Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

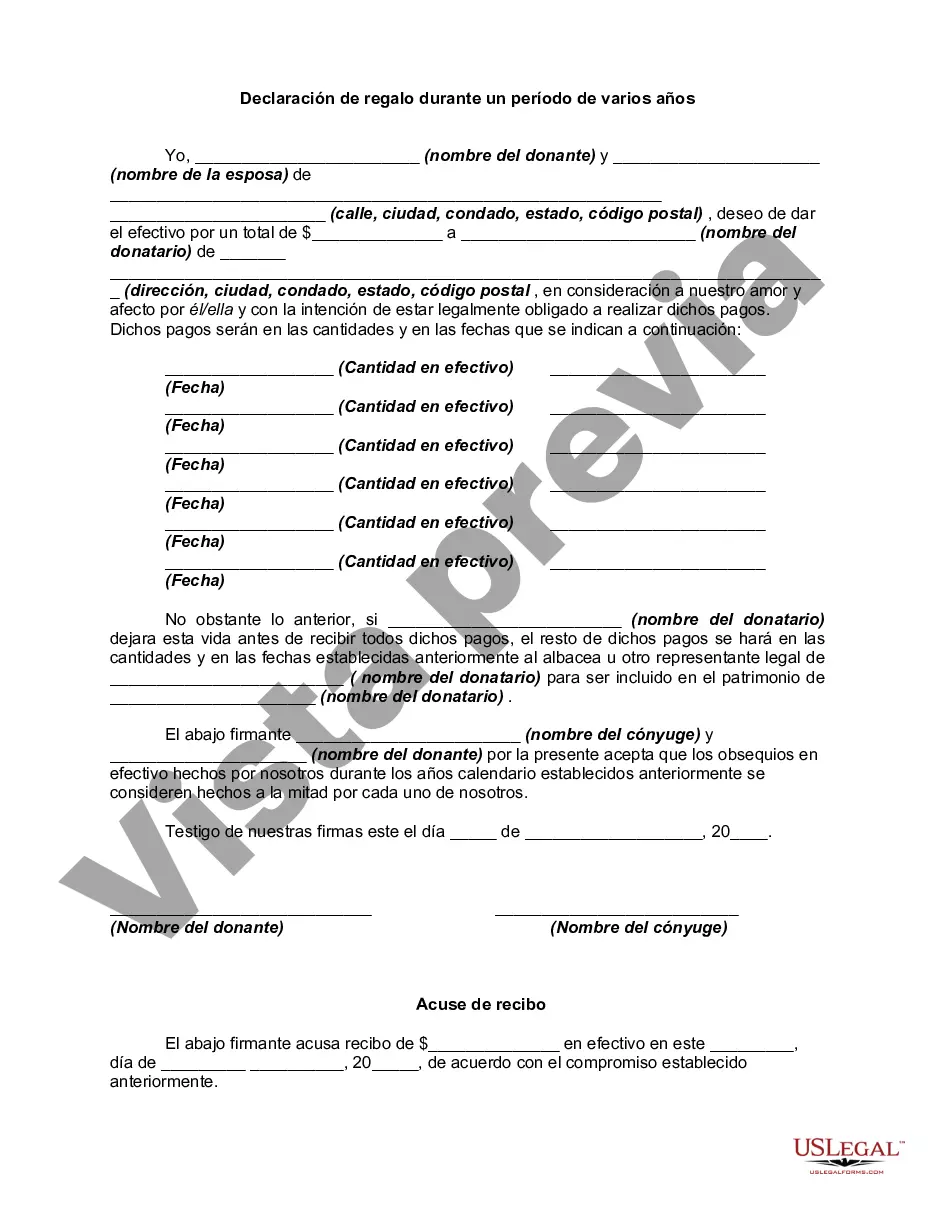

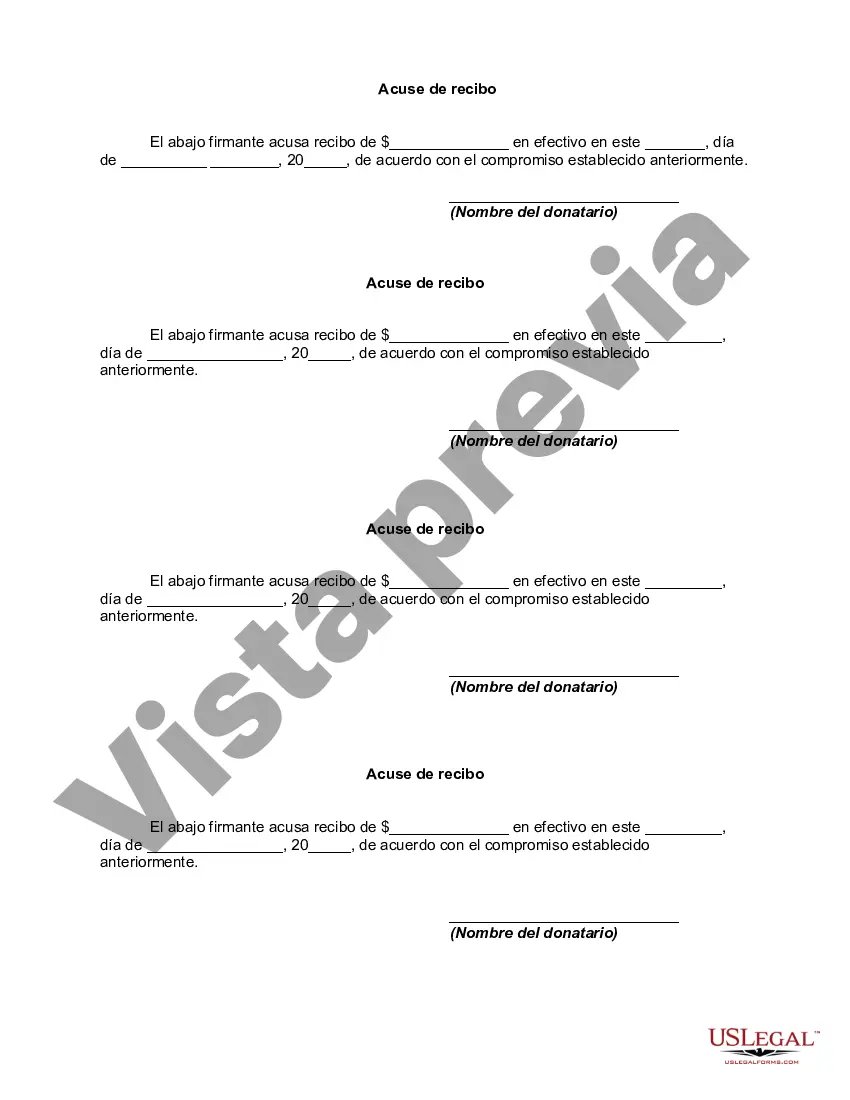

Los Angeles, California, Declaration of Gift Over Several Year periods is a legal document that outlines the process of gifting assets or property to individuals or organizations in the Los Angeles area over a specified timeframe. This declaration ensures that all parties involved comply with the applicable laws and regulations surrounding gift-giving. The Los Angeles, California, Declaration of Gift Over Several Year periods is particularly pertinent when the giver intends to distribute gifts gradually over multiple years. This approach allows for better management of assets and provides the opportunity to plan for tax implications, estate planning, and financial stability. There are several types of Los Angeles, California, Declarations of Gift over Several Year Periods that individuals or entities may consider, including: 1. Personal Gifts: This type of declaration involves gifting personal possessions, such as jewelry, artwork, or collectibles, to family members, friends, or loved ones residing in Los Angeles, California. 2. Financial Gifts: This declaration pertains to the gifting of cash, stocks, bonds, or other financial assets to individuals or organizations within Los Angeles, California, over an extended timeframe. It is crucial to properly document and disclose these transactions to ensure compliance with tax laws. 3. Real Estate Gifts: This category of declaration involves the transfer of property, such as residential, commercial, or vacant land, to beneficiaries located in Los Angeles, California. This type of gift can have significant tax implications and requires careful planning and legal documentation. 4. Charitable Gifts: The Los Angeles, California, Declaration of Gift Over Several Year periods also encompasses charitable giving to nonprofit organizations or foundations operating in the Los Angeles area. Donors may choose to give a portion of their assets or property to support causes they care about while availing tax benefits. The Los Angeles, California, Declaration of Gift Over Several Year Period aims to create transparency and clarity in the gifting process while adhering to legal requirements. It provides a structured framework for individuals to distribute their assets gradually over time, ensuring that all parties involved benefit from these planned gifts.Los Angeles, California, Declaration of Gift Over Several Year periods is a legal document that outlines the process of gifting assets or property to individuals or organizations in the Los Angeles area over a specified timeframe. This declaration ensures that all parties involved comply with the applicable laws and regulations surrounding gift-giving. The Los Angeles, California, Declaration of Gift Over Several Year periods is particularly pertinent when the giver intends to distribute gifts gradually over multiple years. This approach allows for better management of assets and provides the opportunity to plan for tax implications, estate planning, and financial stability. There are several types of Los Angeles, California, Declarations of Gift over Several Year Periods that individuals or entities may consider, including: 1. Personal Gifts: This type of declaration involves gifting personal possessions, such as jewelry, artwork, or collectibles, to family members, friends, or loved ones residing in Los Angeles, California. 2. Financial Gifts: This declaration pertains to the gifting of cash, stocks, bonds, or other financial assets to individuals or organizations within Los Angeles, California, over an extended timeframe. It is crucial to properly document and disclose these transactions to ensure compliance with tax laws. 3. Real Estate Gifts: This category of declaration involves the transfer of property, such as residential, commercial, or vacant land, to beneficiaries located in Los Angeles, California. This type of gift can have significant tax implications and requires careful planning and legal documentation. 4. Charitable Gifts: The Los Angeles, California, Declaration of Gift Over Several Year periods also encompasses charitable giving to nonprofit organizations or foundations operating in the Los Angeles area. Donors may choose to give a portion of their assets or property to support causes they care about while availing tax benefits. The Los Angeles, California, Declaration of Gift Over Several Year Period aims to create transparency and clarity in the gifting process while adhering to legal requirements. It provides a structured framework for individuals to distribute their assets gradually over time, ensuring that all parties involved benefit from these planned gifts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.