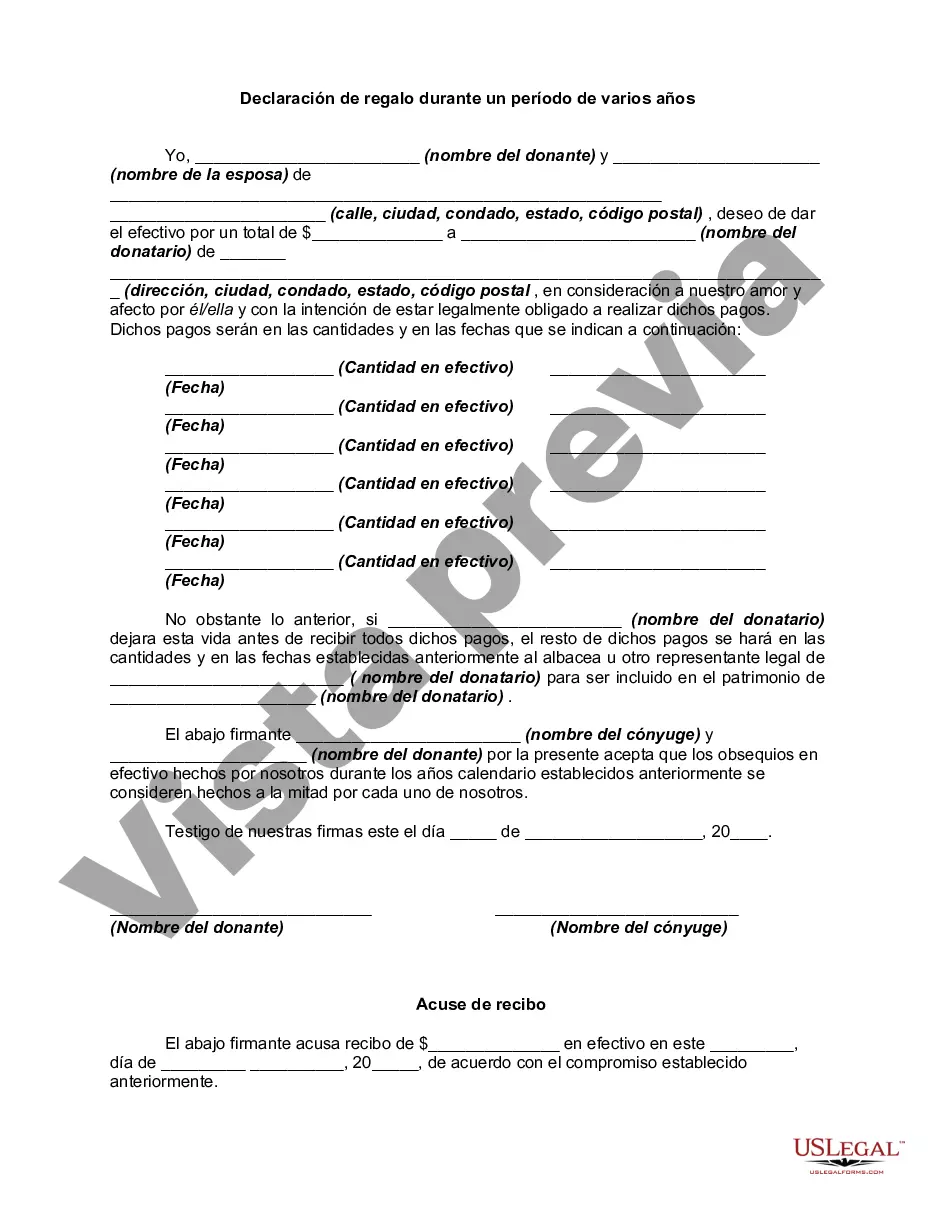

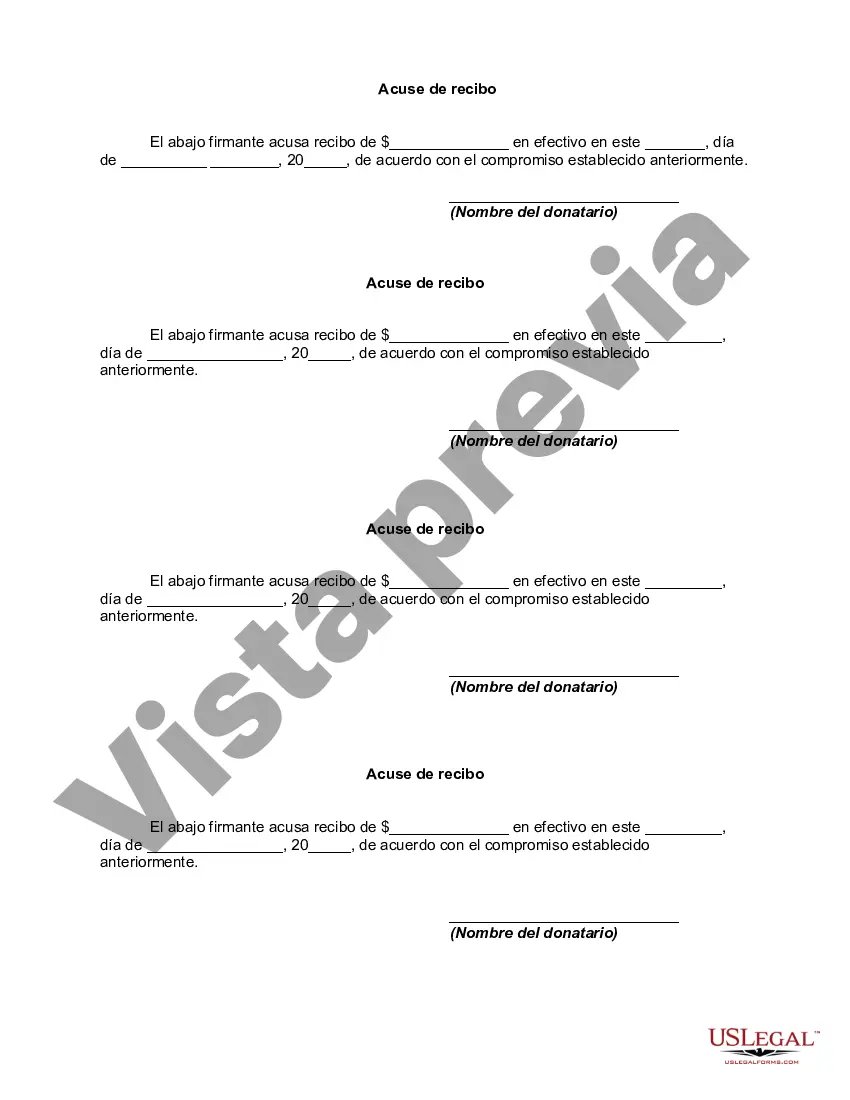

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nassau New York Declaration of Gift over Several Year periods is a legal document that outlines the process of gifting assets or property over an extended period. This declaration holds significance for individuals or organizations residing in Nassau County, New York, who wish to offer valuable gifts to another party but prefer to do so gradually instead of making one-time transfers. The declaration acknowledges the intention of the gift donor to distribute assets or property over several years, thereby specifying the timeframe and schedule of the gifting process. This arrangement allows the donor to plan and coordinate the transfer of gifts while ensuring a smooth transition for the recipient. The Nassau New York Declaration of Gift over Several years Period includes essential details such as the names and contact information of both the donor and recipient, a description of the gifted assets, and the agreed-upon timeframe for the gradual transfer. Moreover, it may also include provisions regarding any tax implications or legal considerations associated with the gift exchange. By utilizing this declaration, individuals or organizations can exercise greater control and flexibility over the gifting process, enabling them to manage their financial resources more effectively. The Nassau New York Declaration of Gift over Several years Period aligns with the legal requirements and regulations of Nassau County, ensuring that the gift transfer adheres to the appropriate guidelines. Types of Nassau New York Declaration of Gift over Several Year periods: 1. Personal Declaration of Gift: This type of declaration involves individuals who desire to gift personal assets, such as cash, jewelry, vehicles, or real estate, over a specified period. The declaration ensures that the gradual transfer meets the preferences of both the donor and recipient. 2. Charitable Declaration of Gift: This variation of the declaration applies to individuals or organizations who plan to make charitable contributions in installments over several years. It provides a structured approach to fulfill philanthropic commitments while enabling the recipient organization to plan its resources accordingly. 3. Family Declaration of Gift: This declaration type caters to families who wish to distribute their assets periodically among family members over a defined period. It establishes clear guidelines for the equitable distribution of assets, facilitating seamless inheritance planning for the entire family. In conclusion, the Nassau New York Declaration of Gift over Several Year periods is a legal document designed for gradual asset or property transfers in Nassau County, New York. It serves as a tool for individuals, families, and organizations to ensure a well-organized and controlled gifting process while complying with legal requirements.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.