Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

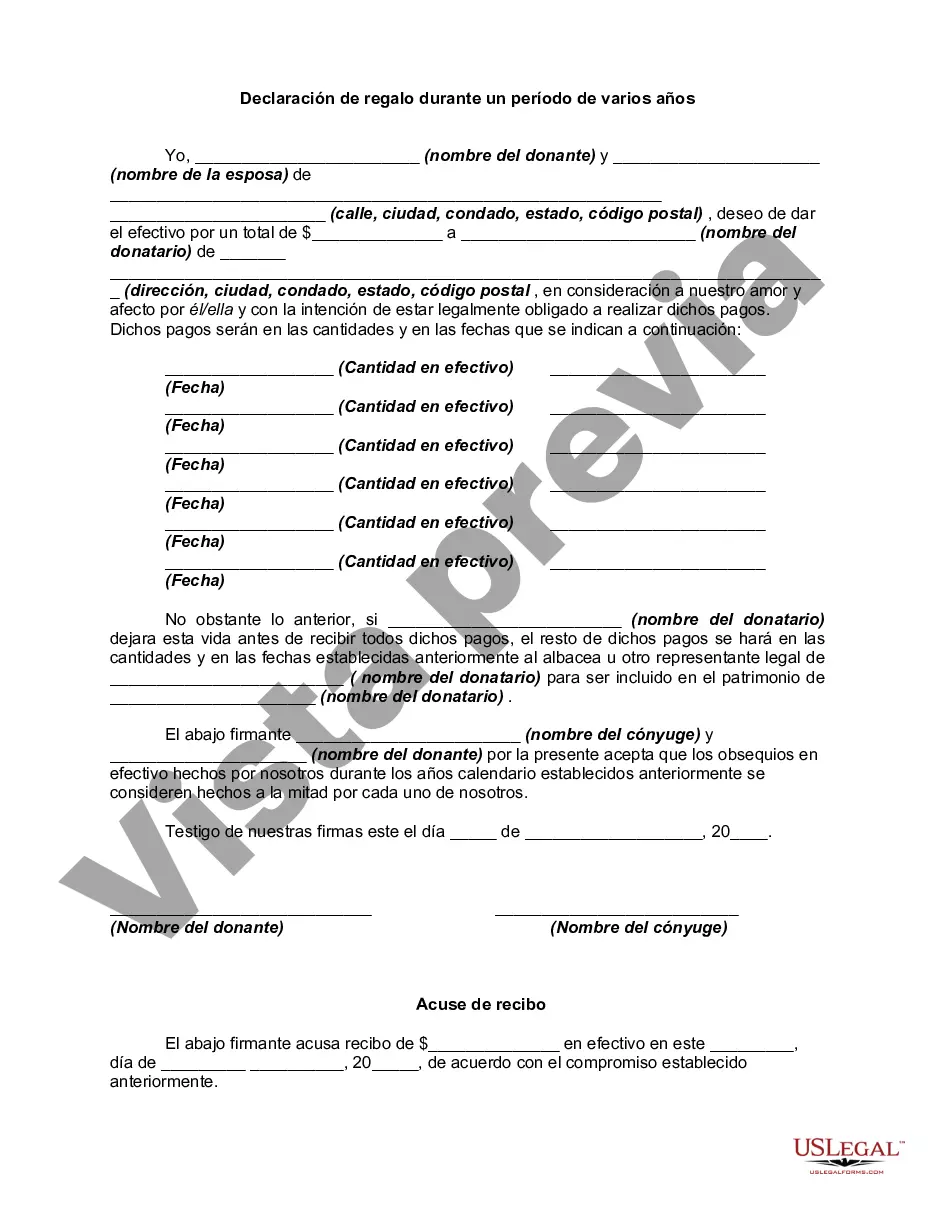

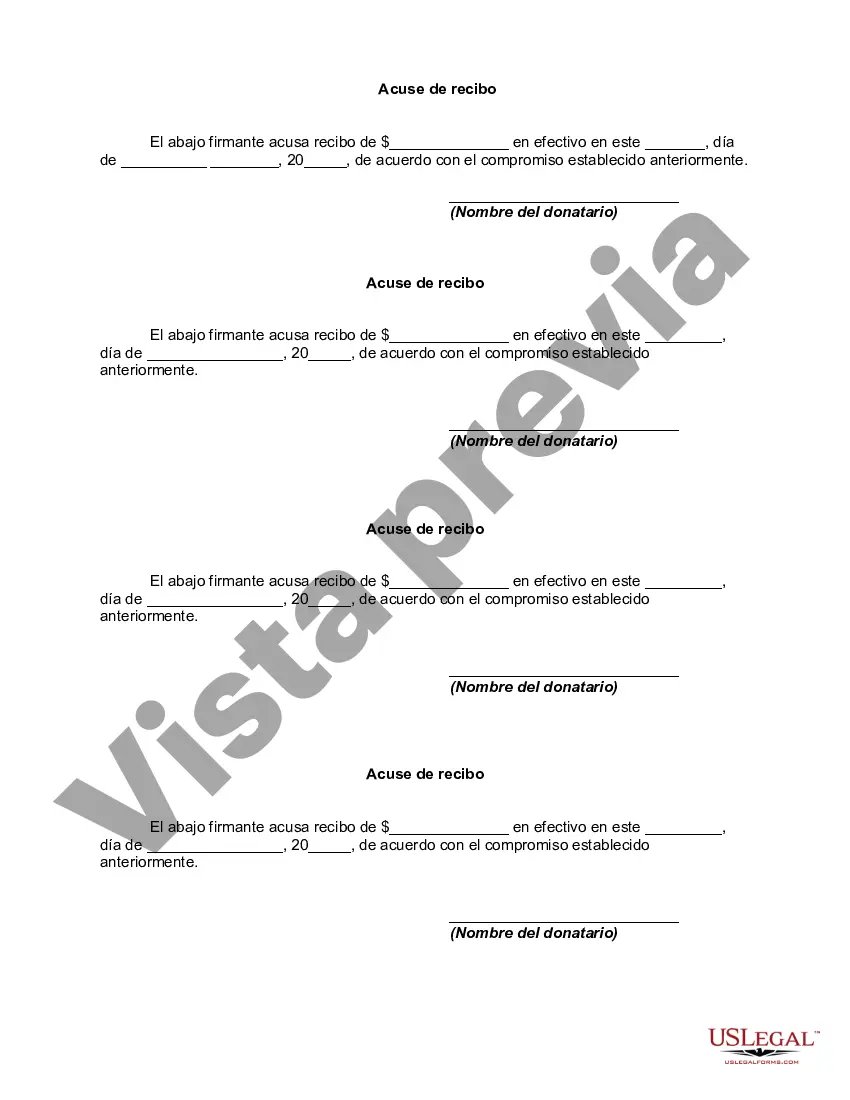

The Dallas, Texas Declaration of Gift Over Several Year periods is a legal document that pertains to the transfer of property or assets from one party to another over a span of multiple years. This declaration outlines the terms and conditions, as well as the intentions of the donor and the recipient, when it comes to gifting valuable items or funds. During the timeframe specified in the declaration, the donor is legally committed to transferring gifts to the recipient as per the agreed-upon schedule. These gifts can take various forms, such as cash, real estate, stocks, bonds, or any other valuable assets. The declaration ensures clarity and safeguards the interests of both parties involved. The Dallas, Texas Declaration of Gift Over Several Year Period caters to different situations, including but not limited to: 1. Personal Gifting: This variation of the declaration is often used for personal gifting purposes, where an individual intends to gift substantial assets to a family member, friend, or loved one. It provides a structured approach for gift transfer over time while complying with legal requirements and ensuring both parties are informed and satisfied. 2. Charitable Gifting: In case an individual wishes to make significant charitable contributions over several years, the declaration can be tailored for such purposes. This allows for a planned, gradual giving approach while ensuring compliance with tax regulations and the recipient organization's guidelines. 3. Estate Planning: The Dallas, Texas Declaration of Gift Over Several Year periods is also commonly employed in estate planning. It enables individuals to gradually gift a portion of their estate to their heirs or beneficiaries over an extended period. This approach may help minimize potential estate taxes while allowing for the orderly transfer of assets. 4. Business Succession: This type of declaration can be utilized when business owners want to pass on their ownership or shares to successors or partners gradually. It provides a mechanism for the smooth transition of ownership over several years, ensuring business continuity and the fulfillment of any legal obligations. In conclusion, the Dallas, Texas Declaration of Gift Over Several Year periods is a legally binding document that facilitates the transfer of valuable assets or funds between a donor and recipient over an extended period. Whether it is for personal, charitable, estate planning, or business succession purposes, this declaration ensures clarity, compliance, and a smooth transfer process.The Dallas, Texas Declaration of Gift Over Several Year periods is a legal document that pertains to the transfer of property or assets from one party to another over a span of multiple years. This declaration outlines the terms and conditions, as well as the intentions of the donor and the recipient, when it comes to gifting valuable items or funds. During the timeframe specified in the declaration, the donor is legally committed to transferring gifts to the recipient as per the agreed-upon schedule. These gifts can take various forms, such as cash, real estate, stocks, bonds, or any other valuable assets. The declaration ensures clarity and safeguards the interests of both parties involved. The Dallas, Texas Declaration of Gift Over Several Year Period caters to different situations, including but not limited to: 1. Personal Gifting: This variation of the declaration is often used for personal gifting purposes, where an individual intends to gift substantial assets to a family member, friend, or loved one. It provides a structured approach for gift transfer over time while complying with legal requirements and ensuring both parties are informed and satisfied. 2. Charitable Gifting: In case an individual wishes to make significant charitable contributions over several years, the declaration can be tailored for such purposes. This allows for a planned, gradual giving approach while ensuring compliance with tax regulations and the recipient organization's guidelines. 3. Estate Planning: The Dallas, Texas Declaration of Gift Over Several Year periods is also commonly employed in estate planning. It enables individuals to gradually gift a portion of their estate to their heirs or beneficiaries over an extended period. This approach may help minimize potential estate taxes while allowing for the orderly transfer of assets. 4. Business Succession: This type of declaration can be utilized when business owners want to pass on their ownership or shares to successors or partners gradually. It provides a mechanism for the smooth transition of ownership over several years, ensuring business continuity and the fulfillment of any legal obligations. In conclusion, the Dallas, Texas Declaration of Gift Over Several Year periods is a legally binding document that facilitates the transfer of valuable assets or funds between a donor and recipient over an extended period. Whether it is for personal, charitable, estate planning, or business succession purposes, this declaration ensures clarity, compliance, and a smooth transfer process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.