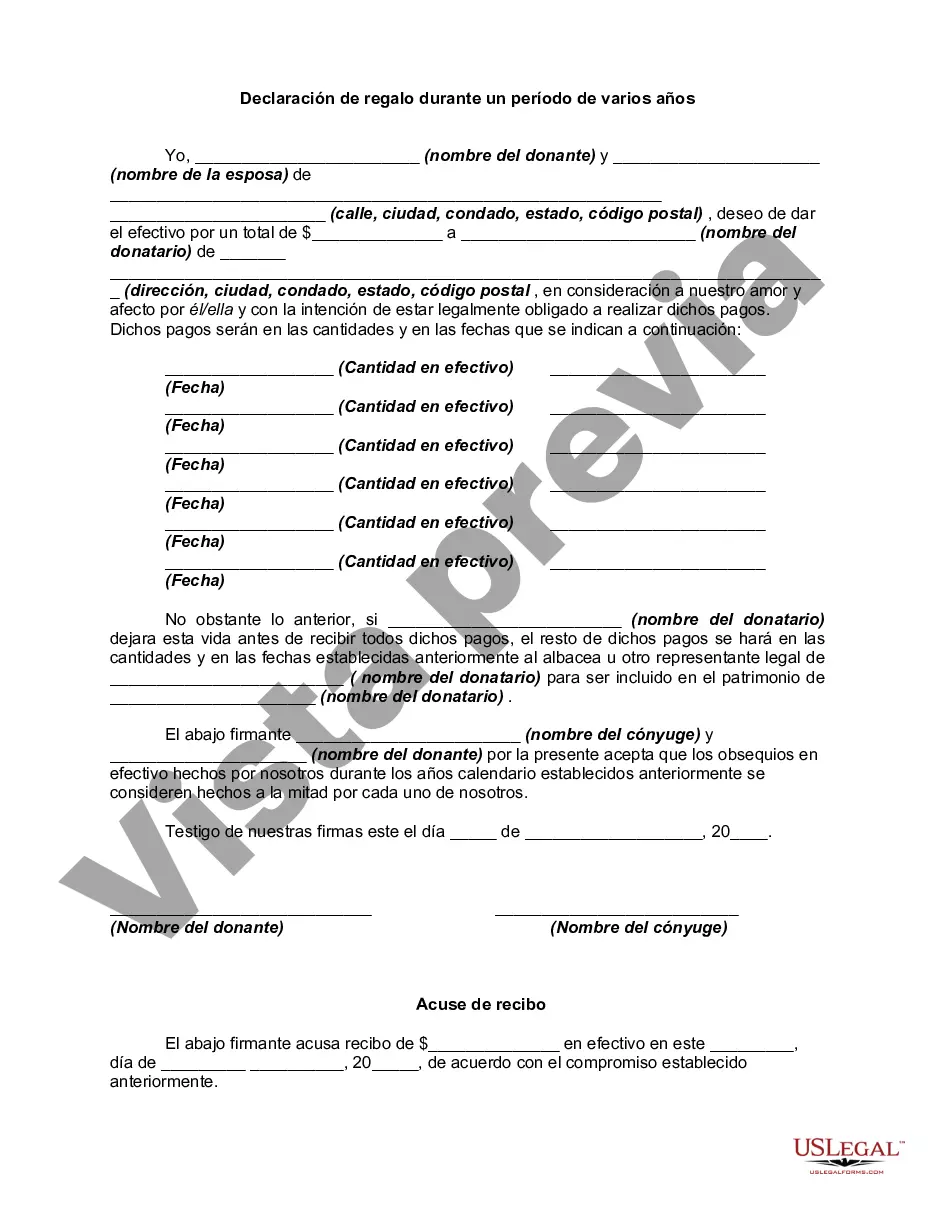

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

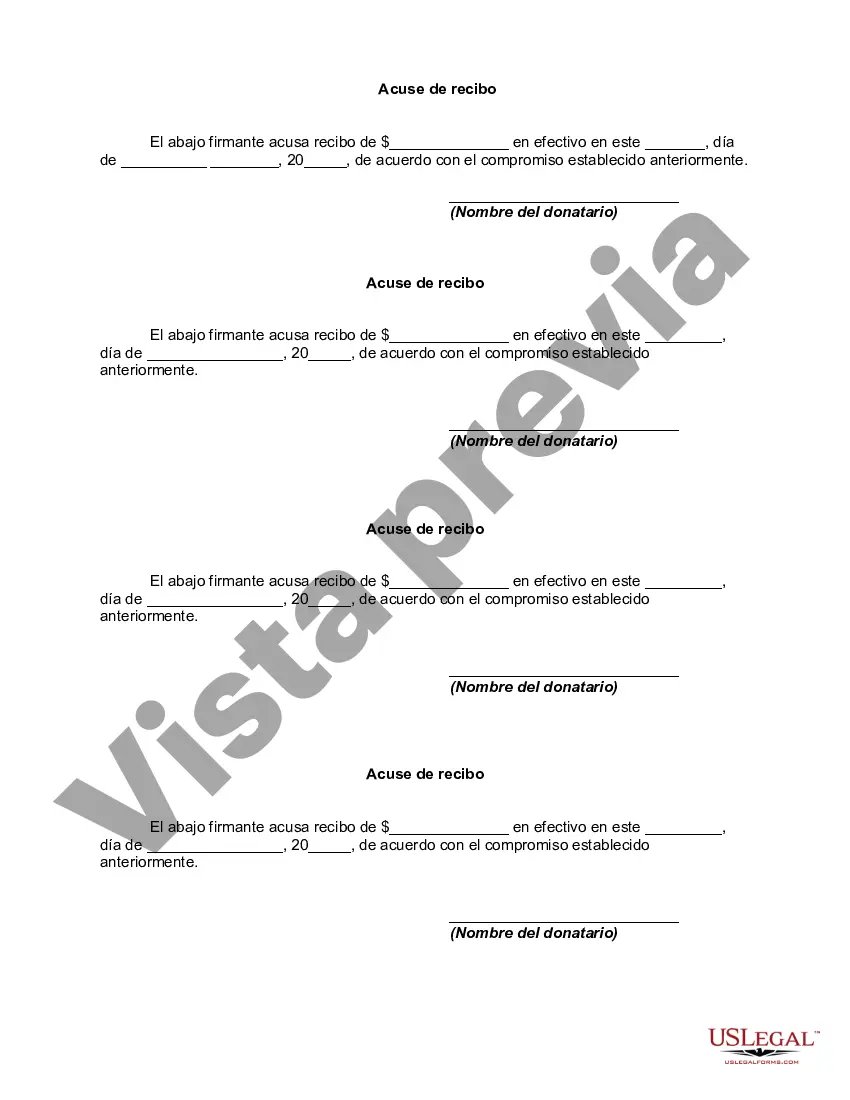

Fairfax Virginia Declaration of Gift Over Several Year periods is a legal document that outlines the process and terms of gifting property, assets, or funds over an extended period in Fairfax, Virginia. This declaration is important for individuals or organizations who wish to distribute their gifts incrementally rather than in a single transaction or lump sum. The purpose of the Fairfax Virginia Declaration of Gift Over Several Year periods is to provide a comprehensive record of the gift, ensuring legal and financial clarity for all parties involved. It sets out the details of the gift, the timeline of distribution, and the conditions or restrictions associated with it. This document serves as evidence of the donor's intent and protects the rights and interests of both the donor and the recipient. There are various types of Fairfax Virginia Declaration of Gift Over Several years Period, depending on the nature of the gift and the donor's specific requirements. Some common types include: 1. Real Estate Gift Declaration: This type of declaration is used when gifting a property or land over several years. It specifies the gradual transfer of ownership and the terms and conditions associated with the gift. 2. Financial Asset Gift Declaration: For individuals donating financial assets such as stocks, bonds, or mutual funds over a specified period, this declaration outlines the transfer process and any applicable restrictions or conditions. 3. Personal Property Gift Declaration: In the case of gifting valuable personal assets, such as artwork, jewelry, or antiques, this declaration clarifies the gradual transfer and any terms or conditions related to the gift. 4. Charitable Gift Declaration: Often used by philanthropists, this type of declaration refers to a long-term donation made to a charitable organization. It outlines the periodic distribution of funds or assets, specifying the purpose and conditions of use. Regardless of the specific type, a Fairfax Virginia Declaration of Gift Over Several Year periods should be drafted by a qualified attorney or legal professional to ensure compliance with state laws and to protect the interests of all parties involved. It is an essential document for long-term gifting arrangements, providing clarity and legal protection throughout the process.Fairfax Virginia Declaration of Gift Over Several Year periods is a legal document that outlines the process and terms of gifting property, assets, or funds over an extended period in Fairfax, Virginia. This declaration is important for individuals or organizations who wish to distribute their gifts incrementally rather than in a single transaction or lump sum. The purpose of the Fairfax Virginia Declaration of Gift Over Several Year periods is to provide a comprehensive record of the gift, ensuring legal and financial clarity for all parties involved. It sets out the details of the gift, the timeline of distribution, and the conditions or restrictions associated with it. This document serves as evidence of the donor's intent and protects the rights and interests of both the donor and the recipient. There are various types of Fairfax Virginia Declaration of Gift Over Several years Period, depending on the nature of the gift and the donor's specific requirements. Some common types include: 1. Real Estate Gift Declaration: This type of declaration is used when gifting a property or land over several years. It specifies the gradual transfer of ownership and the terms and conditions associated with the gift. 2. Financial Asset Gift Declaration: For individuals donating financial assets such as stocks, bonds, or mutual funds over a specified period, this declaration outlines the transfer process and any applicable restrictions or conditions. 3. Personal Property Gift Declaration: In the case of gifting valuable personal assets, such as artwork, jewelry, or antiques, this declaration clarifies the gradual transfer and any terms or conditions related to the gift. 4. Charitable Gift Declaration: Often used by philanthropists, this type of declaration refers to a long-term donation made to a charitable organization. It outlines the periodic distribution of funds or assets, specifying the purpose and conditions of use. Regardless of the specific type, a Fairfax Virginia Declaration of Gift Over Several Year periods should be drafted by a qualified attorney or legal professional to ensure compliance with state laws and to protect the interests of all parties involved. It is an essential document for long-term gifting arrangements, providing clarity and legal protection throughout the process.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.