Liquidated damages may be incorporated as a clause in an agreement when the parties to the agreement agree to the payment of a certain sum as a fixed and agreed upon payment for doing or not doing certain things particularly mentioned in the agreement. It is the amount of money specified in a contract to be awarded in the event that the agreement is violated, often when the actual damages are difficult to determine with specificity.

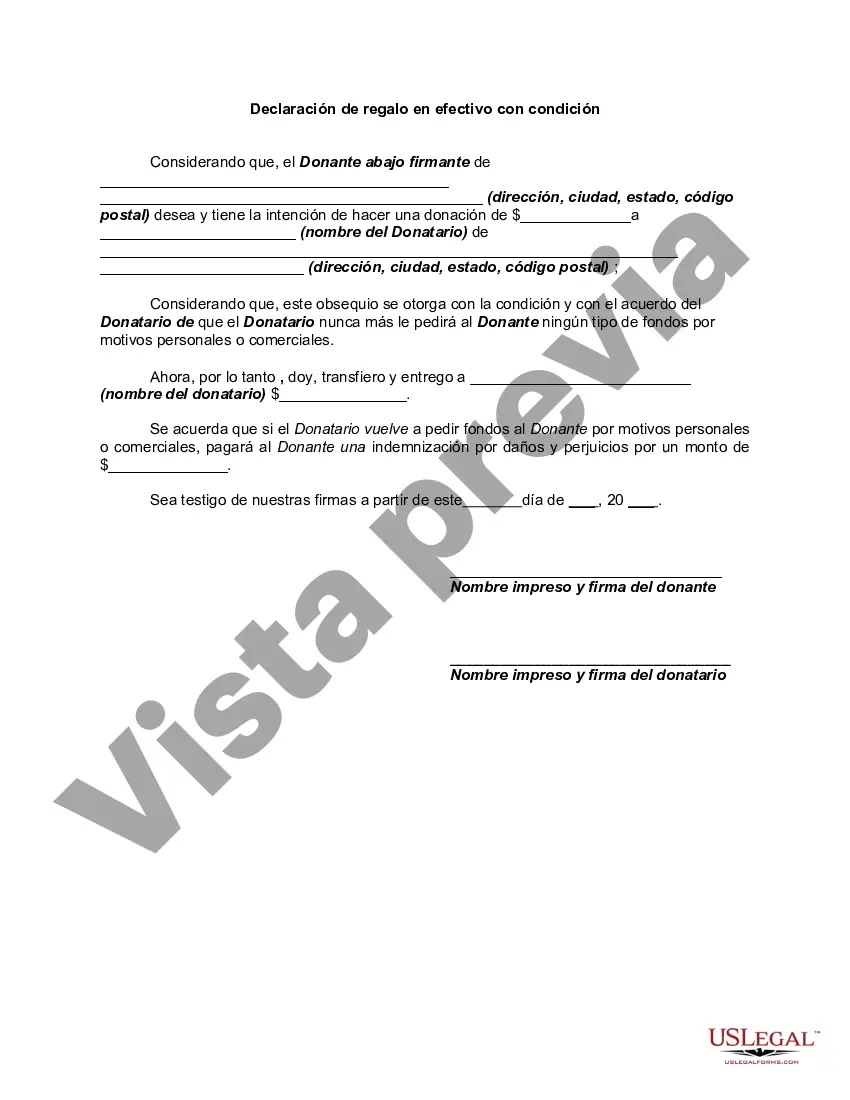

The San Diego California Declaration of Cash Gift with Condition is a legal document that establishes the terms and conditions for the gifting of cash in the city of San Diego, California. This declaration is a formal agreement between the giver (donor) and the recipient (done), outlining the specific conditions and requirements for the cash gift. The San Diego California Declaration of Cash Gift with Condition serves as a means to ensure that both parties fully understand and agree to the conditions associated with the gifted amount. This document is typically used when the giver desires to place certain restrictions or conditions on the use of the cash gifted. Keywords: San Diego, California, Declaration of Cash Gift with Condition, legal document, gifting, cash gift, terms and conditions, agreement, donor, recipient, restrictions, conditions. Different types of San Diego California Declaration of Cash Gift with Condition may include: 1. Educational Donation: This type of declaration is specifically designed for cash gifts that are meant to support educational purposes. It may outline the use of the cash gift for tuition fees, educational supplies, or educational programs. 2. Charitable Donation: This declaration pertains to cash gifts that are intended for charitable causes. It may specify the charity or organization to which the gift should be directed. Additionally, it may state any specific conditions regarding the utilization of the funds. 3. Medical Expense Donation: This type of declaration is used when the cash gift is intended to assist with medical expenses. It may include details on reimbursing medical bills, covering treatment costs, or financing necessary medical procedures or medications. 4. Restricted Usage Donation: This declaration contains conditions that restrict the utilization of the cash gift to particular purposes. For example, it may restrict the funds to be used solely for home renovations, business ventures, or a specific personal project. 5. Philanthropic Donation: This type of declaration refers to cash gifts made with the intention of benefiting a philanthropic cause or a non-profit organization. It may specify the purpose of the gift, ensuring that it aligns with the donor's philanthropic goals. When drafting a San Diego California Declaration of Cash Gift with Condition, it is essential to consult with legal professionals to ensure compliance with applicable laws and regulations.The San Diego California Declaration of Cash Gift with Condition is a legal document that establishes the terms and conditions for the gifting of cash in the city of San Diego, California. This declaration is a formal agreement between the giver (donor) and the recipient (done), outlining the specific conditions and requirements for the cash gift. The San Diego California Declaration of Cash Gift with Condition serves as a means to ensure that both parties fully understand and agree to the conditions associated with the gifted amount. This document is typically used when the giver desires to place certain restrictions or conditions on the use of the cash gifted. Keywords: San Diego, California, Declaration of Cash Gift with Condition, legal document, gifting, cash gift, terms and conditions, agreement, donor, recipient, restrictions, conditions. Different types of San Diego California Declaration of Cash Gift with Condition may include: 1. Educational Donation: This type of declaration is specifically designed for cash gifts that are meant to support educational purposes. It may outline the use of the cash gift for tuition fees, educational supplies, or educational programs. 2. Charitable Donation: This declaration pertains to cash gifts that are intended for charitable causes. It may specify the charity or organization to which the gift should be directed. Additionally, it may state any specific conditions regarding the utilization of the funds. 3. Medical Expense Donation: This type of declaration is used when the cash gift is intended to assist with medical expenses. It may include details on reimbursing medical bills, covering treatment costs, or financing necessary medical procedures or medications. 4. Restricted Usage Donation: This declaration contains conditions that restrict the utilization of the cash gift to particular purposes. For example, it may restrict the funds to be used solely for home renovations, business ventures, or a specific personal project. 5. Philanthropic Donation: This type of declaration refers to cash gifts made with the intention of benefiting a philanthropic cause or a non-profit organization. It may specify the purpose of the gift, ensuring that it aligns with the donor's philanthropic goals. When drafting a San Diego California Declaration of Cash Gift with Condition, it is essential to consult with legal professionals to ensure compliance with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.