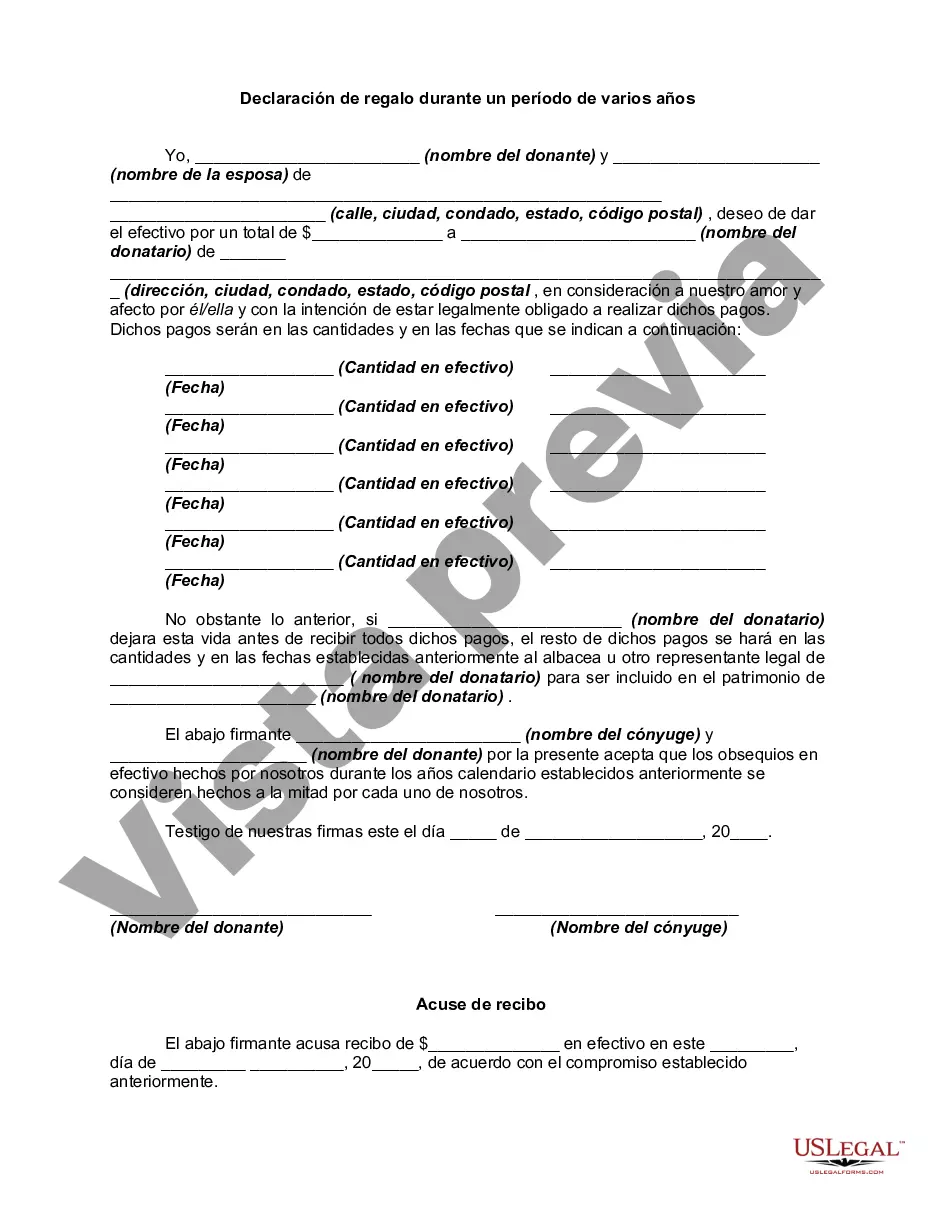

Although a written instrument is not usually essential to the validity of a gift inter vivos, to ensure compliance with the delivery requirement, and to avoid misunderstanding, a gift transfer should be made by a delivered written instrument. The language of the instrument must express a present intention to pass title to the property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

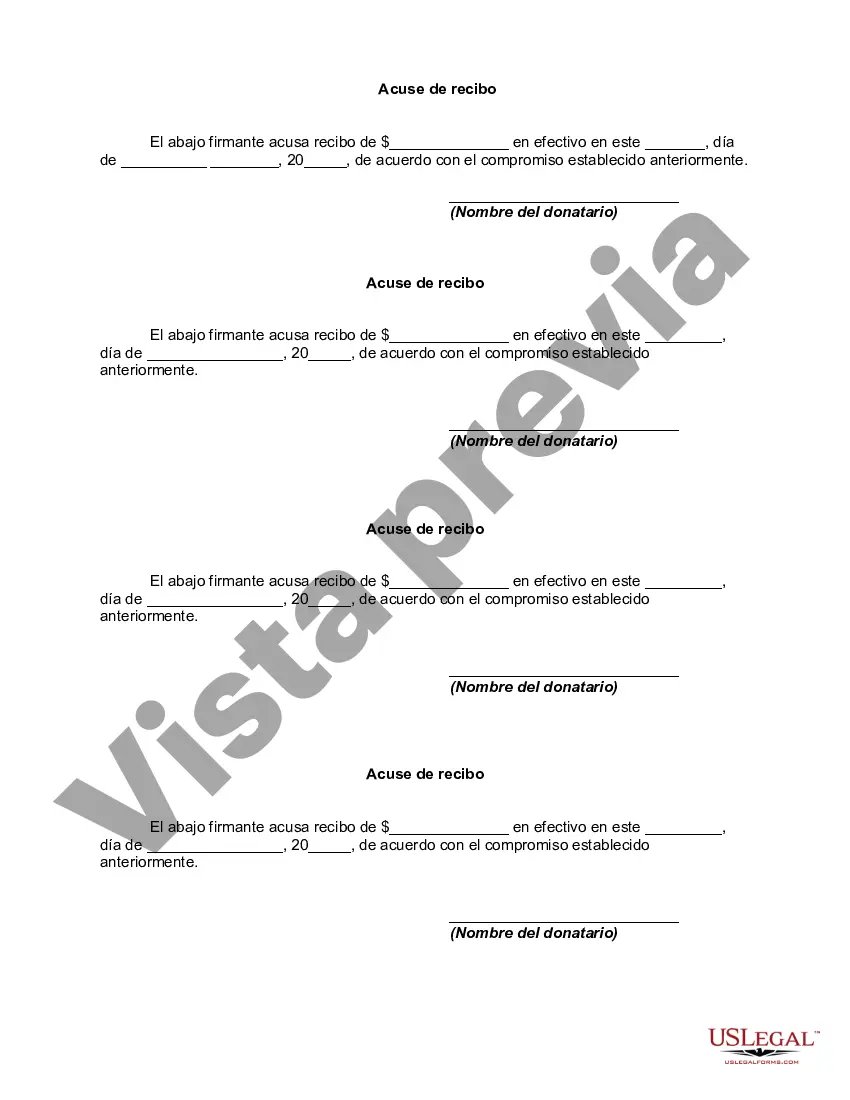

The Orange California Declaration of Gift Over Several Year periods is a legal document that allows individuals to make gifts over a period of multiple years in a structured and organized manner. This declaration is commonly used by individuals in Orange, California, who want to distribute their assets or wealth gradually to their beneficiaries while minimizing tax burdens and ensuring their intentions are legally upheld. One type of Orange California Declaration of Gift Over Several Year periods is the "Revocable Declaration of Gift." This type of declaration allows the donor to revoke or modify the gift during their lifetime. It provides flexibility in managing the assets, ensuring that the donor maintains control over their property until they pass away or decide otherwise. Another type is the "Irrevocable Declaration of Gift." In contrast to the revocable declaration, the irrevocable declaration means that the gift cannot be altered or revoked once it has been made. This type of declaration is often used for asset protection, estate planning, or charitable giving purposes. The Orange California Declaration of Gift Over Several Year periods includes various important components. Firstly, it outlines the donor's details, such as their name, address, and contact information. It also identifies the recipient or beneficiaries of the gifts, specifying their names and any conditions or restrictions on the gifts. Additionally, the declaration mentions the assets or properties being gifted, providing detailed descriptions of each item and their estimated value. Furthermore, the declaration specifies the timeframe over which the gifts will be made, including the start and end dates of the gifting period. It may also include provisions for the frequency and amount of each gift, ensuring a consistent and structured distribution of assets. This helps in effective estate planning and prevents potential disputes among beneficiaries. The Orange California Declaration of Gift Over Several Year periods also addresses tax considerations and provides guidelines to ensure compliance with applicable tax laws. It may include provisions related to gift tax exemptions or any tax-efficient strategies for minimizing tax liabilities. It is crucial to consult with an experienced attorney or estate planner familiar with California laws when considering a Declaration of Gift Over Several Year periods. They can provide personalized advice and draft a legally enforceable declaration that aligns with your specific goals and intentions, ensuring a smooth and organized transfer of wealth over time.The Orange California Declaration of Gift Over Several Year periods is a legal document that allows individuals to make gifts over a period of multiple years in a structured and organized manner. This declaration is commonly used by individuals in Orange, California, who want to distribute their assets or wealth gradually to their beneficiaries while minimizing tax burdens and ensuring their intentions are legally upheld. One type of Orange California Declaration of Gift Over Several Year periods is the "Revocable Declaration of Gift." This type of declaration allows the donor to revoke or modify the gift during their lifetime. It provides flexibility in managing the assets, ensuring that the donor maintains control over their property until they pass away or decide otherwise. Another type is the "Irrevocable Declaration of Gift." In contrast to the revocable declaration, the irrevocable declaration means that the gift cannot be altered or revoked once it has been made. This type of declaration is often used for asset protection, estate planning, or charitable giving purposes. The Orange California Declaration of Gift Over Several Year periods includes various important components. Firstly, it outlines the donor's details, such as their name, address, and contact information. It also identifies the recipient or beneficiaries of the gifts, specifying their names and any conditions or restrictions on the gifts. Additionally, the declaration mentions the assets or properties being gifted, providing detailed descriptions of each item and their estimated value. Furthermore, the declaration specifies the timeframe over which the gifts will be made, including the start and end dates of the gifting period. It may also include provisions for the frequency and amount of each gift, ensuring a consistent and structured distribution of assets. This helps in effective estate planning and prevents potential disputes among beneficiaries. The Orange California Declaration of Gift Over Several Year periods also addresses tax considerations and provides guidelines to ensure compliance with applicable tax laws. It may include provisions related to gift tax exemptions or any tax-efficient strategies for minimizing tax liabilities. It is crucial to consult with an experienced attorney or estate planner familiar with California laws when considering a Declaration of Gift Over Several Year periods. They can provide personalized advice and draft a legally enforceable declaration that aligns with your specific goals and intentions, ensuring a smooth and organized transfer of wealth over time.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.