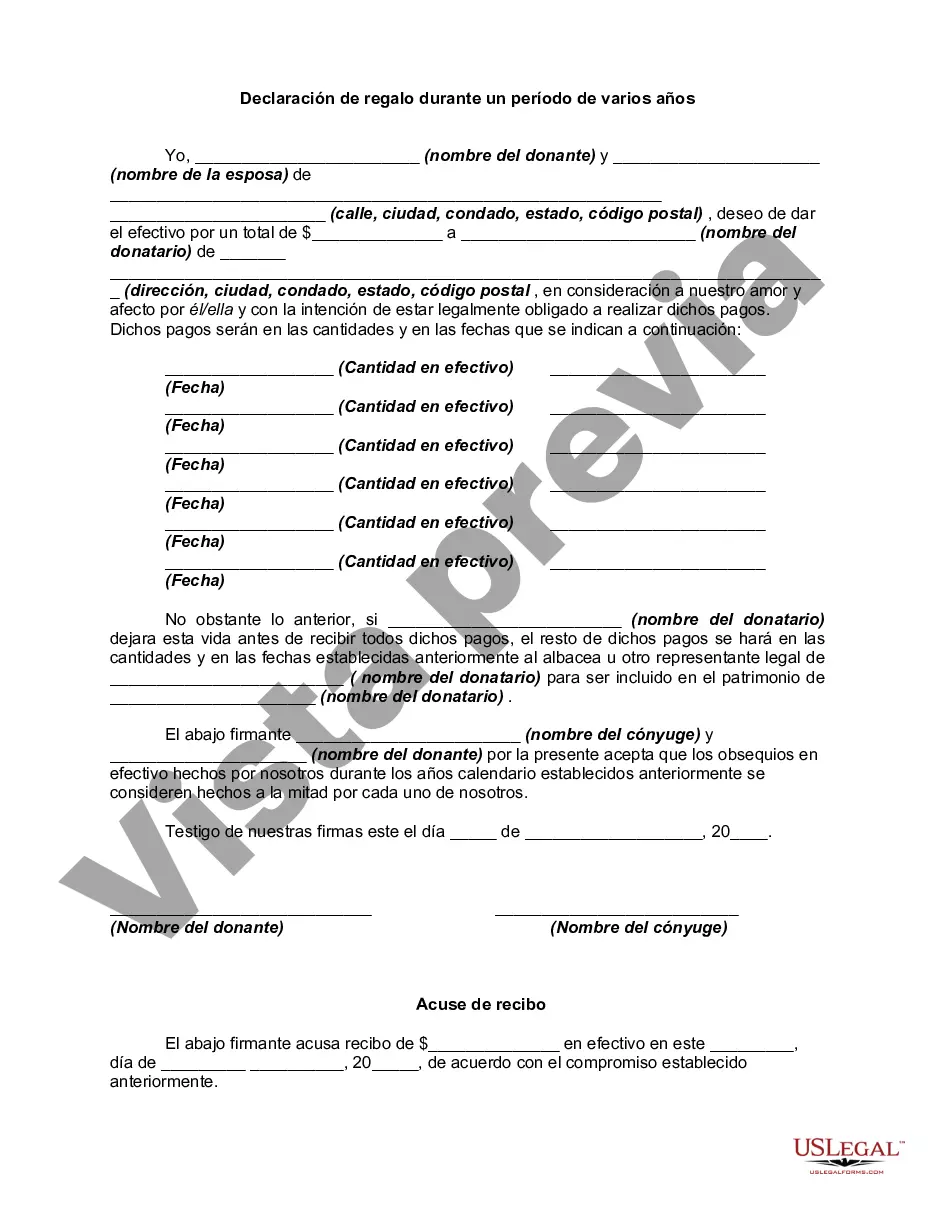

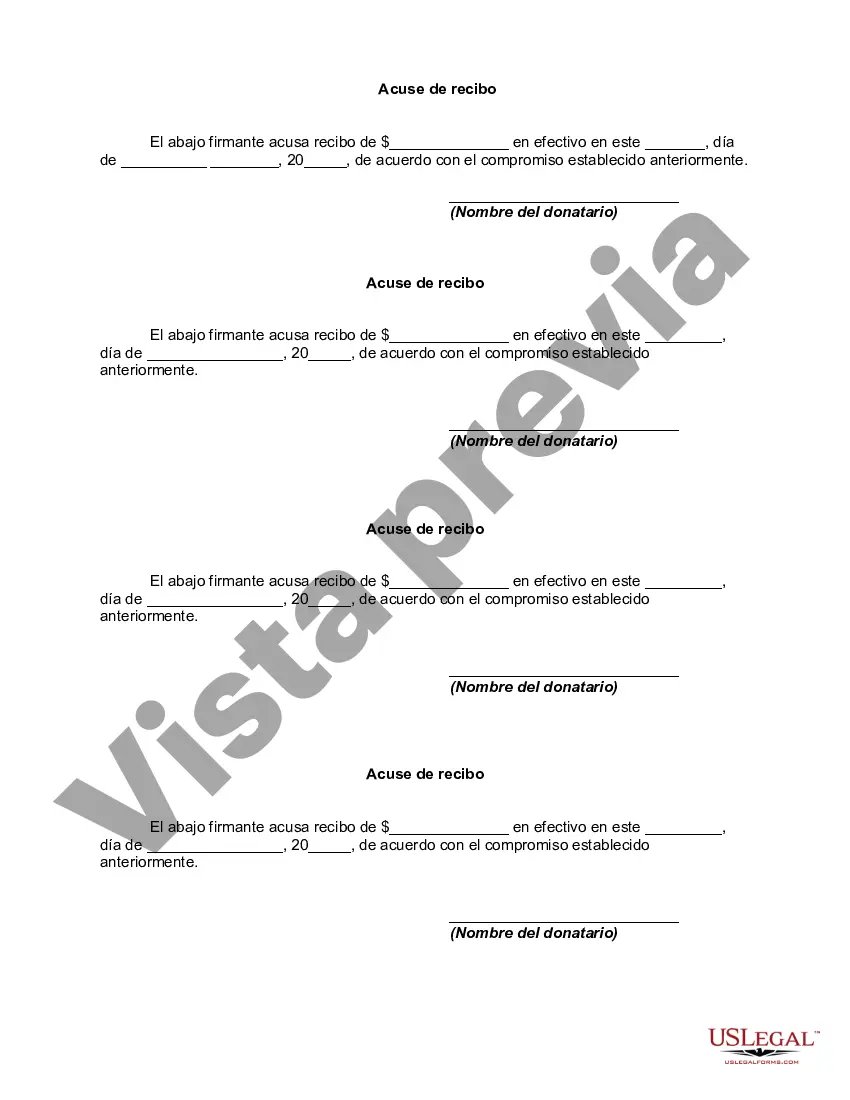

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Franklin Ohio Declaration of Gift Over Several Year periods is a legal document that outlines the process of gifting assets or funds over a span of multiple years in the city of Franklin, Ohio. This declaration is an important tool for individuals or organizations looking to distribute their wealth gradually while adhering to applicable laws and tax regulations. It enables residents of Franklin, Ohio, to effectively plan and execute their charitable giving strategies without facing any legal ramifications. The Franklin Ohio Declaration of Gift Over Several Year Period serves as a comprehensive framework that ensures the smooth transfer of assets while minimizing any financial burden for the giver. By spreading out the generous contributions over multiple years, individuals can make a significant impact on various causes close to their hearts while maximizing tax benefits and optimizing their financial planning. There are different types of Franklin Ohio Declaration of Gift Over Several years Period, each catering to specific needs and circumstances. Some variations include: 1. Personal Asset Gifting Declaration — This type of declaration is utilized by individuals who wish to gift personal assets such as property, vehicles, jewelry, or artwork over a designated period. It allows the donor to specify the timing, value, and recipient(s) of each gift, ensuring a structured and planned transfer of their assets. 2. Financial Donation Declaration — This declaration is commonly used by individuals or organizations that intend to donate a significant sum of money or financial instruments, such as stocks, bonds, or mutual funds, over several years. By outlining the timing, amount, and purpose of each donation, the donor can effectively support various charitable causes while maintaining a manageable financial commitment. 3. Business or Estate Donation Declaration — This type of declaration is often employed by entrepreneurs or individuals with substantial estates who plan to allocate portions of their business or estate assets as gifts over an extended timeframe. This enables the donor to make a lasting impact on charitable organizations or causes while ensuring the successful transfer of their business or estate holdings over the specified period. In conclusion, the Franklin Ohio Declaration of Gift Over Several Year Period offers a structured and legally compliant pathway for individuals and organizations to engage in philanthropic activities. By spreading out their gifts, donors can optimize their impact, tax benefits, and financial planning, positively influencing the community of Franklin, Ohio.Franklin Ohio Declaration of Gift Over Several Year periods is a legal document that outlines the process of gifting assets or funds over a span of multiple years in the city of Franklin, Ohio. This declaration is an important tool for individuals or organizations looking to distribute their wealth gradually while adhering to applicable laws and tax regulations. It enables residents of Franklin, Ohio, to effectively plan and execute their charitable giving strategies without facing any legal ramifications. The Franklin Ohio Declaration of Gift Over Several Year Period serves as a comprehensive framework that ensures the smooth transfer of assets while minimizing any financial burden for the giver. By spreading out the generous contributions over multiple years, individuals can make a significant impact on various causes close to their hearts while maximizing tax benefits and optimizing their financial planning. There are different types of Franklin Ohio Declaration of Gift Over Several years Period, each catering to specific needs and circumstances. Some variations include: 1. Personal Asset Gifting Declaration — This type of declaration is utilized by individuals who wish to gift personal assets such as property, vehicles, jewelry, or artwork over a designated period. It allows the donor to specify the timing, value, and recipient(s) of each gift, ensuring a structured and planned transfer of their assets. 2. Financial Donation Declaration — This declaration is commonly used by individuals or organizations that intend to donate a significant sum of money or financial instruments, such as stocks, bonds, or mutual funds, over several years. By outlining the timing, amount, and purpose of each donation, the donor can effectively support various charitable causes while maintaining a manageable financial commitment. 3. Business or Estate Donation Declaration — This type of declaration is often employed by entrepreneurs or individuals with substantial estates who plan to allocate portions of their business or estate assets as gifts over an extended timeframe. This enables the donor to make a lasting impact on charitable organizations or causes while ensuring the successful transfer of their business or estate holdings over the specified period. In conclusion, the Franklin Ohio Declaration of Gift Over Several Year Period offers a structured and legally compliant pathway for individuals and organizations to engage in philanthropic activities. By spreading out their gifts, donors can optimize their impact, tax benefits, and financial planning, positively influencing the community of Franklin, Ohio.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.