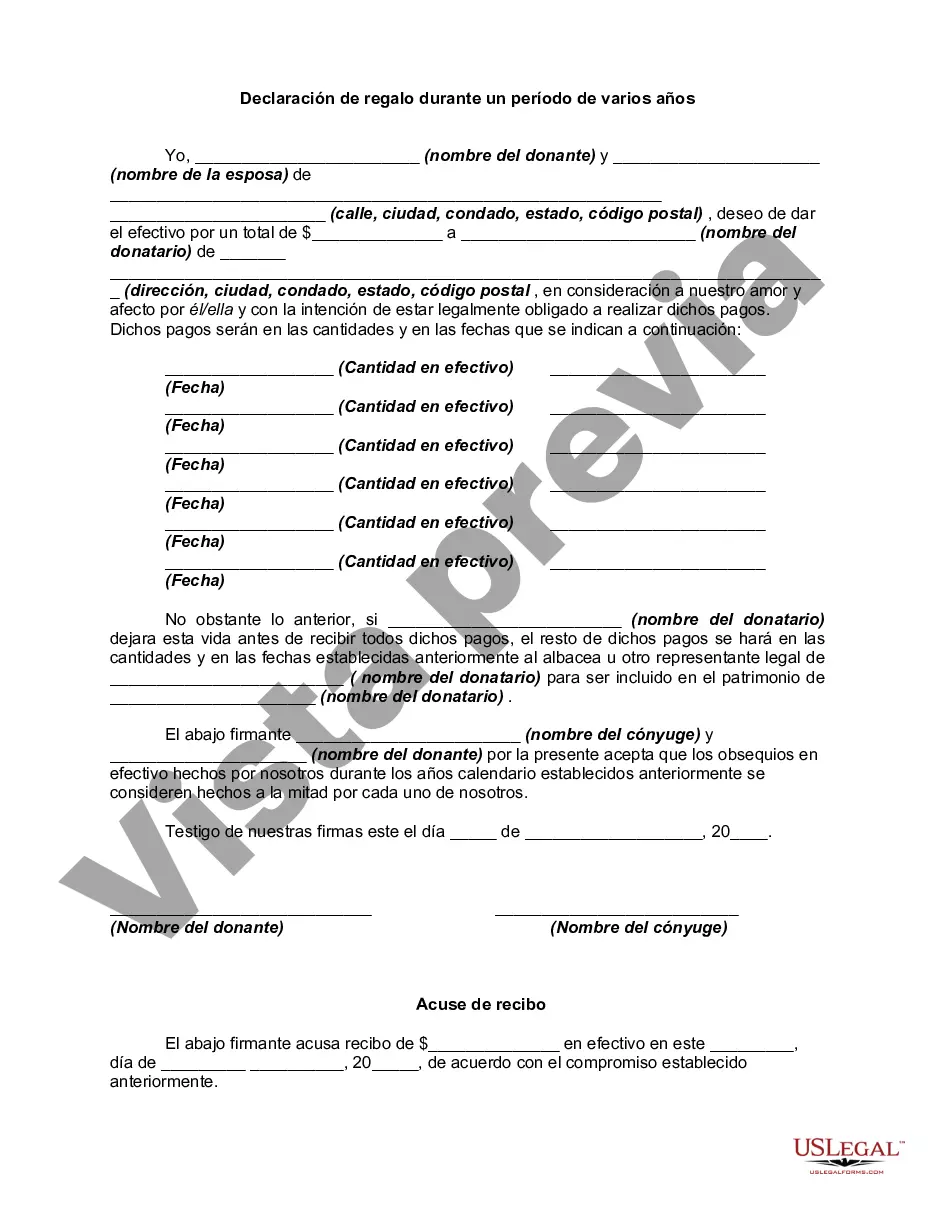

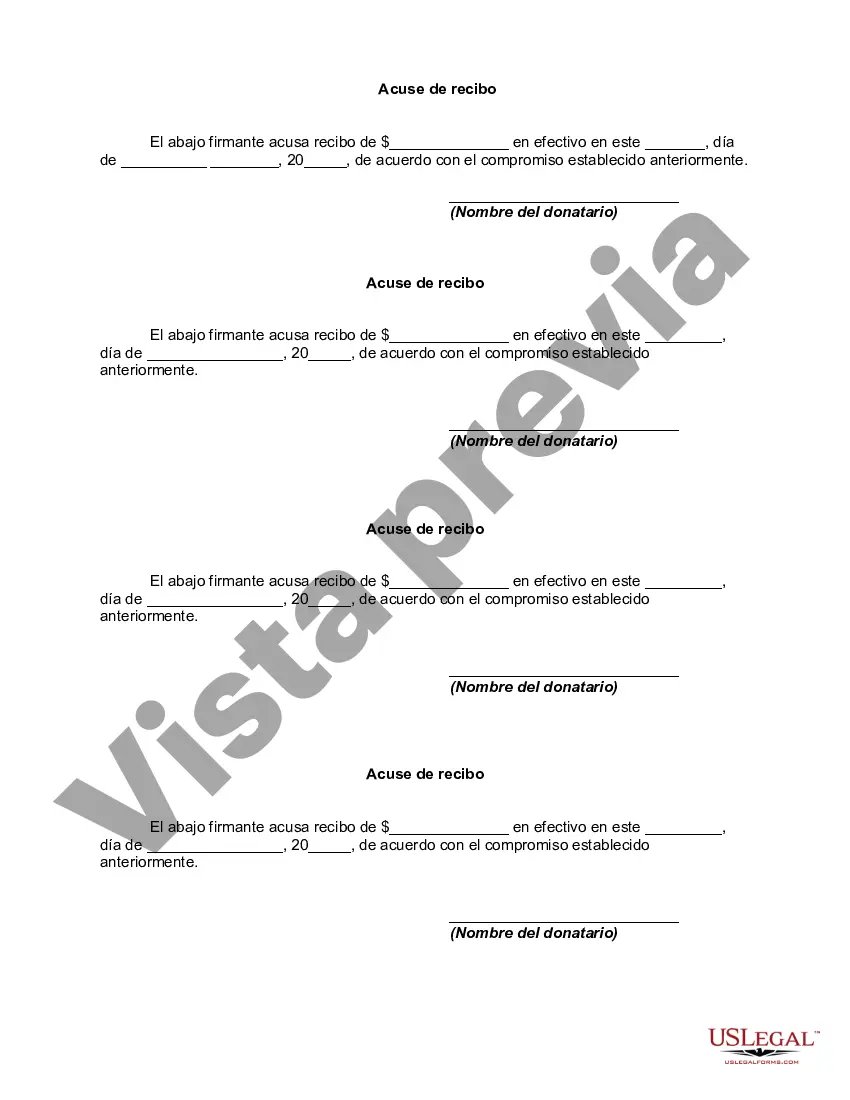

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The Mecklenburg North Carolina Declaration of Gift Over Several Year periods is a legal document that outlines the process of gifting assets or property over a span of multiple years in Mecklenburg County, North Carolina. This declaration is crucial when an individual or entity intends to gift a substantial amount of wealth to another party gradually, rather than through a lump sum donation. By utilizing this declaration, the donor can strategically plan and distribute their gifts, taking advantage of potential tax benefits and spreading out the impact on their own financial standing. The Mecklenburg North Carolina Declaration of Gift Over Several Year periods is especially relevant in estate planning, where individuals wish to transfer their assets to their loved ones or charitable organizations systematically. This declaration ensures that all parties involved are aware of the specifics of the gift, including the nature of the asset, the timeline for distribution, and any specific conditions or restrictions attached to the gift. Some possible variations or types of the Mecklenburg North Carolina Declaration of Gift Over Several Year periods may include: 1. Cash Gift Declaration: This type of declaration involves the gradual gifting of cash or liquid assets over several years, allowing the donor to manage their tax liability efficiently. 2. Real Estate Gift Declaration: In this case, the declaration focuses on the gradual transfer of real estate properties within Mecklenburg County. This type of declaration can include residential properties, commercial buildings, or vacant land. 3. Stock or Securities Gift Declaration: This variation of the declaration pertains to the gifting of stocks, bonds, or other securities over several years. Donors who possess a substantial investment portfolio can leverage this type of declaration to minimize capital gains taxes. 4. Business Ownership Gift Declaration: This type of declaration involves transferring partial ownership or shares of a business to a recipient over a defined period. This may be applicable when business owners are planning for succession or would like to reward key employees gradually. 5. Charitable Gift Declaration: This variation focuses on the gradual donation of assets to charitable organizations, including cash, property, or securities. This approach allows the donor to support causes they care about over a span of years while potentially maximizing the charitable tax deduction. Overall, the Mecklenburg North Carolina Declaration of Gift Over Several Year periods provides a comprehensive framework for individuals and entities involved in planned gifting. It ensures that gifts are transferred smoothly, according to the donor's wishes, and in compliance with relevant laws and regulations.The Mecklenburg North Carolina Declaration of Gift Over Several Year periods is a legal document that outlines the process of gifting assets or property over a span of multiple years in Mecklenburg County, North Carolina. This declaration is crucial when an individual or entity intends to gift a substantial amount of wealth to another party gradually, rather than through a lump sum donation. By utilizing this declaration, the donor can strategically plan and distribute their gifts, taking advantage of potential tax benefits and spreading out the impact on their own financial standing. The Mecklenburg North Carolina Declaration of Gift Over Several Year periods is especially relevant in estate planning, where individuals wish to transfer their assets to their loved ones or charitable organizations systematically. This declaration ensures that all parties involved are aware of the specifics of the gift, including the nature of the asset, the timeline for distribution, and any specific conditions or restrictions attached to the gift. Some possible variations or types of the Mecklenburg North Carolina Declaration of Gift Over Several Year periods may include: 1. Cash Gift Declaration: This type of declaration involves the gradual gifting of cash or liquid assets over several years, allowing the donor to manage their tax liability efficiently. 2. Real Estate Gift Declaration: In this case, the declaration focuses on the gradual transfer of real estate properties within Mecklenburg County. This type of declaration can include residential properties, commercial buildings, or vacant land. 3. Stock or Securities Gift Declaration: This variation of the declaration pertains to the gifting of stocks, bonds, or other securities over several years. Donors who possess a substantial investment portfolio can leverage this type of declaration to minimize capital gains taxes. 4. Business Ownership Gift Declaration: This type of declaration involves transferring partial ownership or shares of a business to a recipient over a defined period. This may be applicable when business owners are planning for succession or would like to reward key employees gradually. 5. Charitable Gift Declaration: This variation focuses on the gradual donation of assets to charitable organizations, including cash, property, or securities. This approach allows the donor to support causes they care about over a span of years while potentially maximizing the charitable tax deduction. Overall, the Mecklenburg North Carolina Declaration of Gift Over Several Year periods provides a comprehensive framework for individuals and entities involved in planned gifting. It ensures that gifts are transferred smoothly, according to the donor's wishes, and in compliance with relevant laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.