Declaration of Cash Gift with Condition accurately reflects the intent and goals of both parties involved. This will help avoid any misunderstandings or conflicts in the future. The document should be clear, precise, and enforceable to provide a foundation for the smooth transfer of the cash gift.The Riverside California Declaration of Cash Gift with Condition is a legal document that outlines the terms and conditions associated with the gifting of a cash amount in the Riverside County area. This declaration is crucial in ensuring that both the giver and recipient understand their responsibilities and obligations related to the gift. Keywords: Riverside California, Declaration of Cash Gift, Condition, legal document, terms and conditions, gifting, cash amount, Riverside County, responsibilities, obligations. There are various types of Riverside California Declaration of Cash Gift with Condition, which may vary depending on the specific conditions attached to the gift. Some common types include: 1. Conditional Terms: This type of declaration is used when the cash gift is given with certain conditions that must be met by the recipient. These conditions could range from specific usage requirements to achieving certain goals or milestones. 2. Tax Implication Conditions: This type of declaration is important when the cash gift exceeds the annual gift tax exclusion amount set by the Internal Revenue Service (IRS). The document may state that the recipient is responsible for any tax liability arising from the cash gift. 3. Reporting and Accountability: In cases where the gift is being given for a specific purpose, such as educational expenses or charitable contributions, the declaration may include provisions requiring the recipient to provide periodic reports or receipts to show how the cash gift was utilized. 4. Repayment Conditions: Occasionally, a declaration may be used when the cash gift is given as a loan or with an expectation of repayment. This type of declaration specifies the terms of repayment, including interest rates, payment schedule, and legal consequences for defaulting on the loan. 5. Revocation Conditions: In certain instances, the giver may wish to have the option to revoke or reclaim the cash gift if certain conditions or circumstances arise. This type of declaration outlines the specific conditions under which the giver can exercise their right to revoke the gift. It is important to consult with a legal professional to ensure that the Riverside California Declaration of Cash Gift with Condition accurately reflects the intent and goals of both parties involved. This will help avoid any misunderstandings or conflicts in the future. The document should be clear, precise, and enforceable to provide a foundation for the smooth transfer of the cash gift.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.