Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Collin Texas Declaration of Gift Over Several Year periods is a legal document used in Collin County, Texas, which allows an individual to declare a gift that will be provided over a span of several years. This declaration is typically made by the donor of the gift and outlines the terms and conditions of the gift transfer. One notable type of Collin Texas Declaration of Gift Over Several Year periods is the Declaration of Gift in Trust. This type of declaration is used when the donor intends to transfer a gift to a trust, which will manage and distribute the gift over a specified period of time. The declaration will specify the purpose of the trust, the beneficiaries, the trustee, and the conditions under which the gifts will be distributed. Another type of declaration is the Declaration of Gift with Annual Exclusion. In this case, the donor declares a gift that will be given annually over several years, taking advantage of the annual gift tax exclusion limit set by the Internal Revenue Service (IRS). This type of declaration ensures that the donor can distribute substantial gifts over a period of time without triggering gift tax implications. The Collin Texas Declaration of Gift Over Several Year periods is crucial to ensure transparency and legal compliance in gift transfers. It serves as an official record of the donor's intent and helps avoid any disputes or conflicts that may arise in the future regarding the gift. By specifying the duration and conditions of the gift transfer, this declaration provides clarity to both the donor and the recipient. In summary, the Collin Texas Declaration of Gift Over Several Year periods is a legal document that enables individuals in Collin County, Texas, to declare gifts that will be given over an extended span of time. It comes in different types, such as the Declaration of Gift in Trust and the Declaration of Gift with Annual Exclusion, each serving specific purposes and ensuring the proper distribution of gifts.Collin Texas Declaration of Gift Over Several Year periods is a legal document used in Collin County, Texas, which allows an individual to declare a gift that will be provided over a span of several years. This declaration is typically made by the donor of the gift and outlines the terms and conditions of the gift transfer. One notable type of Collin Texas Declaration of Gift Over Several Year periods is the Declaration of Gift in Trust. This type of declaration is used when the donor intends to transfer a gift to a trust, which will manage and distribute the gift over a specified period of time. The declaration will specify the purpose of the trust, the beneficiaries, the trustee, and the conditions under which the gifts will be distributed. Another type of declaration is the Declaration of Gift with Annual Exclusion. In this case, the donor declares a gift that will be given annually over several years, taking advantage of the annual gift tax exclusion limit set by the Internal Revenue Service (IRS). This type of declaration ensures that the donor can distribute substantial gifts over a period of time without triggering gift tax implications. The Collin Texas Declaration of Gift Over Several Year periods is crucial to ensure transparency and legal compliance in gift transfers. It serves as an official record of the donor's intent and helps avoid any disputes or conflicts that may arise in the future regarding the gift. By specifying the duration and conditions of the gift transfer, this declaration provides clarity to both the donor and the recipient. In summary, the Collin Texas Declaration of Gift Over Several Year periods is a legal document that enables individuals in Collin County, Texas, to declare gifts that will be given over an extended span of time. It comes in different types, such as the Declaration of Gift in Trust and the Declaration of Gift with Annual Exclusion, each serving specific purposes and ensuring the proper distribution of gifts.

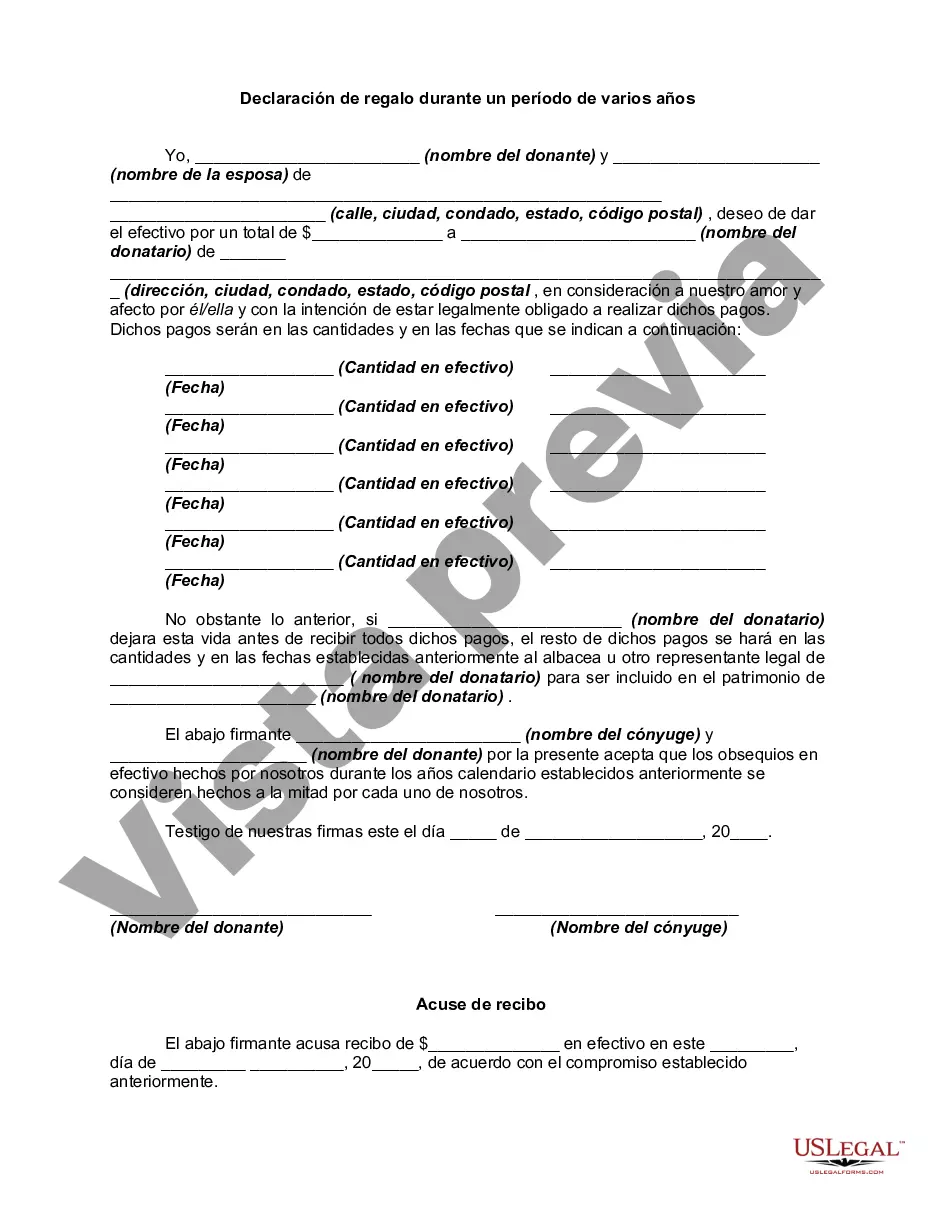

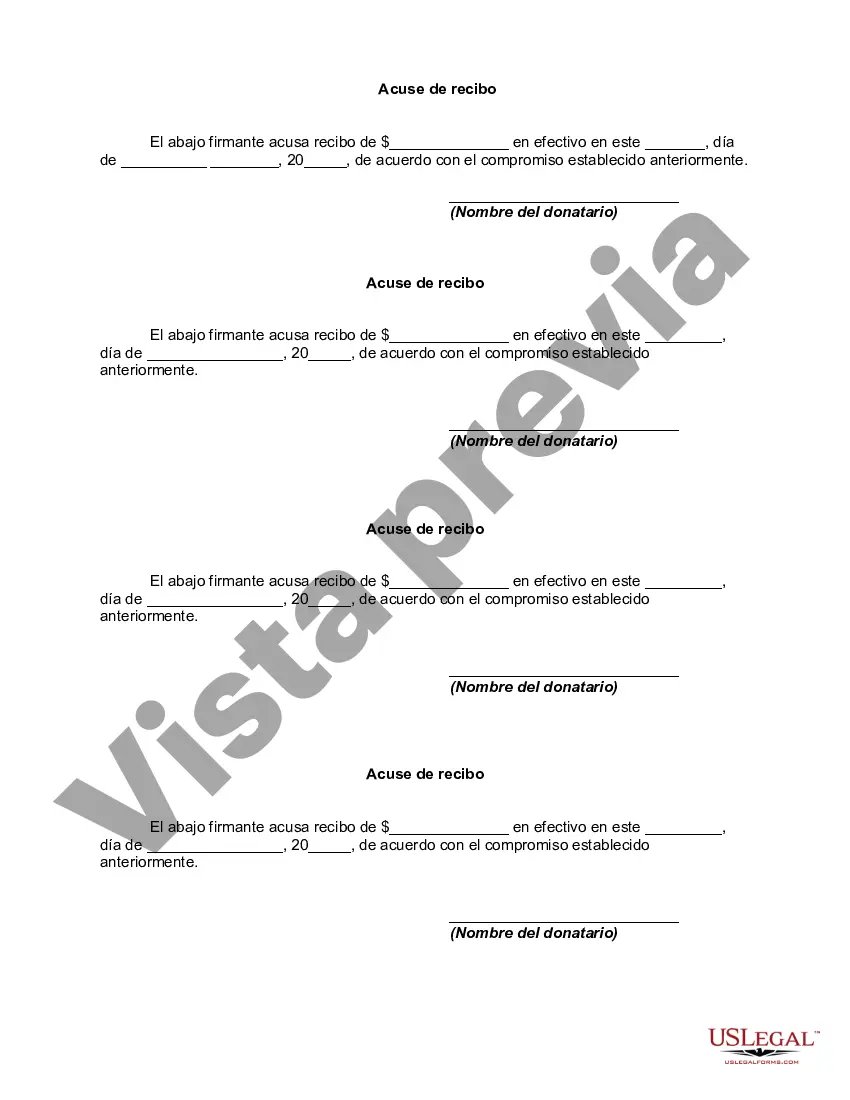

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.