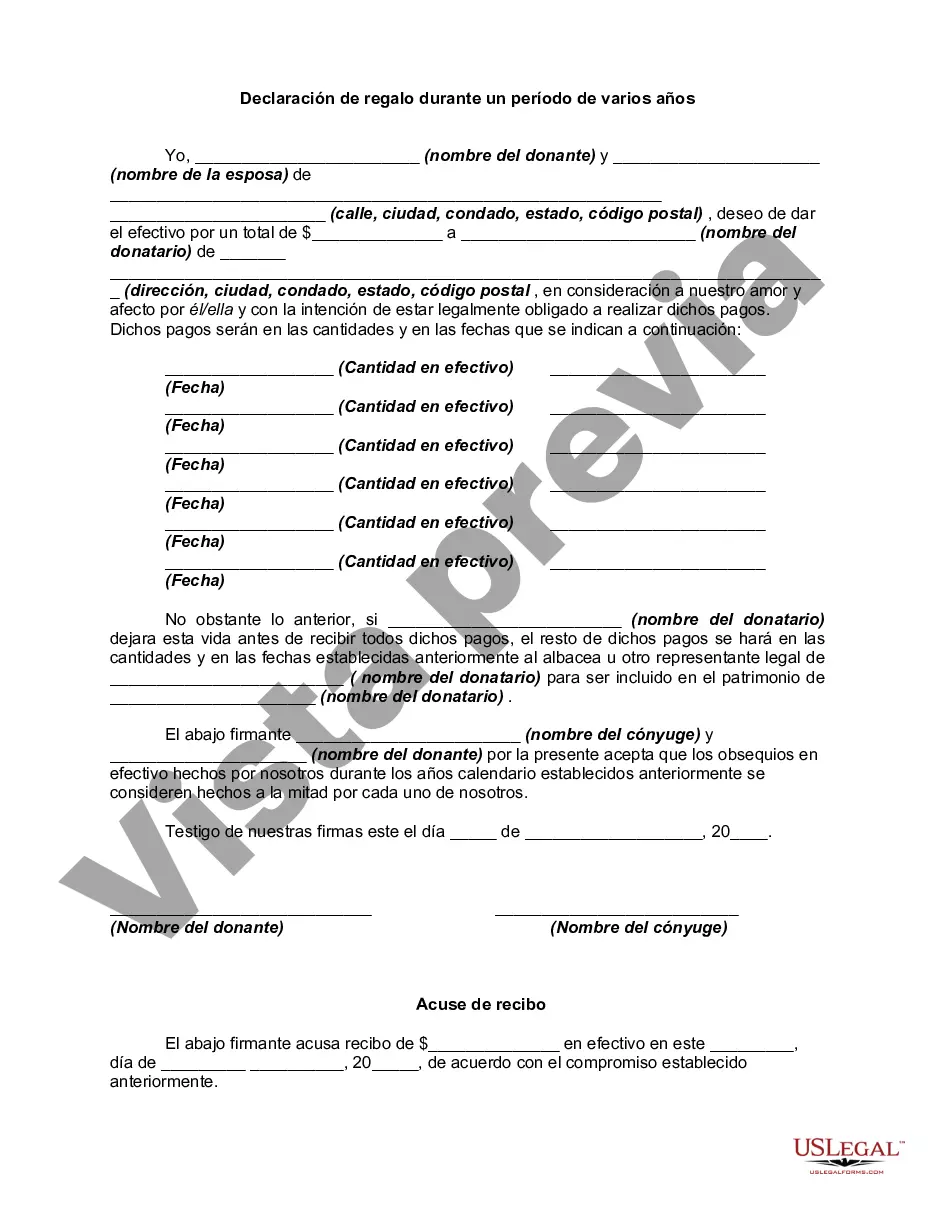

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

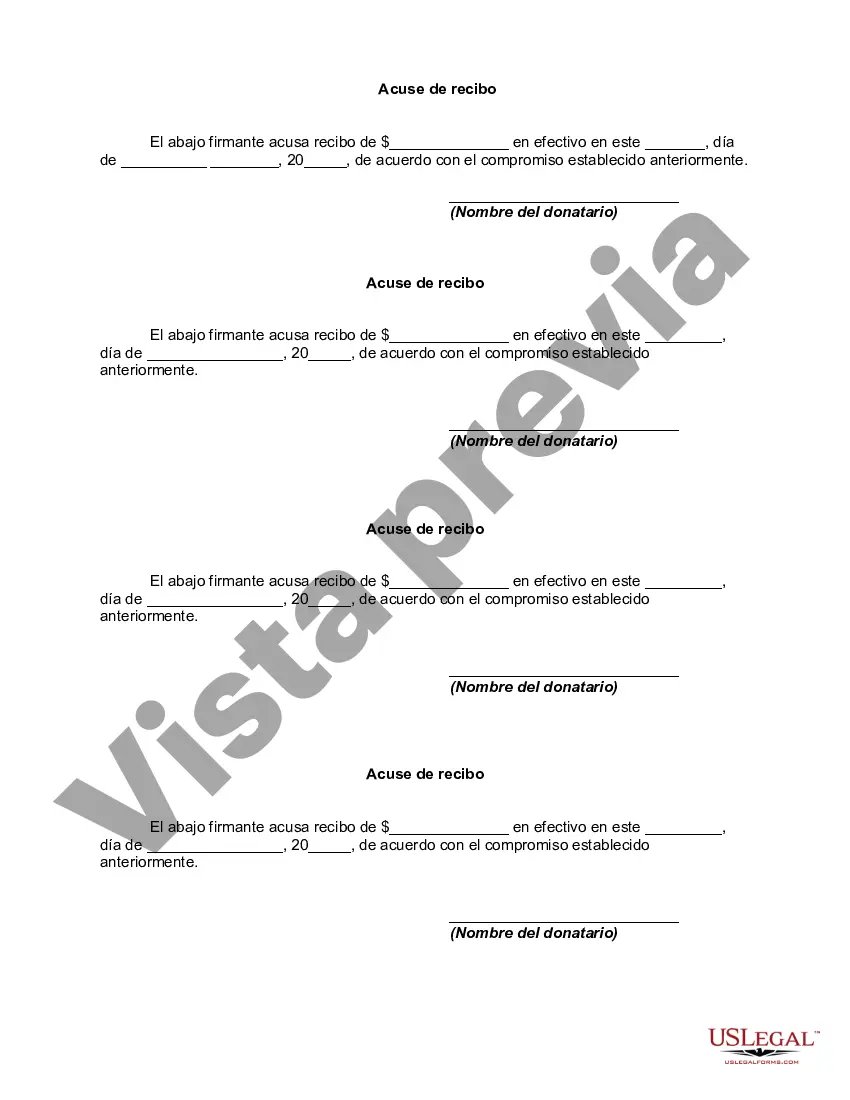

Houston Texas Declaration of Gift Over Several Year periods is a legal document that establishes a detailed record of gifts made by an individual or organization over several years. This declaration is crucial for documenting and tracking gifts, ensuring compliance with tax regulations, and providing transparency for both the donor and the recipient. Keywords: Houston Texas, Declaration of Gift, Several Year periods, legal document, gifts, individual, organization, record, compliance, tax regulations, transparency. Types of Houston Texas Declaration of Gift Over Several Year periods: 1. Individual Donor Declaration: This type of declaration is created and signed by an individual donor who wishes to document their gifts made over several years to a specific recipient or organization. It includes the donor's personal information, details of each gift, and various legal provisions. 2. Organization Donor Declaration: This type of declaration is issued by an organization or foundation that wants to document their gifts made over several years. It includes the organization's information, details of each gift, and legal provisions governing the declaration. 3. Recipient's Acknowledgment: This is a separate document that may accompany the declaration of gift. It acknowledges the receipt of gifts and confirms the organization's or individual's compliance with the regulations associated with the declaration. It may include details such as the date of receipt, the nature of the gifts, and any specific conditions or restrictions. 4. Consolidated Declaration: In some cases, donors or recipients may choose to consolidate their gift records from multiple years into a single declaration. This allows for more convenient record-keeping and provides a comprehensive overview of all gifts made over the specified period. 5. Tax-related Declaration: Apart from being a record-keeping document, the Houston Texas Declaration of Gift Over Several Year periods can also have tax implications. Donors or organizations may create a specific type of declaration that focuses on complying with relevant tax regulations, ensuring proper reporting of gifts, and providing necessary information to the tax authorities. Overall, the Houston Texas Declaration of Gift Over Several Year periods is a crucial legal instrument used to accurately and transparently document gifts made by individuals or organizations over extended periods. It serves to establish a comprehensive record, comply with tax regulations, and maintain transparency between donors and recipients.Houston Texas Declaration of Gift Over Several Year periods is a legal document that establishes a detailed record of gifts made by an individual or organization over several years. This declaration is crucial for documenting and tracking gifts, ensuring compliance with tax regulations, and providing transparency for both the donor and the recipient. Keywords: Houston Texas, Declaration of Gift, Several Year periods, legal document, gifts, individual, organization, record, compliance, tax regulations, transparency. Types of Houston Texas Declaration of Gift Over Several Year periods: 1. Individual Donor Declaration: This type of declaration is created and signed by an individual donor who wishes to document their gifts made over several years to a specific recipient or organization. It includes the donor's personal information, details of each gift, and various legal provisions. 2. Organization Donor Declaration: This type of declaration is issued by an organization or foundation that wants to document their gifts made over several years. It includes the organization's information, details of each gift, and legal provisions governing the declaration. 3. Recipient's Acknowledgment: This is a separate document that may accompany the declaration of gift. It acknowledges the receipt of gifts and confirms the organization's or individual's compliance with the regulations associated with the declaration. It may include details such as the date of receipt, the nature of the gifts, and any specific conditions or restrictions. 4. Consolidated Declaration: In some cases, donors or recipients may choose to consolidate their gift records from multiple years into a single declaration. This allows for more convenient record-keeping and provides a comprehensive overview of all gifts made over the specified period. 5. Tax-related Declaration: Apart from being a record-keeping document, the Houston Texas Declaration of Gift Over Several Year periods can also have tax implications. Donors or organizations may create a specific type of declaration that focuses on complying with relevant tax regulations, ensuring proper reporting of gifts, and providing necessary information to the tax authorities. Overall, the Houston Texas Declaration of Gift Over Several Year periods is a crucial legal instrument used to accurately and transparently document gifts made by individuals or organizations over extended periods. It serves to establish a comprehensive record, comply with tax regulations, and maintain transparency between donors and recipients.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.